Market Data

November 16, 2017

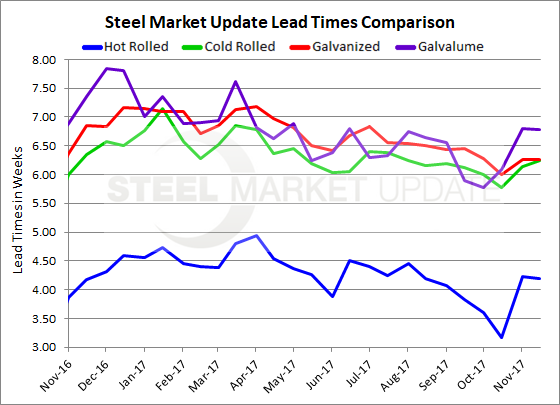

Steel Mill Lead Times: Support for Price Hikes?

Written by Tim Triplett

The latest lead time data based on the Steel Market Update flat rolled steel survey—largely unchanged from two weeks ago–offers no clear indication of whether this week’s price announcements by three of the flat rolled steel mills will be accepted by the marketplace.

SMU began collecting responses from steel buyers on Monday of this week, prior to the mill price hike announcements which began on Wednesday for flat rolled. At least 90 percent of the total responses were received prior to the announcements. One of the key indicators tracked by SMU is the lead times for hot rolled, cold rolled, galvanized and Galvalume steels. The farther and faster lead times move out, the more support the mill price hikes are likely to see. Lead times on each product are somewhat higher than reported in mid-October, but have seen little change in the past two weeks. Calculated on a three-month moving average basis, lead times on all four products are considerably shorter than they were at mid-year.

Hot rolled lead times averaged 4.20 weeks in mid-November, about the same as early in the month, but a week longer than in mid-October when HRC lead times averaged 3.16 weeks. Last year at this time, in a period when hot rolled prices were on the rise, HRC lead times were about the same at 4.18 weeks.

Cold-rolled lead times remain a bit over six weeks (6.24 weeks), up from 5.77 weeks in mid-October and 6.14 weeks in early November, but at about the same level as this time last year. Cold rolled lead times have fluctuated within a narrow one-week range over the past 12 months, averaging about 6.36 weeks overall.

Galvanized lead times were unchanged from two weeks ago at 6.26 weeks. In mid-October, GI lead times averaged six weeks. Last year at this time, GI lead times were slightly higher at 6.85 weeks. Likewise, Galvalume lead times, at 6.79 weeks, are little changed from two weeks ago, but up notably from 6.09 weeks in mid-October. One year ago, AZ lead times were a bit higher at 7.36 weeks.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.