Analysis

November 2, 2017

October Auto Sales Better Than Expected

Written by Sandy Williams

Hurricane recovery, fleet sales and rental car companies contributed to a strong month for U.S. auto sales. Pickup trucks and SUVs continue to be snapped up by consumers.

“We did see continued hurricane replacement at the beginning of the month,” Michelle Krebs, an analyst at car-shopping website Autotrader, told Bloomberg. “The economic factors are also in trucks’ favor. People are back to work and construction activity is up, which is good for truck sales.”

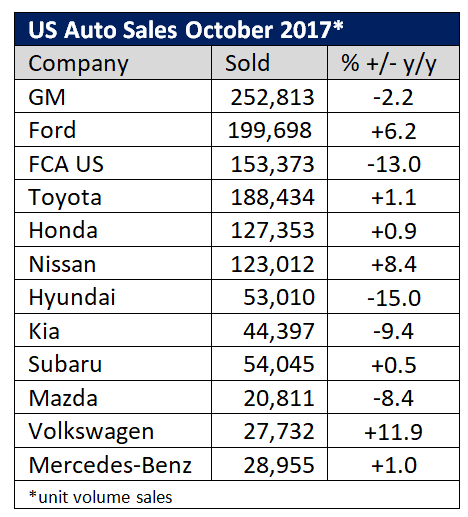

Ford, Toyota, Nissan and Volkwagen all reported increases in October. General Motors’ sales declined 2.2 percent, while FCA U.S. sales dropped 13 percent following a 43 percent cut in fleet sales.

Total sales are expected to reach 1.35 million vehicles in October for a seasonally adjusted annual rate of 18 million units, according to WardsAuto. The October SAAR exceeds sales of 17.8 million in 2016, but is less than September’s 18.48 million mark.

“We are heading into the fourth quarter with good momentum, thanks to a strong U.S. economy and very strong pickup and crossover sales,” says Kurt McNeil, vice president-U.S. sales operations at GM.