Market Data

November 26, 2017

WSA: Global Steel Output Continues to Surge

Written by Peter Wright

Driven primarily by construction in the developing world, growth in global steel production continues to surge, according to Steel Market Update’s latest analysis of World Steel Association data.

Steel production in the month of October was 145,254,000 metric tons, up from 141,576,000 in September. Capacity utilization decreased from 73.5 percent to 72.9 percent. Production was up and capacity utilization down because there were more days in October and tons per day decreased. The three-month moving averages (3MMA) that we prefer to use were 143,886,000 metric tons and 73.1 percent, respectively.

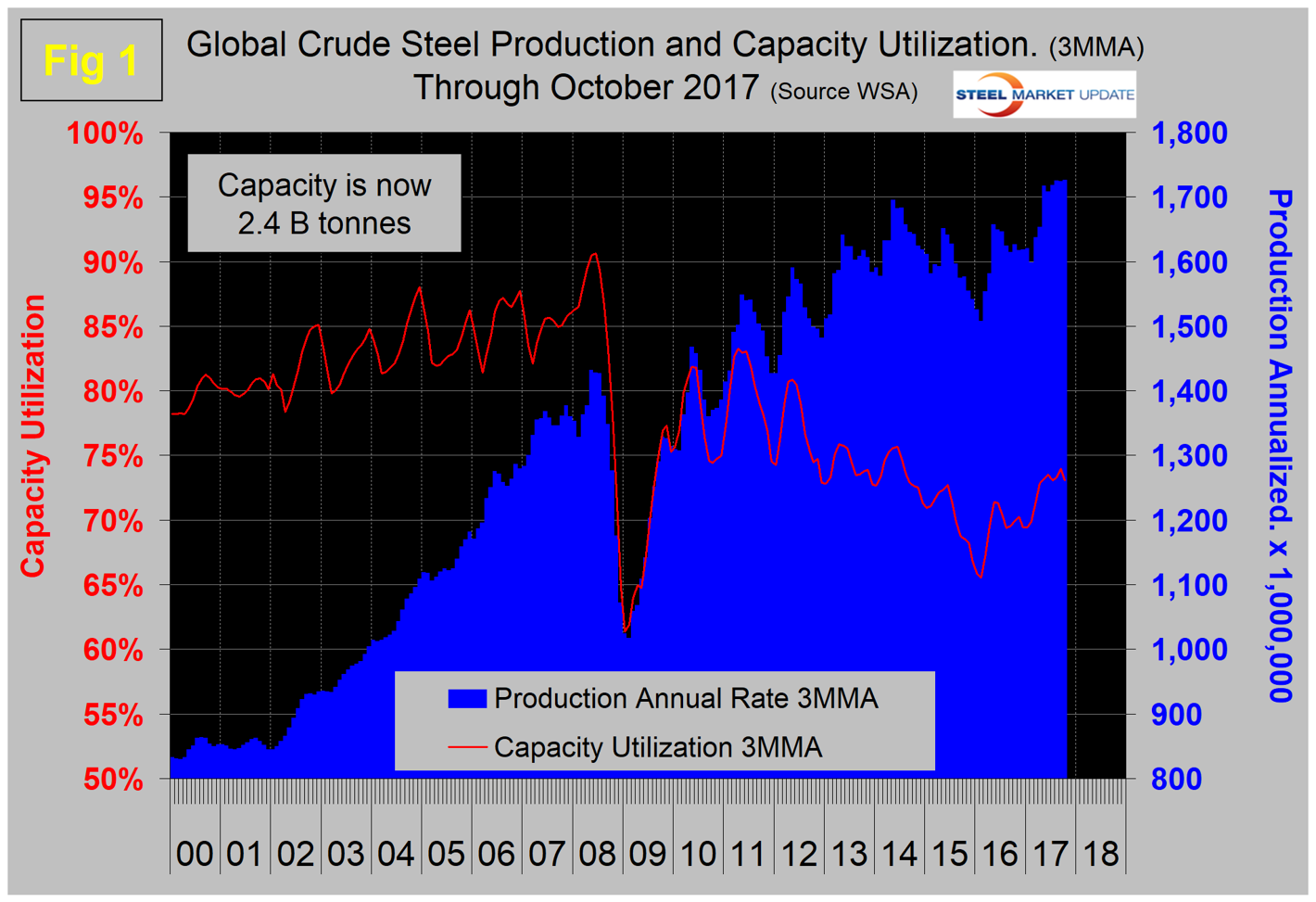

Figure 1 shows monthly production and capacity utilization since January 2000. The summer slowdown that has occurred in each of the last seven years is not happening in 2017. On a tons-per-day basis, production in October was 4.686 million metric tons with a 3MMA of 4.692 million metric tons, which was down slightly from the all-time high in June of 4.695 million metric tons. In three months through October, production was up by 6.1 percent year over year. On a 3MMA basis, capacity utilization was on an erratically downward trajectory from mid-2011 through February 2016 when it bottomed out at 65.5 percent. There has been an over 7 percent increase since then. In each of the last eight months, the 3MMA of capacity utilization has been greater than 72 percent for the first time since June 2015. Last October, the OECD’s steel committee estimated that global capacity would increase by almost 58 million metric tons per year between 2016 and 2018 bringing the total to 2.43 billion tons. That forecast is coming to pass as capacity is now approaching 2.4 billion tons.

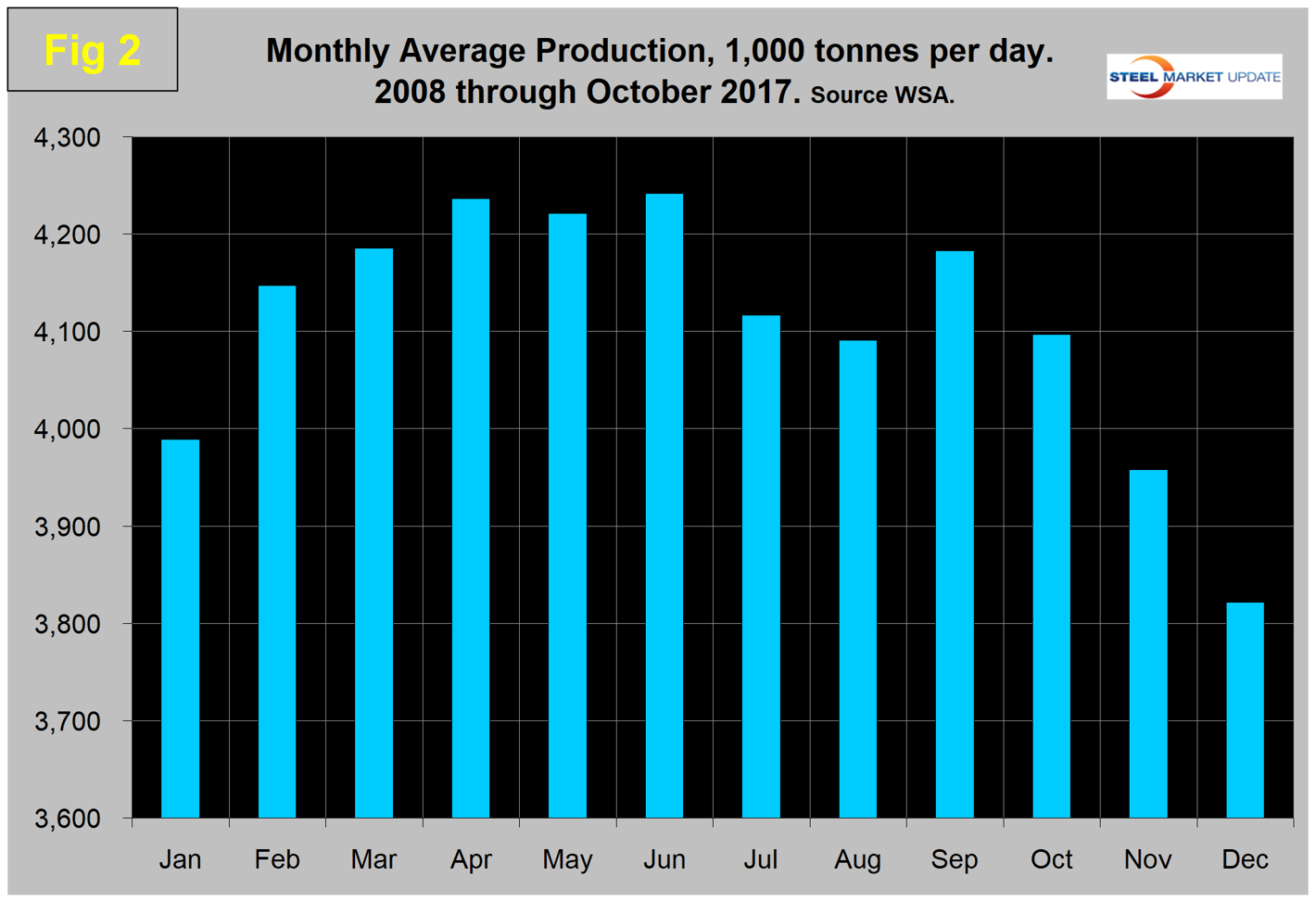

As we dig deeper into what is going on, we start with seasonality. Global production has peaked in the early summer for the last seven years with April and June on average having the highest volume. Figure 2 shows the average tons per day production for each month since 2008. In those 10 years on average, October has been down by 2.1 percent; this year October was down by 0.7 percent.

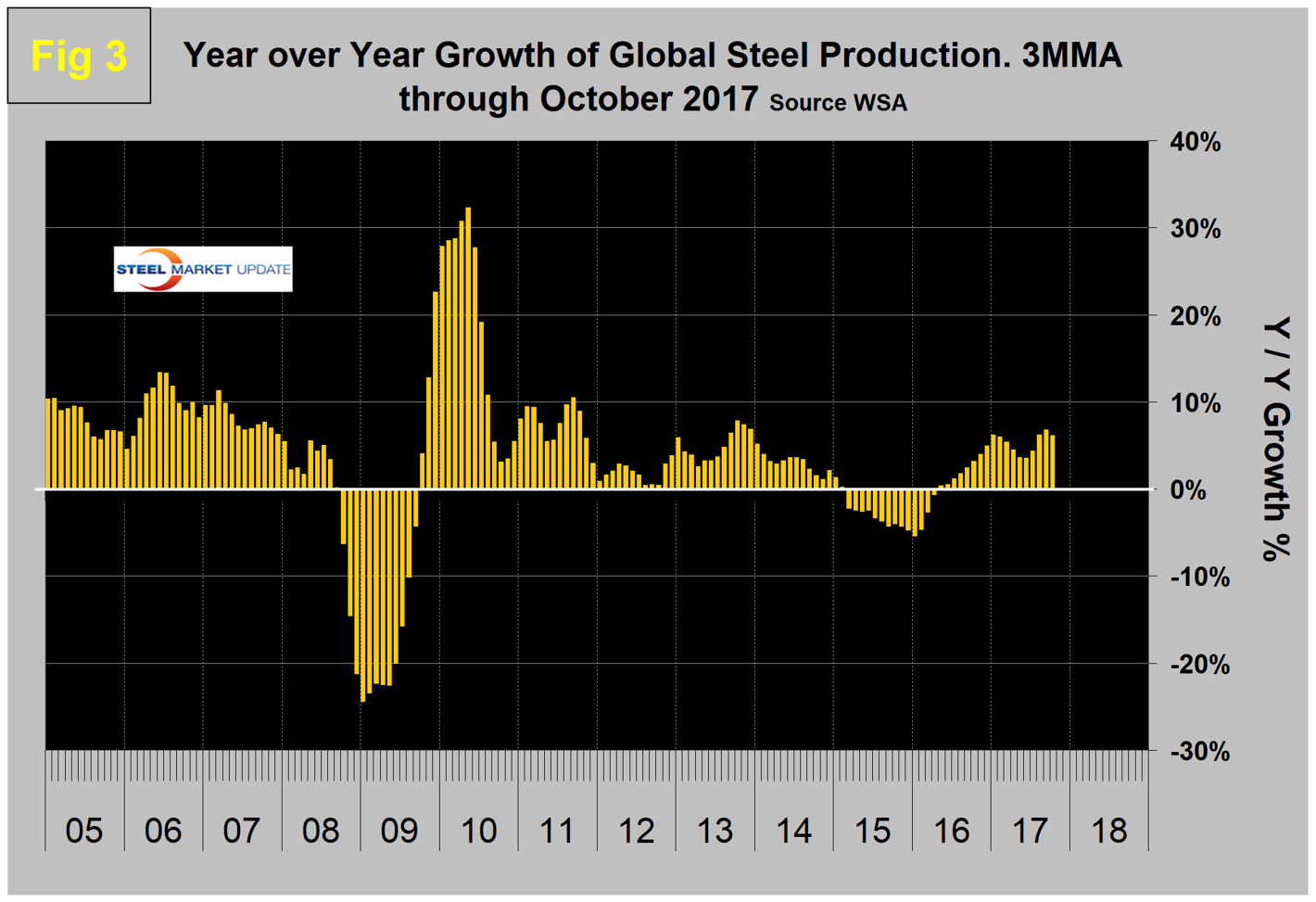

Figure 3 shows the monthly year-over-year growth rate on a 3MMA basis since January 2005. Production began to contract in March 2015 and the contraction accelerated through January 2016 when it reached negative 5.4 percent. Growth became positive in May last year and has been greater than 6.0 percent for the last three months. In the 14 months through May, China’s growth rate was lower than the rest of the world. That changed in the five months through October when China began to pull away again. In October, China expanded by 6.6 percent, the world as a whole grew by 6.1 percent, and the world excluding China expanded by 5.7 percent. In October, China produced 49.8 percent of the global steel total, down from and 50.7 percent in September and 51.5 percent in August.

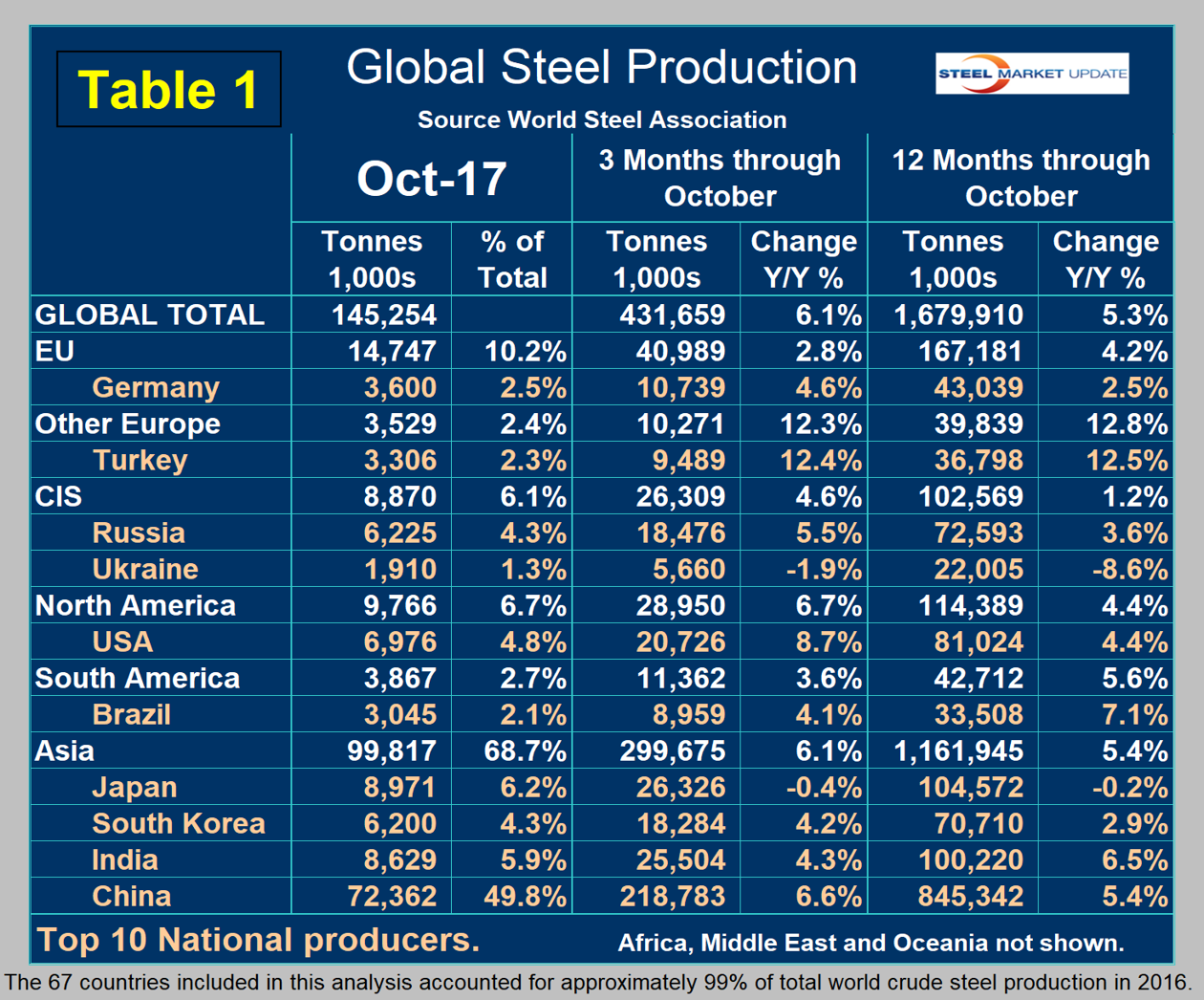

Table 1 shows global production broken down into regions, the production of the top 10 nations in the single month of October and their share of the global total. It also shows the latest three months’ and 12 months’ production through October with year-over-year growth rates for each period. Regions are shown in white font and individual nations in beige. The world as a whole had positive growth of 6.1 percent in three months and 5.3 percent in 12 months through October. When the three-month growth rate exceeds the 12-month rate, as it does today, we interpret this to be a sign of positive momentum.

Table 1 shows that in both three and 12 months through October year over year, every region had positive growth. At the national level, only Ukraine and Japan contracted. North America was up by 6.7 percent in three months. Within North America, the U.S. was up by 8.7 percent, Canada was up by 7.0 percent and Mexico was down by 1.0 percent. In the first 10 months of 2017, 96.0 million metric tons were produced in NAFTA, 71.2 percent in the U.S., 11.4 percent in Canada and 17.4 percent in Mexico. Other Europe, led by Turkey, had the highest growth rate in three months through October year over year. Asia as a whole was up by 6.1 percent.

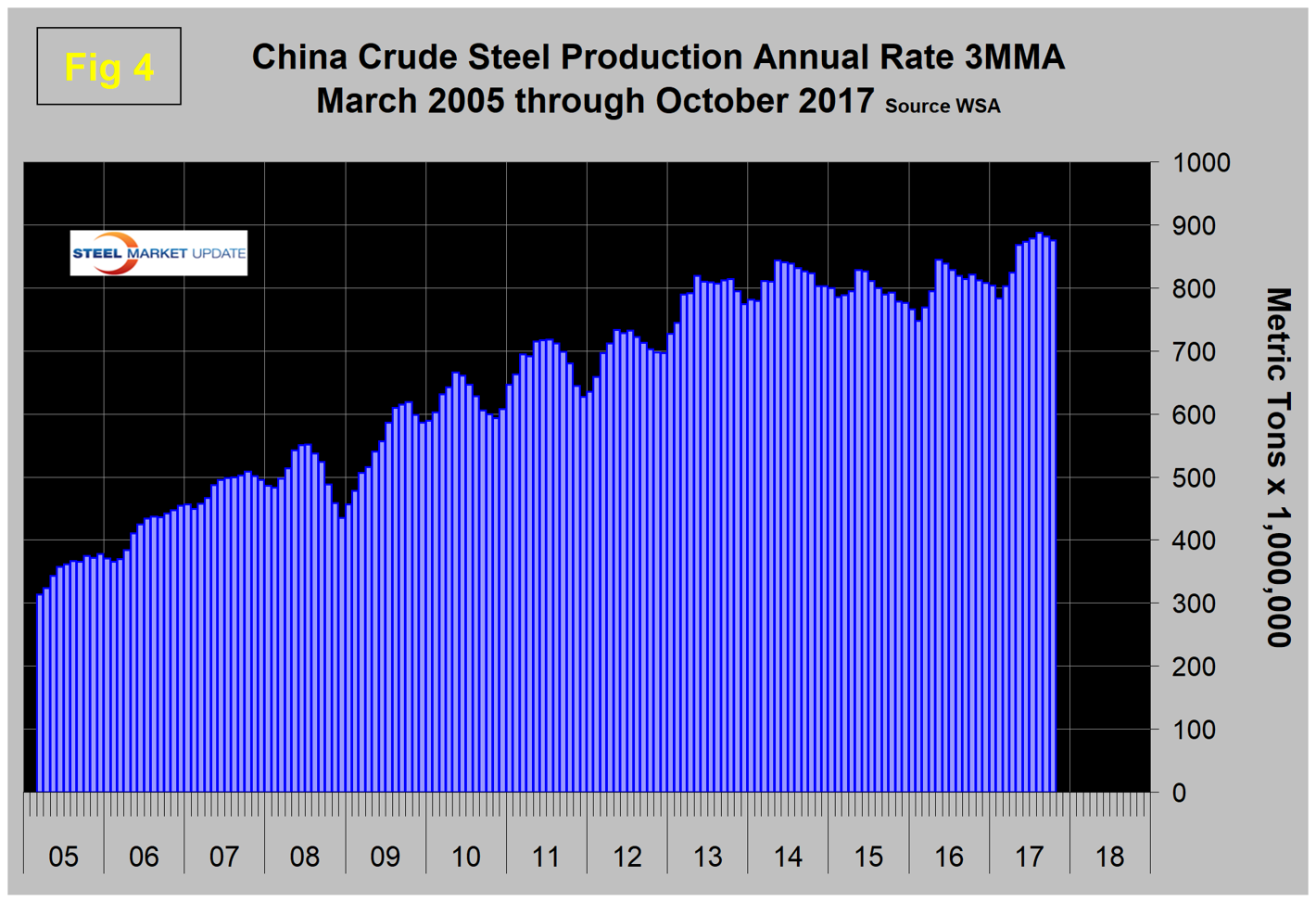

Figure 4 shows China’s production since 2005 and Figure 5 shows the year-over-year growth. China’s production, after slowing for 13 straight months, returned to positive growth each month from May 2016 through October this year. Evidently, the production in Chinese induction furnaces, which were shut down by government mandate this year, was illegal and the output from these furnaces was mostly unreported. This production has been shifted to the mainstream producers where it is recorded, artificially increasing the official output. Platts reported that Tangshan, China’s biggest steelmaking city located in the north, began well-publicized steel output cuts on Nov. 15. This is an attempt to improve air quality in Beijing, Tianjin and 26 surrounding cities.

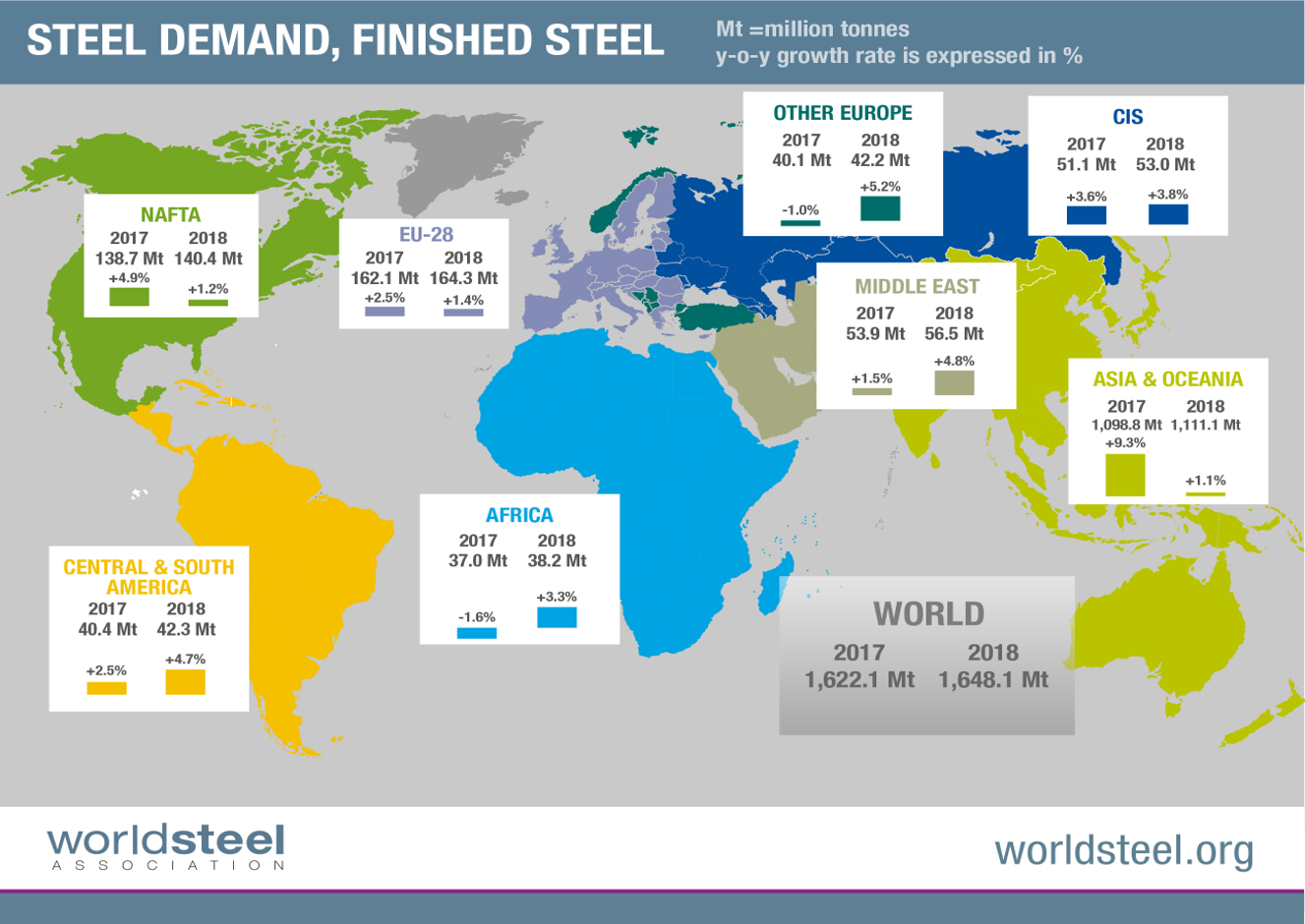

The World Steel Association Short Range Outlook for apparent steel consumption in 2017 and 2018 was revised and published on Oct. 14 (below).

Commenting on the outlook, T.V. Narendran, chairman of the World Steel Economics Committee said: “Progress in the global steel market this year to date has been encouraging. We have seen the cyclical upturn broadening and firming throughout the year, leading to better than expected performances for both developed and developing economies, although the MENA region and Turkey have been an exception. The risks to the global economy that we referred to in our April 2017 outlook, such as rising populism/protectionism, U.S. policy shifts, EU election uncertainties and China deceleration, although remaining, have to some extent abated. This leads us to conclude that we now see the best balance of risks since the 2008 economic crisis. However, escalating geopolitical tension in the Korean peninsula, China’s debt problem and rising protectionism in many locations continue to remain risk factors. In 2018, we expect global growth to moderate, mainly due to slower growth in China, while in the rest of the world steel demand will continue to maintain its current momentum.”

SMU Comment: WSA increased its April forecast for production in 2018 from 1.549 billion metric tons to 1.648 billion metric tons in its October forecast. This would be a projected growth of 1.6 percent in 2018, which based on the present momentum seems low. Globally, steel is back on a roll, driven primarily by construction in the developing world. The emerging and developing economies saw their GDP decline from 2010 through 2015, after which there was a turnaround that the IMF believes will continue through 2022.