Prices

November 14, 2017

SMU Price Ranges & Indices: Up, Down, Sideways...

Written by John Packard

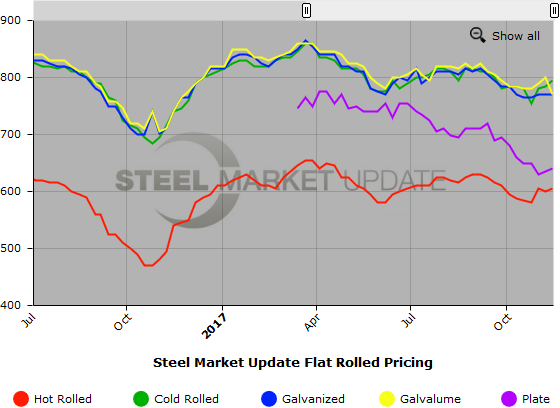

Flat rolled steel prices were mixed this past week. Benchmark hot rolled continues to be one of the better performing of the group. Our HRC average was up $5 per ton this week. Cold rolled was also up, galvanized was sideways and Galvalume dropped $30 per ton. Plate prices on a delivered basis were up $5 per ton for the week, but don’t read too much into that number… The SMU Price Momentum Indicator is still pointing toward Neutral meaning our perception is there is no clear-cut market direction right now. We expect this lack of leadership to continue until lead times slip into the first quarter. At that point demand, inventory levels and lead times will dictate where prices go from here.

On a side note, SMU did hear from a couple of mills today who admitted things were not quite as rosy as they may have looked a couple of weeks back. A steel buyer sent us the lead time sheet just released by one of their suppliers, which referenced lead times as being one to two weeks shorter than what was being referenced just a few days ago. Is this an isolated incident? SMU will continue to ask and will report when we find out.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $590-$620 per ton ($29.50/cwt-$31.00/cwt) with an average of $605 per ton ($30.25/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to one week ago, while the upper end remained the same. Our overall average is up $5 per ton compared to last week. Our price momentum on hot rolled steel is pointing to Neutral indicating prices are expected to remain steady over the next 30 days.

Hot Rolled Lead Times: 3-5 weeks

Cold Rolled Coil: SMU price range is $770-$820 per ton ($38.50/cwt-$41.00/cwt) with an average of $795 per ton ($39.75/cwt) FOB mill, east of the Rockies. The lower end of our range remained the same compared to last week, while the upper end rose $20 per ton. Our overall average is up $10 per ton compared to one week ago. Our price momentum on cold rolled steel is pointing to Neutral indicating prices are expected to remain steady over the next 30 days.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU base price range is $37.00/cwt-$40.00/cwt ($740-$800 per ton) with an average of $38.50/cwt ($770 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to one week ago. Our overall average is unchanged compared to last week. Our price momentum on galvanized steel is pointing to Neutral indicating prices are expected to remain steady over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $818-$878 per net ton with an average of $848 per ton FOB mill, east of the Rockies. A note to our readers who also review other galvanized indexes: Right now, not all indexes are using the same G90 zinc coating extra on benchmark .060″ material. SMU uses $78 per ton, while at least one other index is using $86 per ton, which reflects the price change made by NLMK USA. SMU has not yet made a change as we wait for U.S. Steel, ArcelorMittal USA and Nucor to make adjustments to their extras.

Galvanized Lead Times: 3-11 weeks

Galvalume Coil: SMU base price range is $37.00/cwt-$40.00/cwt ($740-$800 per ton) with an average of $38.50/cwt ($770 per ton) FOB mill, east of the Rockies. The lower end of our range declined $20 per ton compared to last week, while the upper end declined $40 per ton. Our overall average is down $30 per ton compared to one week ago. Our price momentum on Galvalume steel is pointing to Neutral indicating prices are expected to remain steady over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,031-$1,091 per net ton with an average of $1,061 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-8 weeks

Plate: SMU price range is $600-$680 per ton ($30.00/cwt-$34.00/cwt) with an average of $640 per ton ($32.00/cwt) FOB delivered. The lower end of our range remained the same compared to one week ago, while the upper end increased $10 per ton. Our overall average is up $5 per ton compared to last week. Our price momentum on plate steel is pointing to Neutral indicating prices are expected to remain steady over the next 30 days.

Plate Lead Times: 4-5 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. To use the graph’s interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or 800-432-3475.