Prices

January 2, 2018

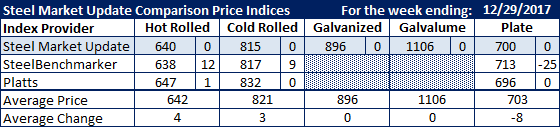

Comparison Price Indices: Little Change Over Holidays

Written by John Packard

Flat rolled steel prices were essentially unchanged last week (week ending Dec. 29, 2017) due to the Christmas and New Year’s Holidays. The only exception being SteelBenchmarker, which only produces their indices twice per month with last week being one of those weeks.

Hot rolled spot prices are hovering at, or near, $640 per ton ($32.00/cwt). Platts is slightly higher at $647 per ton and SteelBenchmarker is slightly lower at $638 per ton. SMU kept our number the same due to vacation schedules and the lack of enough data to justify making a change.

Cold rolled has a wider spread than HRC with SMU at the low end of the range at $815 per ton and Platts at the upper end of the range at $832 per ton.

Galvanized and Galvalume were unchanged for the week.

Plate prices were also stable on Platts and SMU, while down $25 per ton on SteelBenchmarker.

SMU Note: Galvanized prices include $78 in extras for a .060″ G90 product. Galvalume prices include $291 in extras for a .0142” AZ50 Grade 80 product.

FOB points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Plate price FOB points are different for each of the indexes:

SMU: FOB Delivered to the Customer (includes freight)

Platts: FOB Southeaster Mill (does not include freight)