Market Data

October 25, 2017

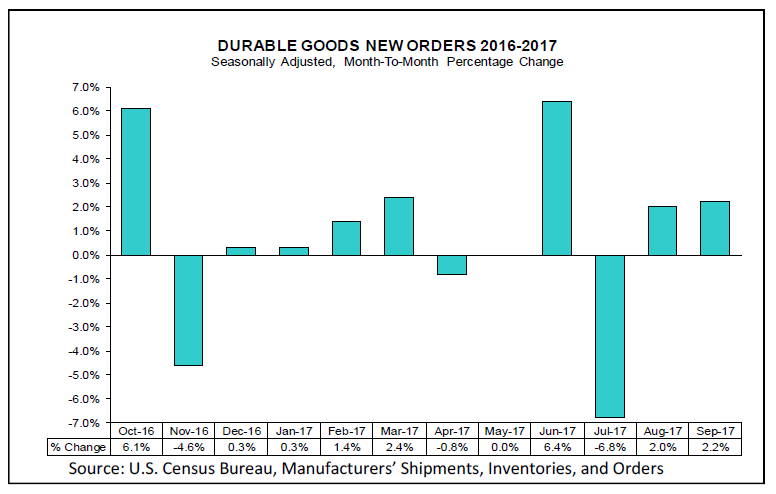

Durable Goods Orders Jump 2.2 Percent on Aircraft Surge

Written by Sandy Williams

Durable goods orders were stronger than anticipated in September, rising 2.2 percent and nearly double economists’ expectations. The volatile transportation sector drove much of the increase. Commercial aircraft orders jumped 64 percent after gaining 52 percent in August.

Orders for core capital goods, which exclude defense and aircraft, rose 1.3 percent, and shipments of core capital goods increased 0.7 percent. Together, they indicate growing business confidence and bode well for future investment.

“Overall, business equipment investment appears to be going from strength to strength, providing further reason to believe that the economy will continue to grow at a healthy pace in the fourth quarter,” said Andrew Hunter of Capital Economics.

New Orders

New orders for manufactured durable goods in September increased $5.1 billion or 2.2 percent to $238.7 billion, the U.S. Census Bureau announced today. This increase, up three of the last four months, followed a 2.0 percent August increase. Excluding transportation, new orders increased 0.7 percent. Excluding defense, new orders increased 2.0 percent. Transportation equipment, also up three of the last four months, led the increase, up $4.0 billion or 5.1 percent to $81.2 billion.

Shipments

Shipments of manufactured durable goods in September, up four of the last five months, increased $2.4 billion or 1.0 percent to $240.5 billion. This followed a 0.7 percent August increase. Transportation equipment, up two of the last three months, led the increase, up $1.1 billion or 1.4 percent to $79.7 billion.

Unfilled Orders

Unfilled orders for manufactured durable goods in September, up following two consecutive monthly decreases, increased $2.8 billion or 0.2 percent to $1,135.1 billion. This followed a virtually unchanged August decrease. Transportation equipment, also up following two consecutive monthly decreases, led the increase, up $1.5 billion or 0.2 percent to $772.1 billion.

Inventories

Inventories of manufactured durable goods in September, up 14 of the last 15 months, increased $2.4 billion or 0.6 percent to $403.6 billion. This followed a 0.5 percent August increase. Transportation equipment, up three consecutive months, led the increase, up $0.8 billion or 0.7 percent to $130.8 billion.

Capital Goods

Nondefense new orders for capital goods in September increased $4.3 billion or 6.1 percent to $74.9 billion. Shipments increased $1.7 billion or 2.4 percent to $73.5 billion. Unfilled orders increased $1.3 billion or 0.2 percent to $704.8 billion. Inventories increased $1.4 billion or 0.8 percent to $179.9 billion. Defense new orders for capital goods in September increased $0.5 billion or 4.1 percent to $11.5 billion. Shipments increased $0.2 billion or 1.7 percent to $10.6 billion. Unfilled orders increased $0.9 billion or 0.7 percent to $143.9 billion. Inventories decreased $0.1 billion or 0.3 percent to $23.4 billion.

Revised August Data

Revised seasonally adjusted August figures for all manufacturing industries were: new orders, $471.8 billion (revised from $471.7 billion); shipments, $476.3 billion (revised from $475.9 billion); unfilled orders, $1,132.3 billion (revised from $1,132.6 billion) and total inventories, $655.9 billion (revised from $655.6 billion).