Analysis

November 27, 2017

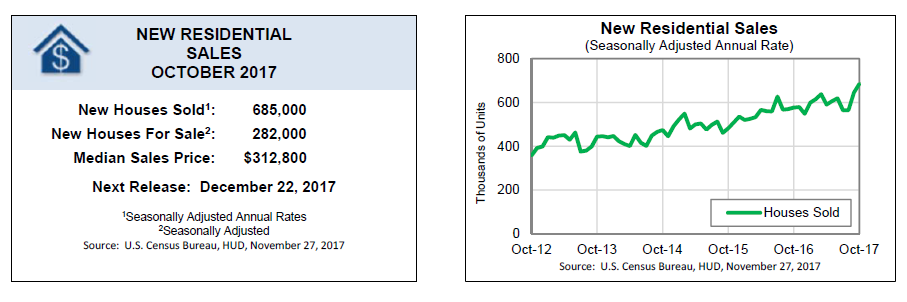

New Home Sales at 10-Year High

Written by Sandy Williams

New home sales jumped 6.2 percent in October to a seasonally adjusted annual rate of 685,000 and a 10-year high. All regions of the U.S. recorded increases, according to data released by the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

September’s seasonally adjusted annual rate was revised downward from 667,000 units to 645,000. Sales year-to-date are 8.9 percent higher than this time last year and on a three-month growth streak.

The median sales price of a new home last month was $312,800 and the average price $400,200. At the end of October, 282,000 new homes were estimated to be for sale. At the current sales rate, that represents a supply of 4.9 months. Inventory is still well short of the six-month supply suggested for a balance of supply and demand.

“The October report shows strong sales growth at entry-level price points,” said Granger MacDonald, chairman of the National Association of Home Builders (NAHB). “In markets where builders are able to provide homes for families with different household budgets, they can fulfill a growing demand for housing.”

Zillow Chief Economist Svenja Gudell said that rising labor and lumber prices “will force builders looking to meet market demand to search for less expensive development options farther away from urban job cores.”

“There is solid growth in the number of sales contracts signed before construction has begun, a strong indicator that new single-family home production should continue to grow as we look ahead to 2018,” said NAHB Chief Economist Robert Dietz. In October, about two-thirds of homes sold were still under construction or not yet begun.

Regionally, sales climbed 30.2 percent in the Northeast, 17.9 percent in the Midwest, 6.4 percent in the West and 1.3 percent in the South.