Prices

November 8, 2017

SMU Price Ranges & Indices: Not Ready to Break Out (Yet)

Written by John Packard

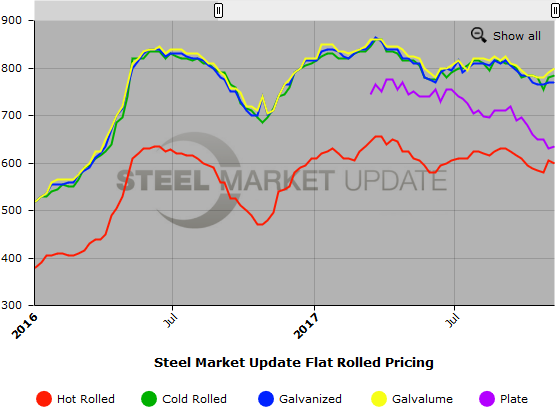

Flat rolled steel prices were mixed this week. There was no clear-cut direction being set, although the expectation is for prices to rise once lead times go into January. For that matter, we did hear from some steel buyers who placed December HRC orders for $600 per ton and at the same time placed January at $620 per ton. Watch the lower end of the ranges in the coming weeks. If there is going to be strength, it will come from the bottom up.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $580-$620 per ton ($29.00/cwt-$31.00/cwt) with an average of $600 per ton ($30.00/cwt) FOB mill, east of the Rockies. The lower end of our range declined $10 per ton compared to one week ago, while the upper end remained the same. Our overall average is down $5 per ton compared to last week. Our price momentum on hot rolled steel is pointing to Neutral indicating prices are expected to remain steady over the next 30 days.

Hot Rolled Lead Times: 3-6 weeks

Cold Rolled Coil: SMU price range is $770-$800 per ton ($38.50/cwt-$40.00/cwt) with an average of $785 per ton ($39.25/cwt) FOB mill, east of the Rockies. The lower end of our range rose $10 per ton compared to last week, while the upper end remained the same. Our overall average is up $5 per ton compared to one week ago. Our price momentum on cold rolled steel is pointing to Neutral indicating prices are expected to remain steady over the next 30 days.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU base price range is $37.00/cwt-$40.00/cwt ($740-$800 per ton) with an average of $38.50/cwt ($770 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to one week ago. Our overall average is unchanged compared to last week. Our price momentum on galvanized steel is pointing to Neutral indicating prices are expected to remain steady over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $818-$878 per net ton with an average of $848 per ton FOB mill, east of the Rockies. A note to our readers who also review other galvanized indexes: Right now, not all indexes are using the same G90 zinc coating extra on benchmark .060″ material. SMU uses $78 per ton, while at least one other index is using $86 per ton, which reflects the price change made by NLMK USA. SMU has not yet made a change as we wait for U.S. Steel, ArcelorMittal USA and Nucor to make adjustments to their extras.

Galvanized Lead Times: 4-11 weeks

Galvalume Coil: SMU base price range is $38.00/cwt-$42.00/cwt ($760-$840 per ton) with an average of $40.00/cwt ($800 per ton) FOB mill, east of the Rockies. The lower end of our range remained the same compared to last week, while the upper end rose $20 per ton. Our overall average is up $10 per ton compared to one week ago. Our price momentum on Galvalume steel is pointing to Neutral indicating prices are expected to remain steady over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,051-$1,131 per net ton with an average of $1,091 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-8 weeks

Plate: SMU price range is $600-$670 per ton ($30.00/cwt-$33.50/cwt) with an average of $630 per ton ($31.75/cwt) FOB delivered. The lower end of our range remained the same compared to one week ago, while the upper end increased $10 per ton. Our overall average is up $5 per ton compared to last week. Our price momentum on plate steel is pointing to Neutral indicating prices are expected to remain steady over the next 30 days.

Plate Lead Times: 3-5 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. To use the graph’s interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or 800-432-3475.