Market Data

November 1, 2017

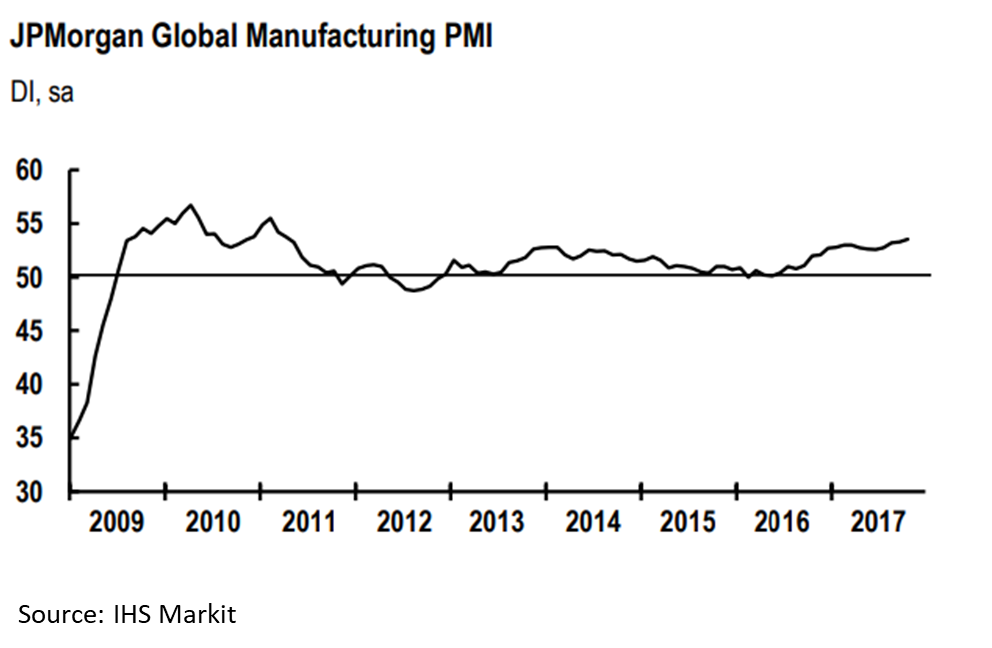

Global Manufacturing Ticks Upward in October

Written by Sandy Williams

Global manufacturing hit a six-and-a-half year high in October. The JP Morgan Global Manufacturing PMI rose to 53.5 from September’s 53.3. Most components of the PMI rose at faster rates in October. Output and output prices softened slightly during the month. Output charges increased reflecting supply chain constraints and longer vendor lead times.

“The global manufacturing PMI points to continued robust gains in production. The output PMI was little changed at an elevated level, while the index of new orders moved up,” commented David Hensley, Director of Global Economic Coordination at J.P. Morgan. Furthermore, the PMI indicates that output growth remains broad-based across the consumer, intermediate and investment goods sectors.”

Eurozone

European manufacturers began the fourth quarter with growth in output and new orders. The increase pressured capacity, leading to survey-record high job creation. Demand for raw materials and shortages of some inputs caused supplier delivery times to lengthen and input prices to rise. Selling prices reflected higher input charges. Strongest performers in the Eurozone were Germany, the Netherlands and Austria. All countries in the region recorded growth in October. The October PMI of 58.5 was the highest since February 2011. Sentiment for business conditions in the next 12 months remained positive, but dipped slightly from September’s three-month-high.

Russia

The PMI fell to 51.1 in October from September’s reading of 51.9 as manufacturers started the fourth quarter at a softer pace. Overall growth was at a four-month low, but export orders rose at the fastest rate since November 2012. Backlogs decreased as pressure eased on production capacity. Exchange rate fluctuations and supplier shortages added to higher input prices for the month. Supplier delivery times increased to their longest since May. Survey respondents remained confident about future business conditions, citing larger client bases and planned investment.

China

The Caixin China General Manufacturing PMI remained unchanged at 51.0 in October indicating marginal growth for the month. New business increased moderately in October as did new export sales. The rate of growth for production was the weakest in four months. Raw material inventories declined for the second month as firms used existing stock to fill production needs. The 12-month outlook was at its second lowest level since August 2016. Inventories declined as current stock was used to meet production. Stringent environmental inspection and low stock levels slowed delivery times by suppliers. Manufacturers raised selling prices to protect margins.

Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group, said: “China’s manufacturing sector expanded steadily in October. But the stringent production curbs imposed by the government to reduce pollution and relatively low inventory levels have added to cost pressures on companies in midstream and downstream industries, which could have a negative impact on production in the coming months.”

South Korea

Employment and output declined in South Korea during October. The PMI inched downward to 50.2 from 50.6 in September. New business rose at a softer pace and export orders declined as demand from China lessened. Employment levels were reduced marginally for the second consecutive month. Higher raw material prices prompted customers to place orders earlier than usual, adding to growing backlogs. Survey panelists expect improving business conditions during the next 12 months.

Mexico

The devastating earthquake in Mexico disrupted manufacturing in October. The PMI fell from 52.8 in September to 49.2 in October, entering contraction for the first time in four years. Output, new orders, employment and inventories all contracted, along with flattening of orders from abroad. Supply chain disruptions slowed delivery times as suppliers experienced raw material shortages. Currency weakness added to the quickest pace of cost inflation since June. Selling prices increased as cost burdens were passed on to clients. Panelists expressed the weakest confidence in business conditions since March due to economic uncertainty.

Canada

Manufacturing weakened in Canada during October resulting in a dip in the PMI to 54.3 from 55.0. New orders and output rose at weaker rates. Exports declined for the first time in a year, albeit slightly. Supplier delivery times were lengthened by Hurricane Harvey adding additional costs for raw materials. As input prices rose, manufacturers passed on price rises to clients. Backlogs increased for the sixth time in seven months spurring new hiring activity to ease pressure on capacity. Finished goods inventories fell as firms relied on stock to fill orders.

United States

The IHS Markit U.S. Manufacturing PMI gained 1.5 points in October, rising to 54.6 and accelerating at its quickest pace so far in 2017. Production grew on strong underlying demand and new orders. Export activity picked up among clients from Europe and Asia. Supplier shortages following the hurricanes contributed to higher input prices and extended delivery times. Manufacturer optimism regarding future output was at a three-month high as more favorable business conditions were anticipated.