Market Data

November 29, 2017

Economic Indicators Remain Favorable for Manufacturing

Written by Peter Wright

Economic indicators of manufacturing activity are still healthy overall and suggest conditions should remain positive for the balance of this year and into the first quarter of 2018.

This report summarizes seven data sources that describe the state of manufacturing in the U.S. We have reported on most of these separately in our Steel Market Update publications and therefore will be brief in this summary. We don’t expect these data sources to all point in the same direction. Our intention in summarizing them in one document is to provide a consensus of the state of this critical steel consumption sector. Based on AISI estimates of steel mill shipments by market classification, almost 50 percent of the steel consumed in the U.S. is manufacturing-oriented. This breaks down to about 27 percent in ground transportation including infrastructure, 9 percent in machinery and equipment, 5 percent in appliances, 4 percent in defense and about 4 percent in containers.

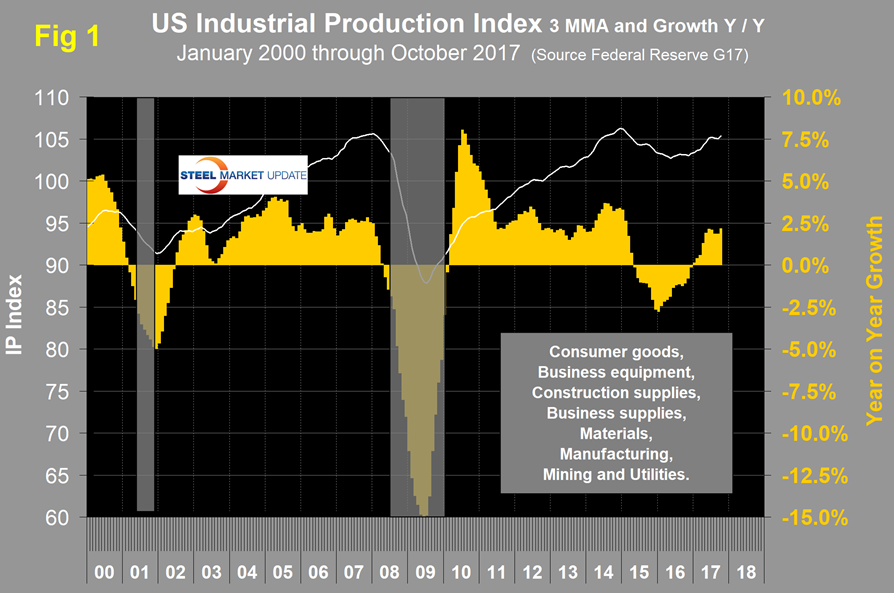

The Industrial Production Index

Figure 1 shows the IP index since January 2007 with the year-over-year growth. The three-month moving average (3MMA) had negative growth every month from October 2015 through December 2016 as shown by the brown bars in Figure 1. January this year was the first month of positive growth in the 3MMA since August 2015. Economy.com reported: “Industrial production rose a healthy 0.9 percent in October, beating the consensus forecast and our above-consensus projection. This is the largest monthly gain since April. The hearty headline was supported by robust gains in manufacturing and utilities, whereas mining production lost ground. Manufacturing production also had its best gains since April, advancing 1.3 percent. Capacity utilization rose 0.6 percentage point; and in manufacturing, it increased 0.9 percentage point.” (Note: Economy.com is reporting month-over-month growth. The SMU comment above refers to year-over-year growth).

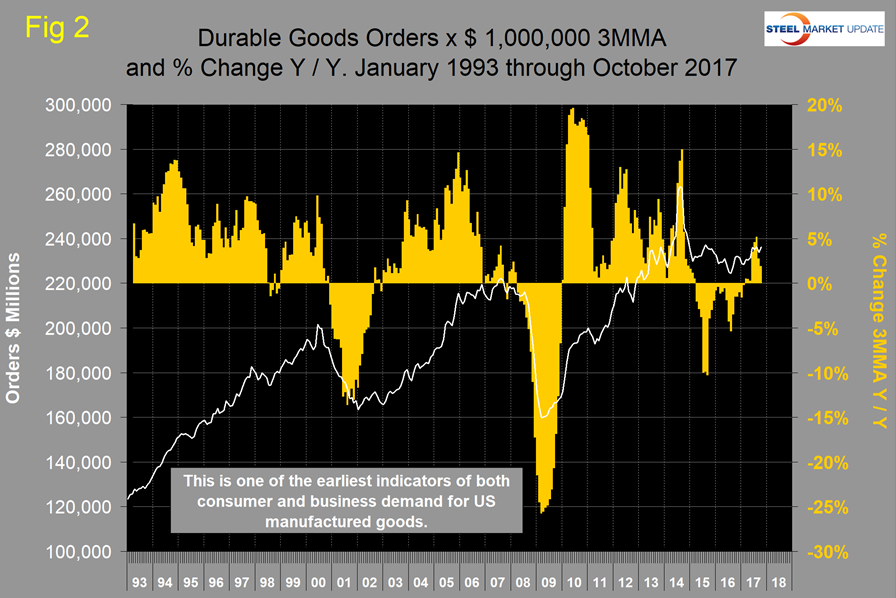

New Orders for Durable Goods

The U.S. Census Bureau announced last week that new orders for manufactured durable goods in October increased by $2.34 billion or 1.0 percent on a 3MMA basis. Figure 2 shows the 3MMA of monthly orders for durable goods since January 2010 with the percent change year over year. March this year was the first month since April 2015 to have positive year-over-year growth. There has been an improving trend since August 2015 with a positive surge in the most recent data for June through October this year.

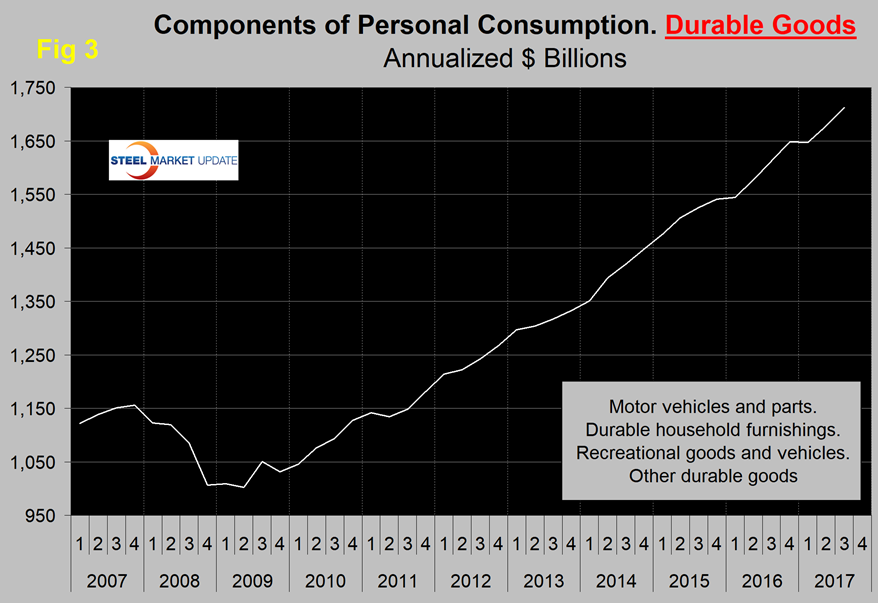

The Durable Goods Portion of GDP

The first estimate of Q3 GDP came in at 3.0 percent annualized, which was a repeat of Q2. A sub-component of the quarterly data is durable goods, which is part of the personal consumption calculation. It therefore contains no military hardware or civil aircraft data. This is shown in Figure 3 and, presumably because of the exclusions just mentioned, looks nothing like Figure 2. With the exception of one quarter, which was Q1 2017, the durable goods portion of GDP saw positive growth every quarter since Q2 2011.

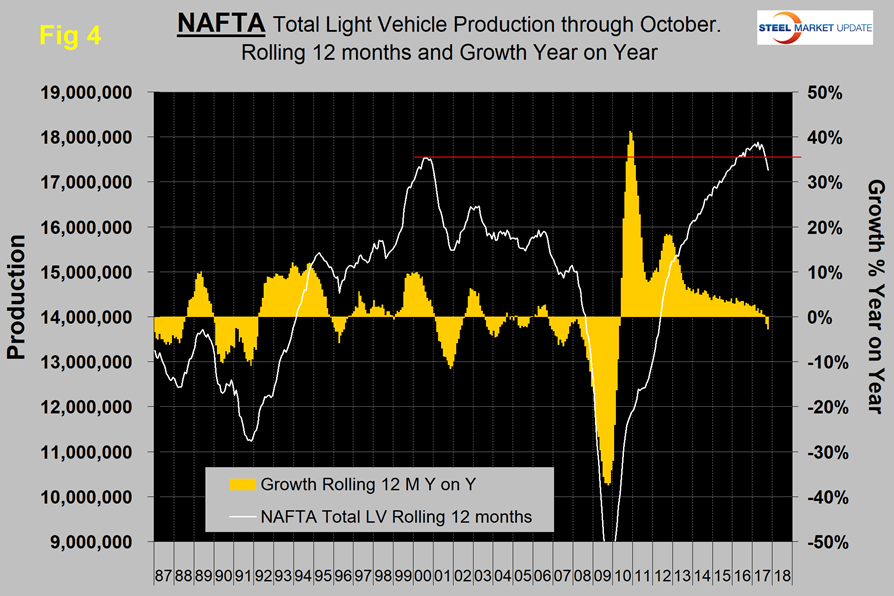

Light Vehicle Production in NAFTA

On a rolling 12-month basis year over year through October, LV production in NAFTA decreased by 2.7 percent. September declined by 1.5 percent. These were the first months of contraction since May 2010. There has been a very gradual slowdown in growth for the last three years as indicated by the brown bars in Figure 4. The data source is Ward’s Automotive. We understand that the main hang-up in the NAFTA negotiations revolves around auto parts manufacture and final point of assembly. There is a huge movement of components and subassemblies in both directions across the southern border, therefore it is not known whether the Ward’s data exaggerates or deflates the national differentials.

Manufacturing Employment

Manufacturing employment dived during the recession and gradually improved from the spring of 2010 through 2014. Growth was flat in 2015 and declined slightly in 2016 when 23,000 jobs were lost in the year as a whole. There was a turnaround in first 10 months of this year when 138,000 manufacturing jobs were created (Figure 5). The motor vehicles and parts subcomponent of manufacturing employment has gained only 1,000 jobs this year.

Manufacturing Productivity

The Bureau of Labor Statistics reported that in Q2 2017 manufacturing productivity improved by an upwardly revised 1.3 percent year over year (Figure 6). This was the highest growth rate since Q4 2012. In Q3, growth fell back to 0.1 percent meaning that productivity is almost exactly where it was in Q3 last year.

The ISM Manufacturing Index

The ISM Manufacturing Index is a diffusion index. The Institute of Supply Management states that “diffusion indexes have the properties of leading indicators and are convenient summary measures showing the prevailing direction of change and the scope of change. An index value above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates the opposite.” Figure 7 shows the 3MMA of the ISM index from January 1997 through October 2017 with an improving trend since January 2016. In October, the 3MMA of the index at 59.43 was the highest since April 2011.

SMU Comment: The ISM index, which we give the most credence, is at its strongest level since April 2011 and signaling expansion. This is the only leading indicator examined in this update. Auto assemblies and supplier industries are slowing in NAFTA, and the U.S. and Canada are losing share to Mexico. Manufacturing has added 138,000 jobs this year through October, but there has been virtually no productivity improvement in the last four quarters. The industrial production index and new orders for durable goods have positive growth. On balance, these seven measures are positive and portend well into the first quarter of 2018.