Prices

November 28, 2017

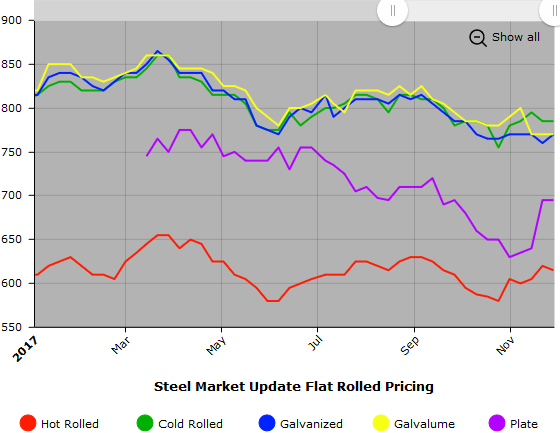

SMU Price Ranges & Indices: Third Week of "Mixed" Pricing

Written by John Packard

Steel Market Update canvassed a large number of flat rolled and plate steel buyers during the course of the last 24 hours. The goal was to better understand where spot prices were being offered (and by whom) and if there were any differences in momentum or the negotiation positions of the various steel mills. We found a “mixed” market for the third week in a row. However, the conversations we had helped clarify why the spot market prices were “mixed” and a lot of it has to do with what mills have December tonnage left and those who do not. We will have much more about the conversations that we had with steel buyers (and in some cases with the steel mills themselves) in Thursday evening’s edition of Steel Market Update.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $590-$640 per ton ($29.50/cwt-$32.00/cwt) with an average of $615 per ton ($30.75/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to one week ago, while the upper end remained the same. Our overall average is down $5 per ton compared to last week. Our price momentum on hot rolled steel is pointing to Neutral indicating prices are expected to remain steady over the next 30 days.

Hot Rolled Lead Times: 3-5 weeks

Cold Rolled Coil: SMU price range is $760-$810 per ton ($38.00/cwt-$40.50/cwt) with an average of $785 per ton ($39.25/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged compared to one week ago. Our price momentum on cold rolled steel is pointing to Neutral indicating prices are expected to remain steady over the next 30 days.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU base price range is $36.50/cwt-$40.50/cwt ($730-$810 per ton) with an average of $38.50/cwt ($770 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $10 per ton compared to one week ago. Our overall average is up $10 per ton compared to last week. Our price momentum on galvanized steel is pointing to Neutral indicating prices are expected to remain steady over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $808-$888 per net ton with an average of $848 per ton FOB mill, east of the Rockies. A note to our readers who also review other galvanized indexes: Right now, not all indexes are using the same G90 zinc coating extra on benchmark .060″ material. SMU uses $78 per ton, while NLMK uses $86 per ton and Nucor uses $90 per ton. SMU has not yet made a change as we wait for others to make adjustments to their extras.

Galvanized Lead Times: 3-11 weeks

Galvalume Coil: SMU base price range is $37.00/cwt-$40.00/cwt ($740-$800 per ton) with an average of $38.50/cwt ($770 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged compared to one week ago. Our price momentum on Galvalume steel is pointing to Neutral indicating prices are expected to remain steady over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,031-$1,091 per net ton with an average of $1,061 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-8 weeks

Plate: SMU price range is $670-$720 per ton ($33.50/cwt-$36.00/cwt) with an average of $695 per ton ($34.75/cwt) FOB delivered. Both the lower and upper ends of our range remained the same compared to one week ago. Our overall average is unchanged compared to last week. Our price momentum on plate steel is pointing to Neutral indicating prices are expected to remain steady over the next 30 days.

Plate Lead Times: 5-12 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. To use the graph’s interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or 800-432-3475.