Market Data

November 16, 2017

SMU Survey: Mills Negotiate Right Up to Price Announcements

Written by Tim Triplett

Buyers of flat rolled steel report that most domestic steel mills are open to negotiating spot prices, especially on cold rolled and coated products, even though the major mills announced price hikes this week.

About half of the respondents to this week’s Steel Market Update market trends questionnaire reported a mixed market, with some mills firmer than others when it comes to negotiating price. About 42 percent said mill order books are weaker than advertised and suppliers are willing to talk price. Only 8 percent described mill pricing as firm. Note that most buyers responded to SMU’s questionnaire on Monday and Tuesday, before the mill price announcements on Wednesday.

“As with every contract season, the mills that had a net loss of contractual tons for 2018 are willing to negotiate in order to backfill those losses. Those that had net gains are firm and less likely to negotiate,” commented one buyer. “There appears to be an uptick in order entry. Lead time has jumped out in the last 10 days or so. Most mills are into middle December to late December shipments. A few are already quoting early January,” reported another. “Time is running out on those few mills that still have December tons. If you’re a buyer and you don’t have your deal done, you’d better hurry,” said a third.

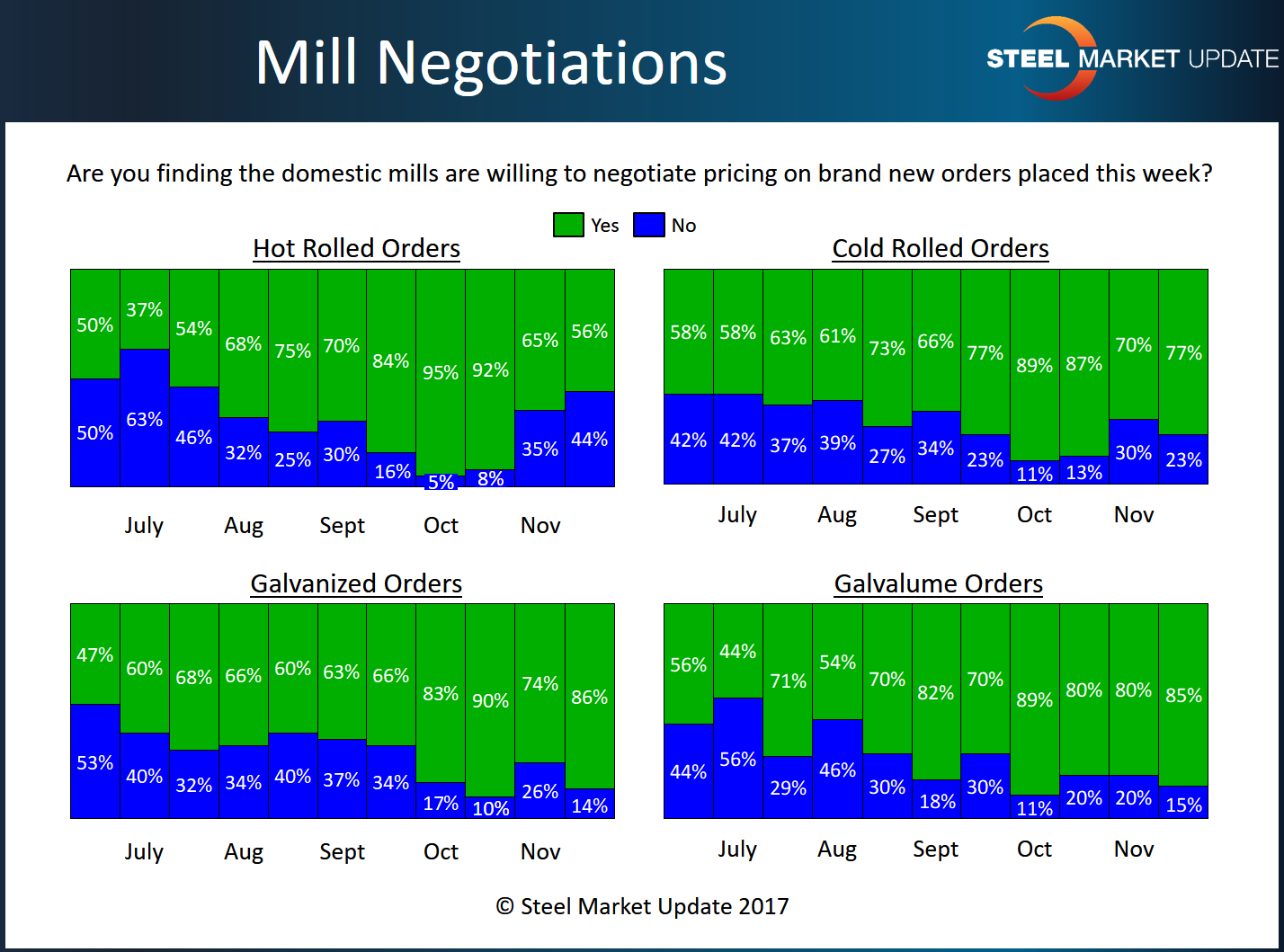

Demand for hot rolled steel appears to be strengthening as the percentage of respondents reporting mills willing to negotiate on HRC declined to 56 percent, compared with 65 percent two weeks ago and 92 percent a month ago. That’s the lowest percentage since mid-July.

In cold rolled and coated products, the trend is just the opposite. About 77 percent of buyers said they have found cold mills willing to negotiate prices, up from 70 percent two weeks ago. In galvanized, the percentage increased to 86 percent from 74 percent in the last questionnaire. Likewise, 85 percent of Galvalume buyers said their suppliers were willing to talk price, up from 80 percent in late October.

Steel buyers’ reports of mills’ openness to negotiating pricing makes this week’s price hike announcements that much more surprising. But comments pointing to some mills now taking orders for January and February delivery suggest that demand may be stronger than it appears.

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.