Market Data

November 19, 2017

SMU Survey: Service Center Inventories on the Rise

Written by John Packard

Twice per month, Steel Market Update (SMU) conducts an analysis of the flat rolled steel market and the trends that affect pricing, demand, etc. Each analysis is conducted via an email invitation to complete a questionnaire. SMU invites approximately 650 individuals who are active participants in the manufacturing, distribution, toll processing, trading and steel mill segments of the flat rolled steel industry.

The questionnaire is broken into two parts: a main section where all respondents answer the same questions. It is from this section that we derive our current and future SMU Steel Buyers Sentiment Indices. At the end of the main section, we ask our respondents to identify their market segment. At that point, each market segment is broken out into individual surveys with questions that are germane to that specific market.

Service Center Inventories

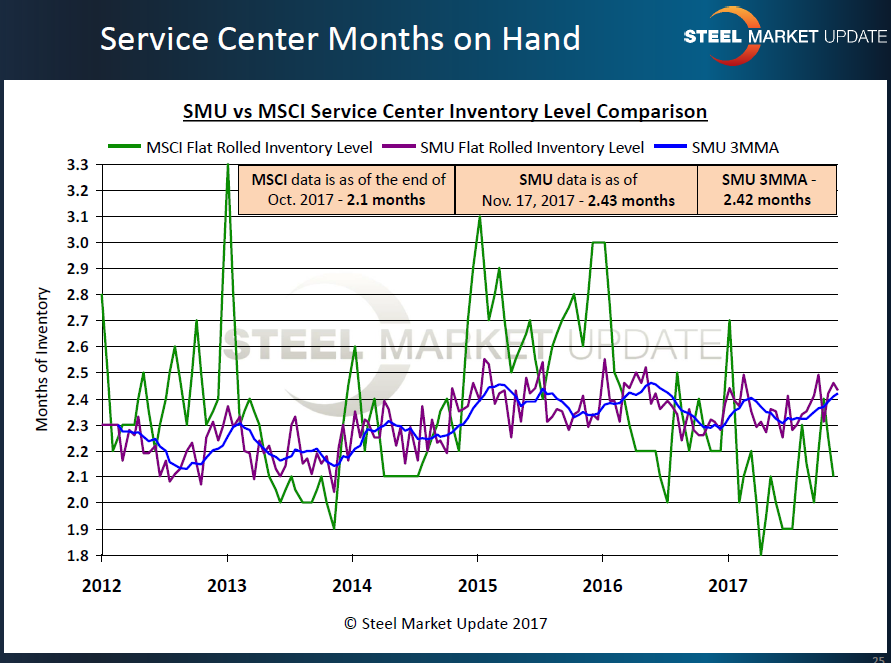

The number of months of supply available on the floors of the flat rolled steel distributors is one of the key influencing factors for flat rolled steel pricing. The steel mills and analysts tend to reference the Metals Service Center Institute (MSCI) as having the most robust data out of the distributors. Steel Market Update has been working diligently for a number of years now to develop our own data out of the service centers so that we, and our readers, have more tools to rely on when making buying and selling decisions.

For many years, we have used our survey as one of the ways we collect inventory data from service centers. It is relatively unsophisticated as we group flat rolled distributors with plate, secondary and HVAC wholesalers. Even so, it does give us an impression as to whether inventories are on the rise or not.

In last week’s survey, we found inventories to be averaging 2.43 months of supply. This is higher than MSCI, which reported service center inventories at 2.1 months of supply on carbon flat rolled as of the end of October.

In the graphic below, you can get a sense of the direction for inventories at the flat rolled steel distributors. It appears inventories have been on the rise on both the MSCI and SMU indices.

Where Will Inventories Go Next?

It is not enough to know the average number of months of supply being held by steel service centers. It is also important to have a feel for what the distributors will be doing next. We try to answer that question through our bi-monthly survey.

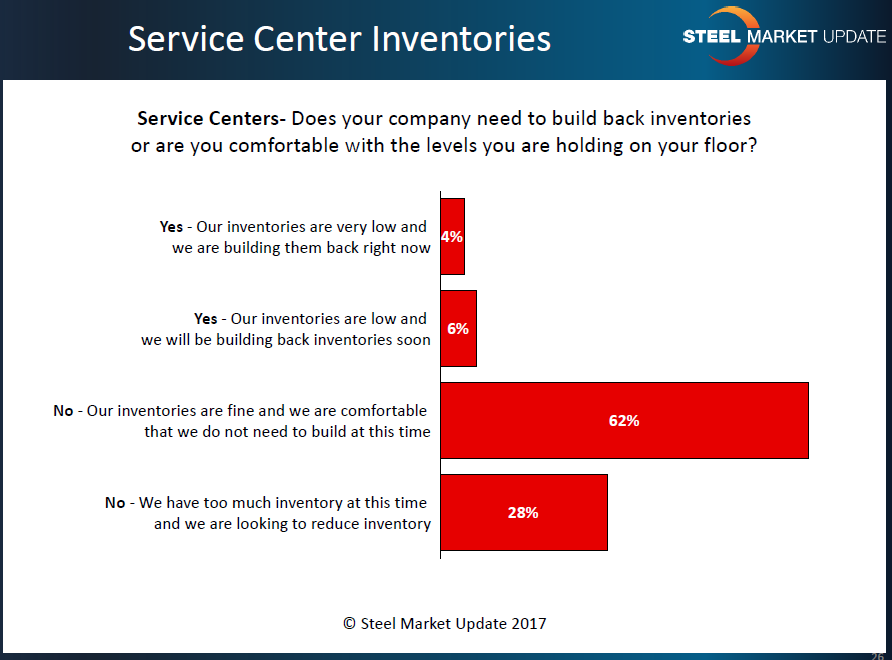

In the analysis just completed last Friday, 10 percent of the service center respondents reported inventory levels as low and being built back either right now (4 percent) or soon (6 percent). The rest of the respondents reported inventories as being “comfortable” (62 percent) or in excess of where their company would like them to be (28 percent).