Market Data

November 30, 2017

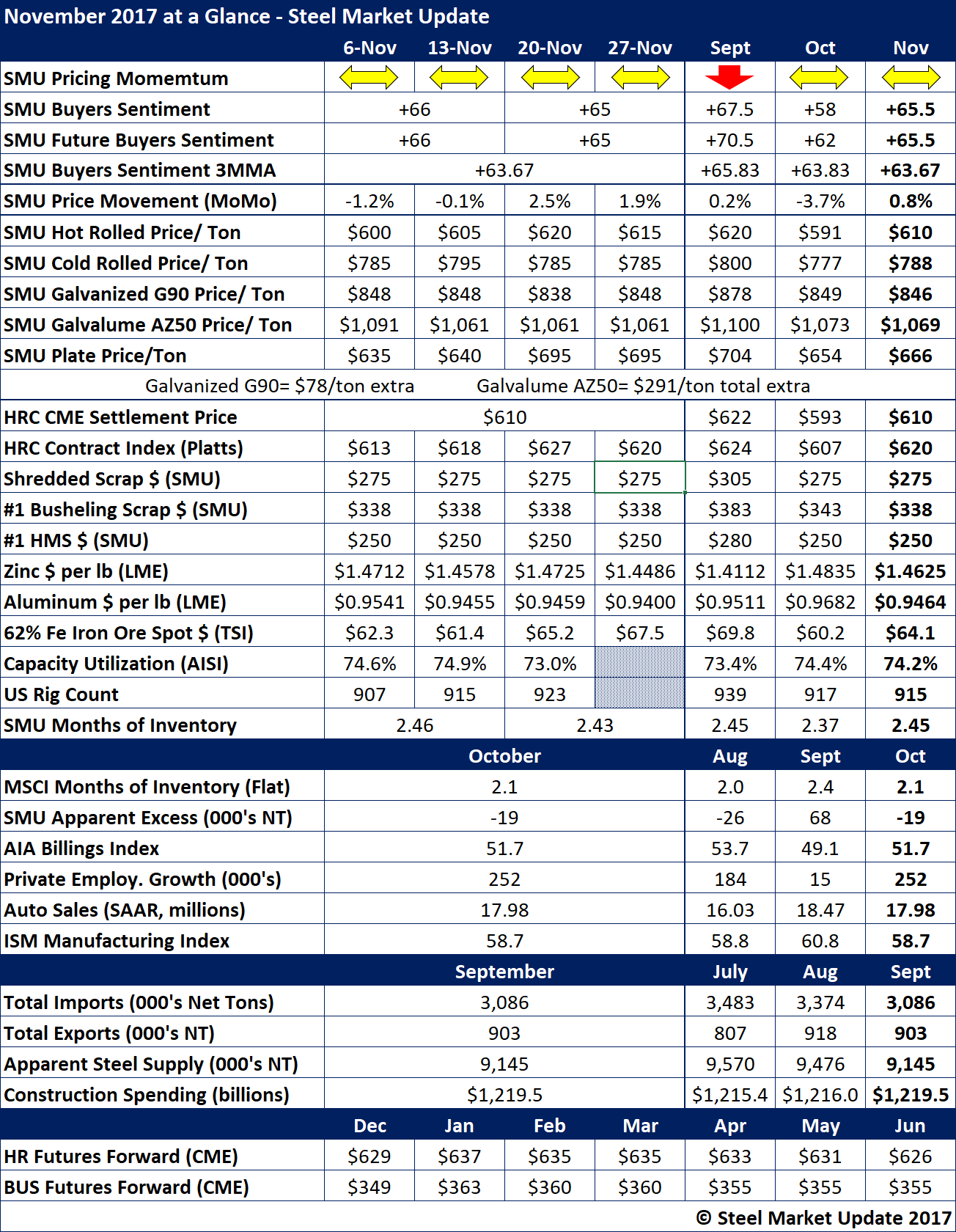

November at a Glance

Written by John Packard

Flat rolled steel Price Momentum ended the month as it began, pointing to a sideways or “mixed” market. Our flat rolled steel price indices averages over the past three months show very little movement in steel prices. Benchmark hot rolled averaged $610 per ton, which is actually lower than the $620 average we saw at the end of September. Prices are up “modestly” compared to October when the latest round of price increases began.

MSCI reported flat rolled inventories at 2.1 months of supply. Our new service center flat rolled inventories index saw the market having more supply with our months of supply being 2.8 months.

At the same time, SMU analysis of the MSCI inventories levels (assuming they are correct) found the distributors inventories as being balanced with a -19,000 ton deficit.

You can learn more about our inventories analysis by becoming a Premium level member. If interested, please contact us at 800-432-3475 or info@SteelMarketUpdate.com.

Below you will find a number of the indices followed by Steel Market Update during the course of the month.