Market Data

October 26, 2017

SMU Steel Market Survey: A Taste of the Process/Results

Written by John Packard

Twice per month, Steel Market Update conducts an analysis on the flat rolled steel market. Our focus is on pricing and price direction, demand, inventory management, international steel, buyers’ sentiment, service center spot price direction, mill lead times and negotiations, and more. We have been conducting our market analysis going back to late 2008.

The process is accomplished using an online questionnaire, which can be accessed via a link in an emailed invitation sent to approximately 650 steel buyers, sales and management people throughout the United States and Canada.

We intentionally focus much of our attention on two groups: manufacturing companies and flat rolled and plate steel service centers and wholesalers. Those two groups make up 80 to 90 percent of those responding to any one questionnaire. The most recent survey, which concluded on Oct. 19, had a return made up of 46 percent service centers/wholesalers and 42 percent manufacturing companies. The reason we focus on these two groups is because they are the largest buyers of flat rolled steel products.

The balance of the data gathered is from steel mills, trading companies and toll processors. (Last week each represented 4 percent of the respondents.)

The data collected is then compiled, and we produce a 56-slide PowerPoint presentation that is then shared with those responding to our questionnaire and our Premium level members. Our Premium members can access the PowerPoint on our website where we show the most recent edition, as well as past presentations, which can be used as reference materials for organizations.

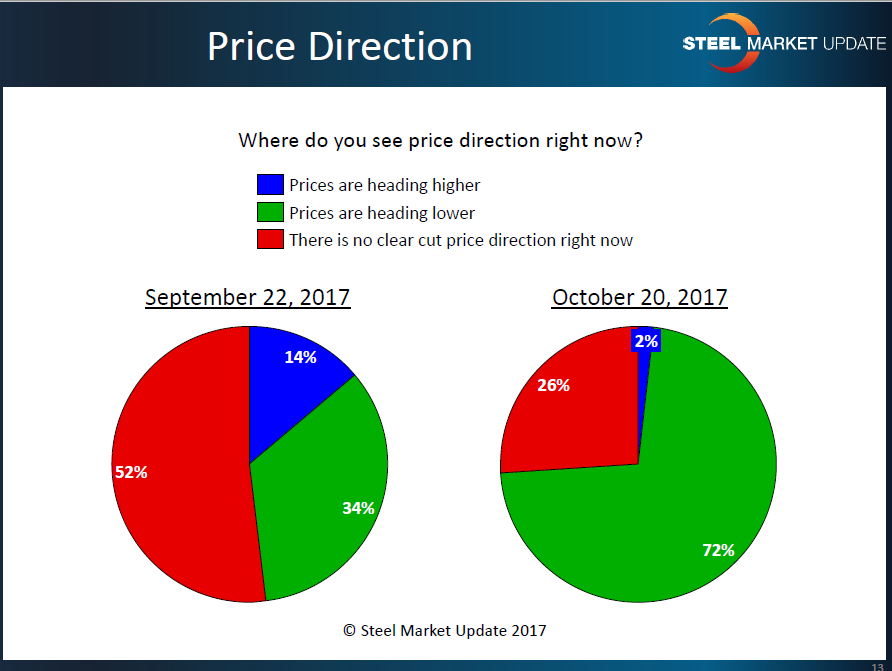

The first section of our questionnaire collects data from the individuals responding to our invitation. Our SMU Steel Buyers Sentiment Indexes, both current and future, are derived from questions in this part of our survey. We also ask questions about overall demand (last week 72 percent of our respondents reported “prices are heading lower,” though the vast majority responded prior to AMUSA’s price announcement).

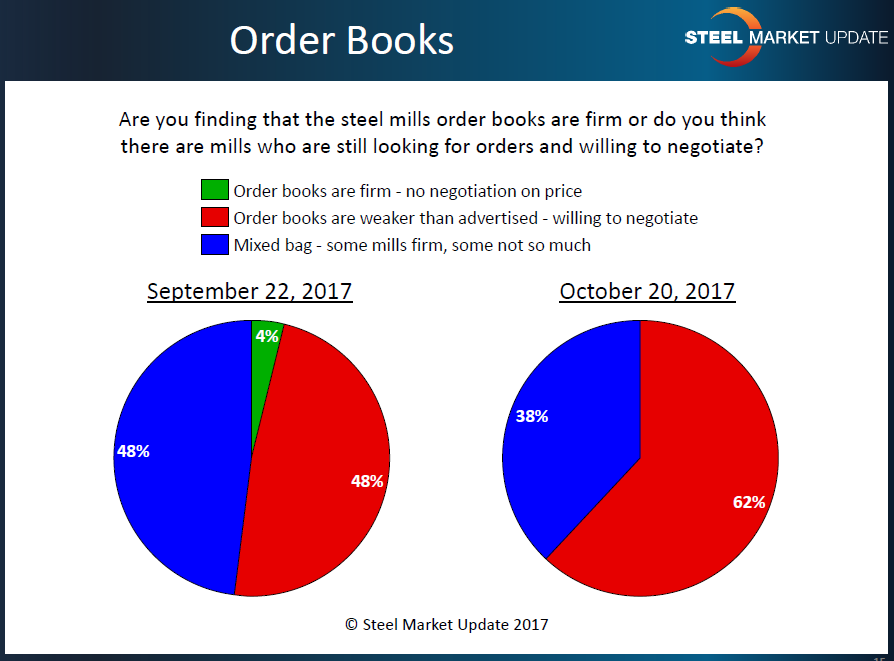

The first section also asks questions about mill order books so that we can identify strengths or weaknesses based on a wider view of the market. Last week, 62 percent of our respondents reported mill order books as weaker than advertised and that the mills were willing to negotiate. Not one person saw order books as “firm” with no negotiation on price.

After the first five or six questions, we ask respondents to identify themselves by type of company, then move them to a questionnaire that is tailored to their industry – manufacturers, service centers, steel mills, trading companies, toll processors.

For more information about how we conduct our surveys and the results from our analysis, go to the survey portion of our website, which is in the Analysis section. A sample survey is here for you to review. If you would like more details about switching (or becoming) a new Premium level member, please contact us at info@SteelMarketUpdate.com.