Prices

January 2, 2018

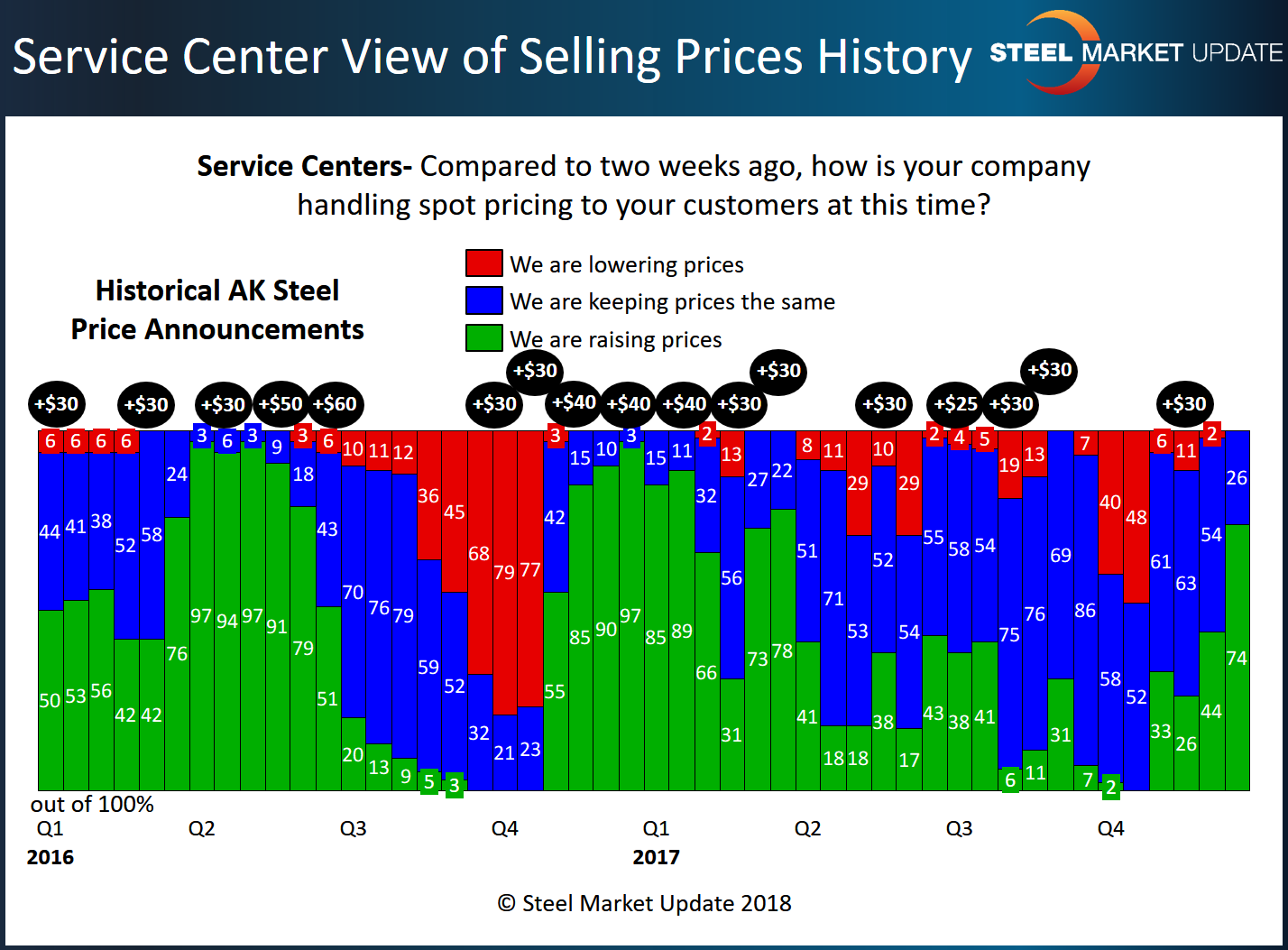

Service Center Spot Prices Surge to Support Mill Increases

Written by John Packard

The week prior to the Christmas holiday, Steel Market Update conducted a review of the flat rolled steel market and the trends impacting supply, demand and pricing trends. The steel survey, sent to 640 individuals involved in the flat rolled and plate industries, found service centers as more supportive of higher spot prices than they had been over the previous few months. SMU believes this support for higher spot pricing out of the distributors will be a positive development for domestic steel mill pricing.

The SMU Price Momentum Indicator begins the New Year pointing toward higher domestic steel prices over the next 30 to 60 days, partially due to the results of our inquiries about steel service center spot pricing.

The majority of manufacturing companies (57 percent) responding to our inquiries reported steel distributors as increasing prices. No manufacturing companies reported spot prices as falling for the first time in three-and-a-half months.

Service centers responding to our survey were even more bullish with 74 percent of the distributors responding reporting their company as raising spot prices to their customers. This is 30 percentage points higher than what we measured at the beginning of December and the most aggressive we have seen service center spot pricing since late first quarter 2017.

This is yet another reason why the SMU Pricing Momentum Indicator is pointing toward higher prices over the next 30 to 60 working days.