Prices

November 21, 2017

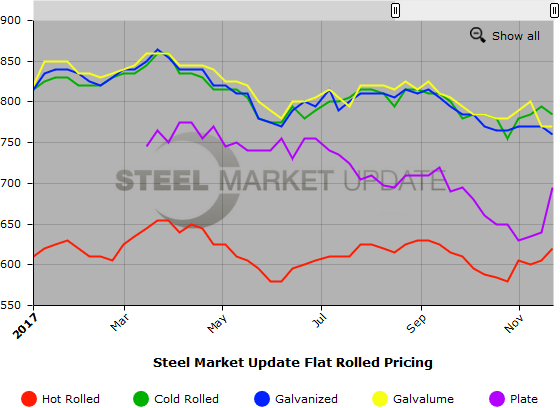

SMU Price Ranges & Indices: It's All About the Calendar

Written by John Packard

Flat rolled and plate steel prices are all over the place this week. We are seeing a distinct difference in pricing from those mills who still have November and December tonnage compared to those whose lead times are into January and beyond. Hot roll appears to be the strongest product with virtually all of our HRC price sources advising that prices are firm at $600 per ton and higher. The weakest products appear to be galvanized and cold rolled. However, when you take into consideration the wider-than-historical spread between hot rolled base prices and that of cold rolled and coated (up to $200 per ton instead of $100-$140 per ton), there is room to move, and that may be what we are seeing now.

We have a couple of sources advising of new orders on galvanized below $36.00/cwt base pricing (2017 delivery). This does not mean all of the mills are there. It may only be one mill that is trying to finish filling their order books. I heard from a mill source who told me their view is that the low end on galvanized is $37.50/cwt for a buyer with tons and pricing goes up to $40.00/cwt for smaller orders. The majority of the base pricing referenced by service centers and end user sources calls for cold rolled, galvanized and Galvalume in the $38.00/cwt-$39.00/cwt range. We have decided to throw out the sub-$36.00/cwt numbers because they are not readily available to the vast majority of steel buyers.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $600-$640 per ton ($30.00/cwt-$32.00/cwt) with an average of $620 per ton ($31.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to one week ago, while the upper end increased $20 per ton. Our overall average is up $15 per ton compared to last week. Our price momentum on hot rolled steel is pointing to Neutral indicating prices are expected to remain steady over the next 30 days.

Hot Rolled Lead Times: 3-5 weeks

Cold Rolled Coil: SMU price range is $760-$810 per ton ($38.00/cwt-$40.50/cwt) with an average of $785 per ton ($39.25/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range declined $10 per ton compared to last week. Our overall average is down $10 per ton compared to one week ago. Our price momentum on cold rolled steel is pointing to Neutral indicating prices are expected to remain steady over the next 30 days.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU base price range is $36.00/cwt-$40.00/cwt ($720-$800 per ton) with an average of $38.00/cwt ($760 per ton) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to one week ago, while the upper end remained the same. Our overall average is down $10 per ton compared to last week. Our price momentum on galvanized steel is pointing to Neutral indicating prices are expected to remain steady over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $798-$878 per net ton with an average of $838 per ton FOB mill, east of the Rockies. A note to our readers who also review other galvanized indexes: Right now, not all indexes are using the same G90 zinc coating extra on benchmark .060″ material. SMU uses $78 per ton, while NLMK uses $86 per ton and Nucor uses $90 per ton. SMU has not yet made a change as we wait for U.S. Steel, ArcelorMittal, and others to make adjustments to their extras.

Galvanized Lead Times: 3-11 weeks

Galvalume Coil: SMU base price range is $37.00/cwt-$40.00/cwt ($740-$800 per ton) with an average of $38.50/cwt ($770 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged compared to one week ago. Our price momentum on Galvalume steel is pointing to Neutral indicating prices are expected to remain steady over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,031-$1,091 per net ton with an average of $1,061 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-8 weeks

Plate: SMU price range is $670-$720 per ton ($33.50/cwt-$36.00/cwt) with an average of $695 per ton ($34.75/cwt) FOB delivered. The lower end of our range jumped up $70 per ton compared to one week ago, while the upper end increased $40 per ton. Our overall average is up $55 per ton compared to last week. Our price momentum on plate steel is pointing to Neutral indicating prices are expected to remain steady over the next 30 days.

Plate Lead Times: Here is a breakdown of plate lead times as sent to us by one of the plate service centers, “We have seen lead times at one supplier move out to 5-6 weeks (SSAB). ArcelorMittal is booked out for December and firmly into January. Nucor Hertford is end of December shipment, Nucor Tuscaloosa is 2nd-3rd week of December and Nucor Longview is 10-12 weeks lead time. Algoma is into January. Evraz is late December shipment. JSW is mid-December shipment.”

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. To use the graph’s interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or 800-432-3475.