Market Data

November 2, 2017

Steel Mills Willing to Talk Price

Written by John Packard

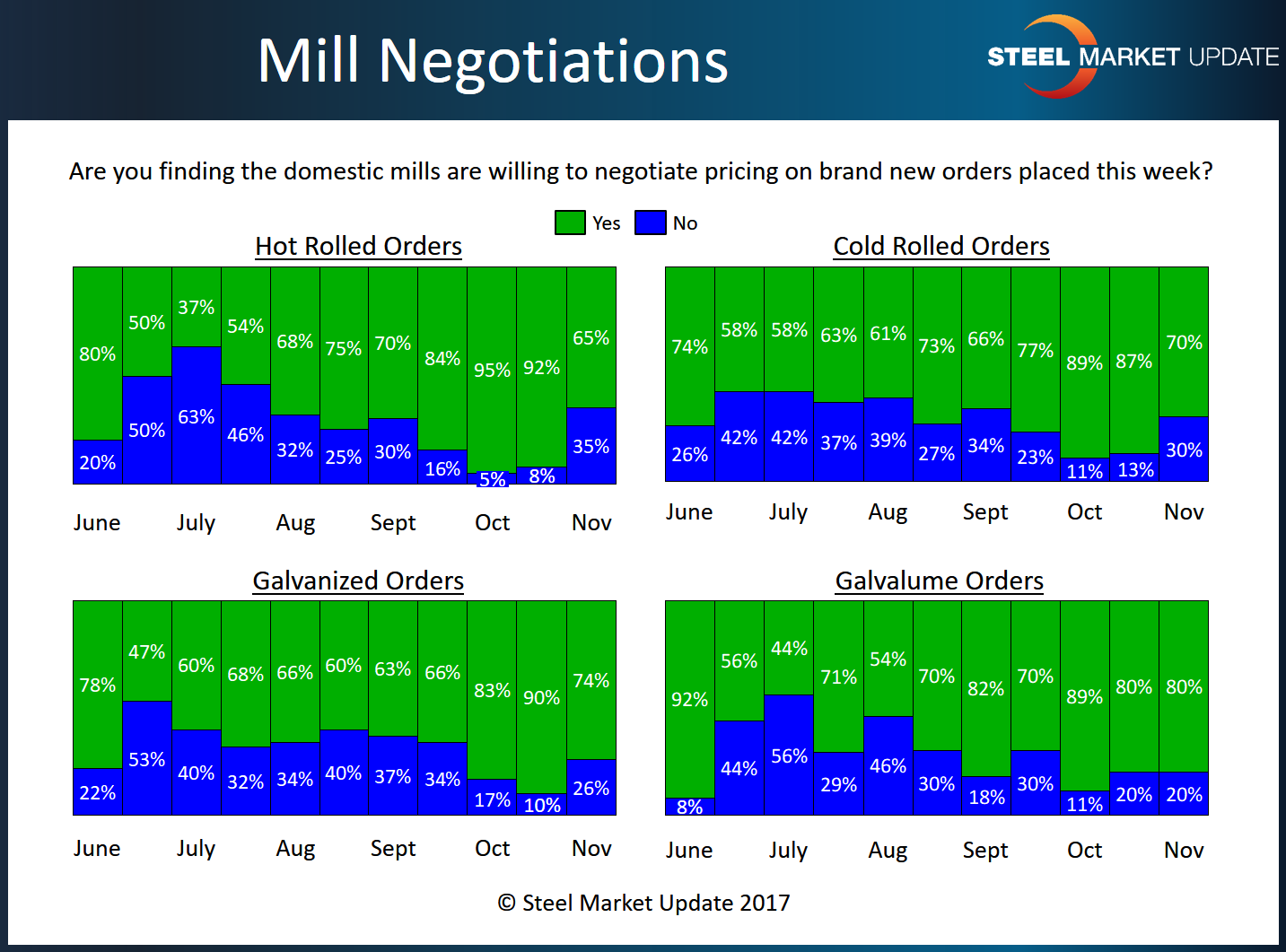

According to the buyers and sellers of flat rolled steel, the domestic steel mills are willing to negotiate spot steel prices. The percentages of those reporting the mills as willing to negotiate has shrunk, but continues to be well above 50 percent. This is a bit of a surprise considering the price announcements made in mid-October by ArcelorMittal USA and most of the other domestic steel mills.

The strongest move was with hot rolled steel, where the percentage of respondents reporting domestic mills as willing to negotiate on HRC shrunk from 92 percent to 65 percent (27 percent lower). It is necessary to go back to August 2017 to find the steel buyers reporting mills less willing to negotiate prices than they are today.

Seventy percent of the cold mills were willing to negotiate steel prices, according to survey respondents. This is down 17 percent from what was reported during the middle of October. As with HRC above, you need to go back to August to find a lower percentage of respondents reporting the mills as willing to negotiate.

Galvanized was 14 percent lower and continued to be higher than what was reported in August. There does not seem to be as much commitment to push GI prices than what we are seeing in hot rolled and cold rolled steels.

Galvalume did not change, with 80 percent of our respondents reporting the domestic mills as willing to negotiate spot prices of AZ.

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.