Market Data

November 21, 2017

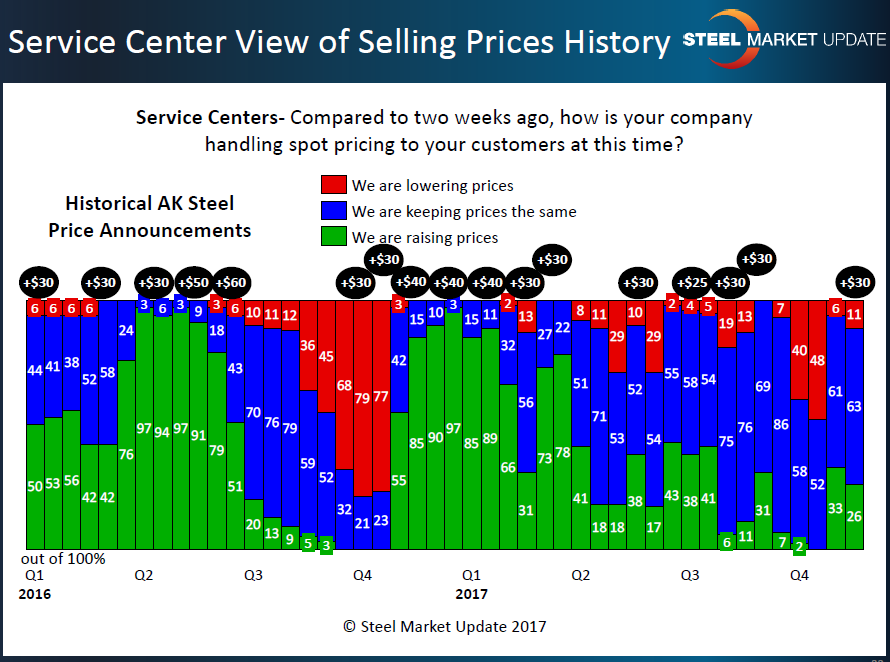

Service Center Spot Pricing Support Weaker Than Expected

Written by John Packard

Flat rolled steel service centers apparently do not have the luxury or ability to raise spot prices, even after two price increases by the domestic steel mills, according to the latest flat rolled steel market trends analysis by Steel Market Update (SMU).

Last week, in SMU’s mid-November flat rolled analysis, one of the key areas we probed was that of service center spot pricing and whether distributors are raising, lowering or keeping prices the same.

We have found a correlation between the success of price increases and how service centers react to spot sales of products to their customers. Hypothetically, if the mills raise prices, then the distributors’ costs should be rising, thus prompting them to increase their spot pricing. If the market is weak and inventories are high, then you tend to see mill price announcements without service centers supporting the increase by raising their spot prices.

In last week’s questionnaire, 47 percent of manufacturing companies reported their service center suppliers maintaining their spot pricing, 40 percent told SMU spot prices were going higher, and 13 percent reported spot prices moving lower than what they saw from suppliers at the beginning of the month.

The service centers themselves were less optimistic about their ability to raise prices. We found 62 percent of the distributors reporting spot prices remaining where they were at the beginning of the month. Another 25 percent told SMU their company was raising prices, while 13 percent reported their company lowering prices.

Here is what that looks like on a historical basis. We have included the AK Steel price announcements for reference.

Service Center Comments Made During the Survey Process:

“We have had very little choice. If we want to sell coils, we must lower to compete.”

“Adjusting price to order requirement (delivery, order size, product, etc). Vanilla business tough to recoup any increase from suppliers.”

“No movement.”

“Same for the most part, but are bumping up when we can.”

“Trying to reduce inventory level for year end.”