Analysis

October 23, 2017

Auto Production: Mexico Keeps Winning

Written by Peter Wright

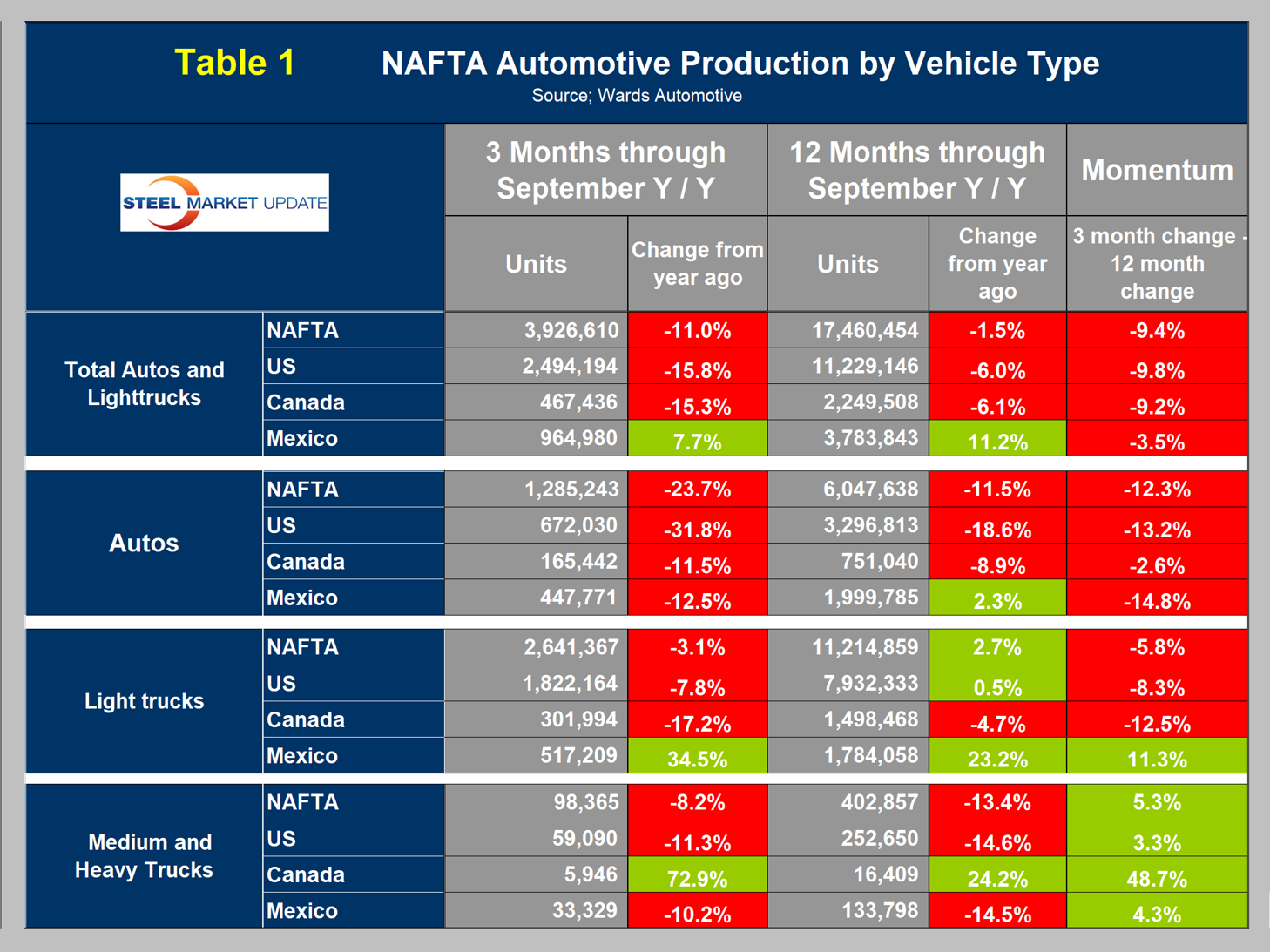

The volume of light vehicle assemblies in the U.S. and Canada is declining at more than 15 percent per year as Mexico’s volume is increasing by 7.7 percent, according to the latest Steel Market Update analysis of auto production in the NAFTA region.

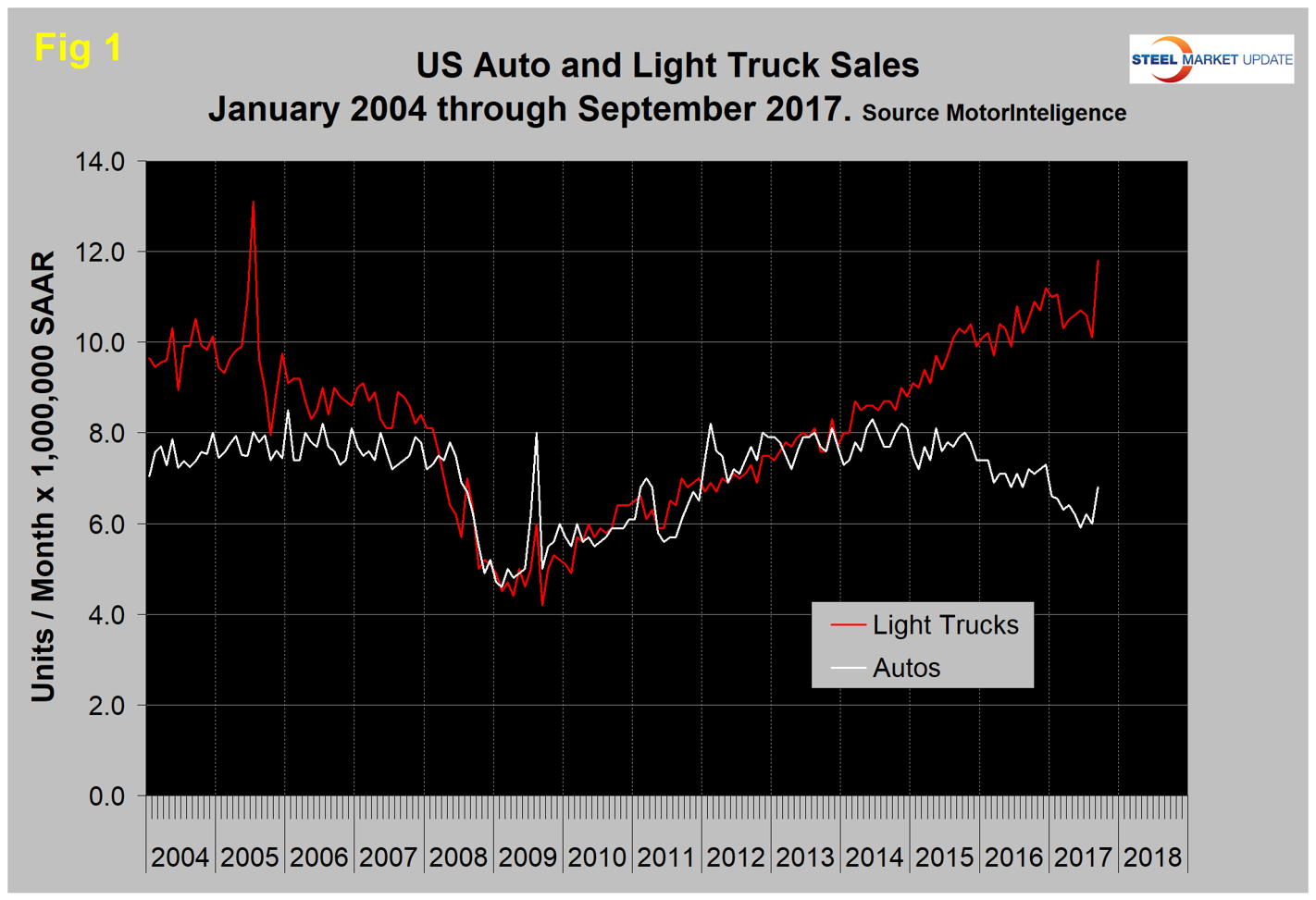

U.S. Vehicle Sales: U.S. new-vehicle sales surged in September to 18.6 million units. This was the highest since July 2005 and a 5.5 percent increase year over year. Economy.com had this to say: “The same factors that dampened sales in September helped vehicle sales surge in September. New-vehicle sales posted their first year-over-year gain for 2017, fueled in large part by replacement vehicles from Hurricane Harvey. Dealerships were bustling in the south-central region of the country, including Houston, where vehicle sales jumped 14 percent compared with last September, according to JD Power. Even so, sales were somewhat lower for Irma-stricken Florida because the storm hit during September. The resurgence in sales caused by Hurricane Irma will likely carry over into October, but will certainly be smaller. According to the National Insurance Crime Bureau, around 297,000 auto insurance claims had been filed because of Harvey and an additional 128,000 were filed related to Irma.”

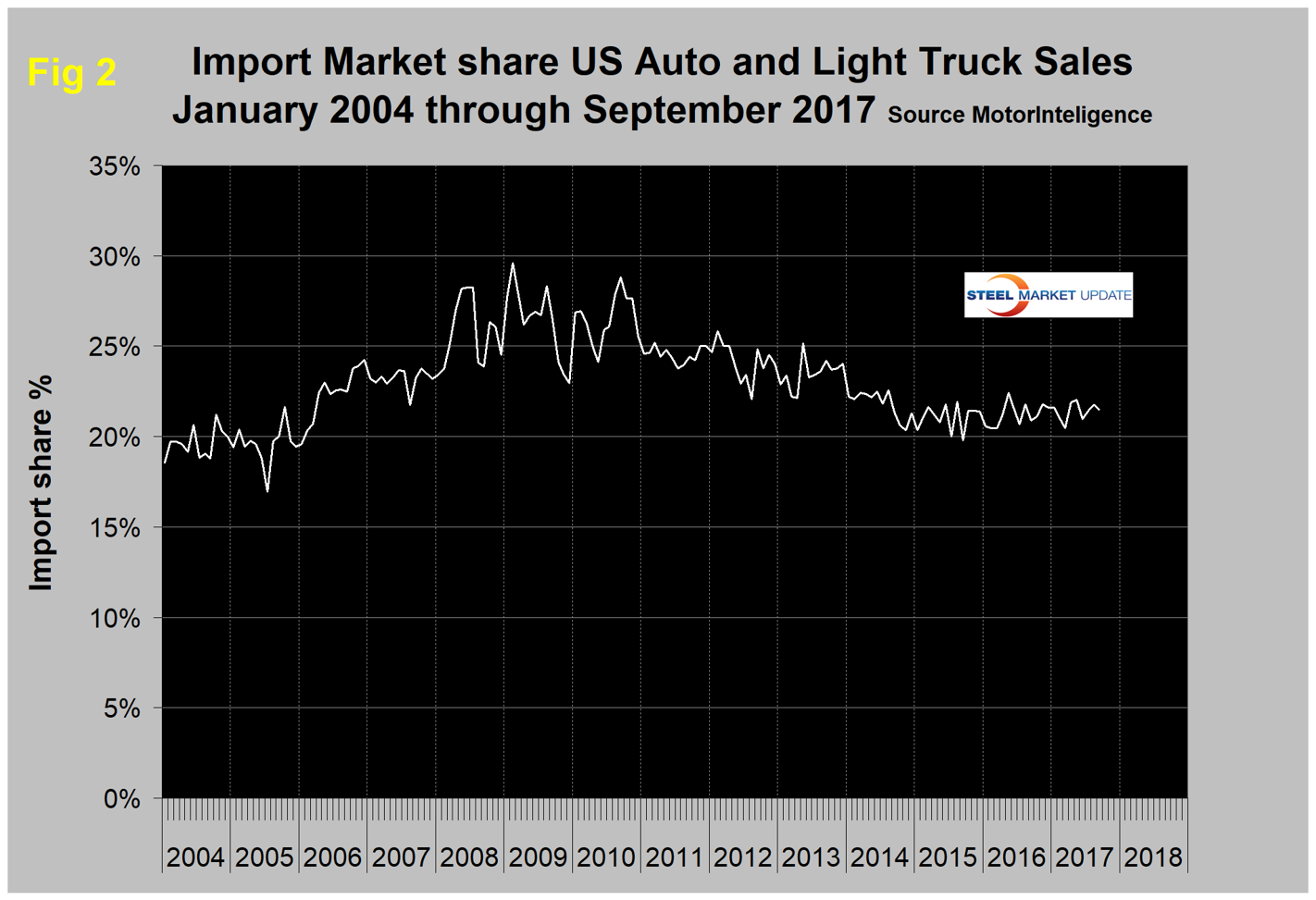

Figure 1 shows auto and light truck sales since January 2004. Import market share at 21.5 percent in September has changed little in the last 18 months as shown in Figure 2.

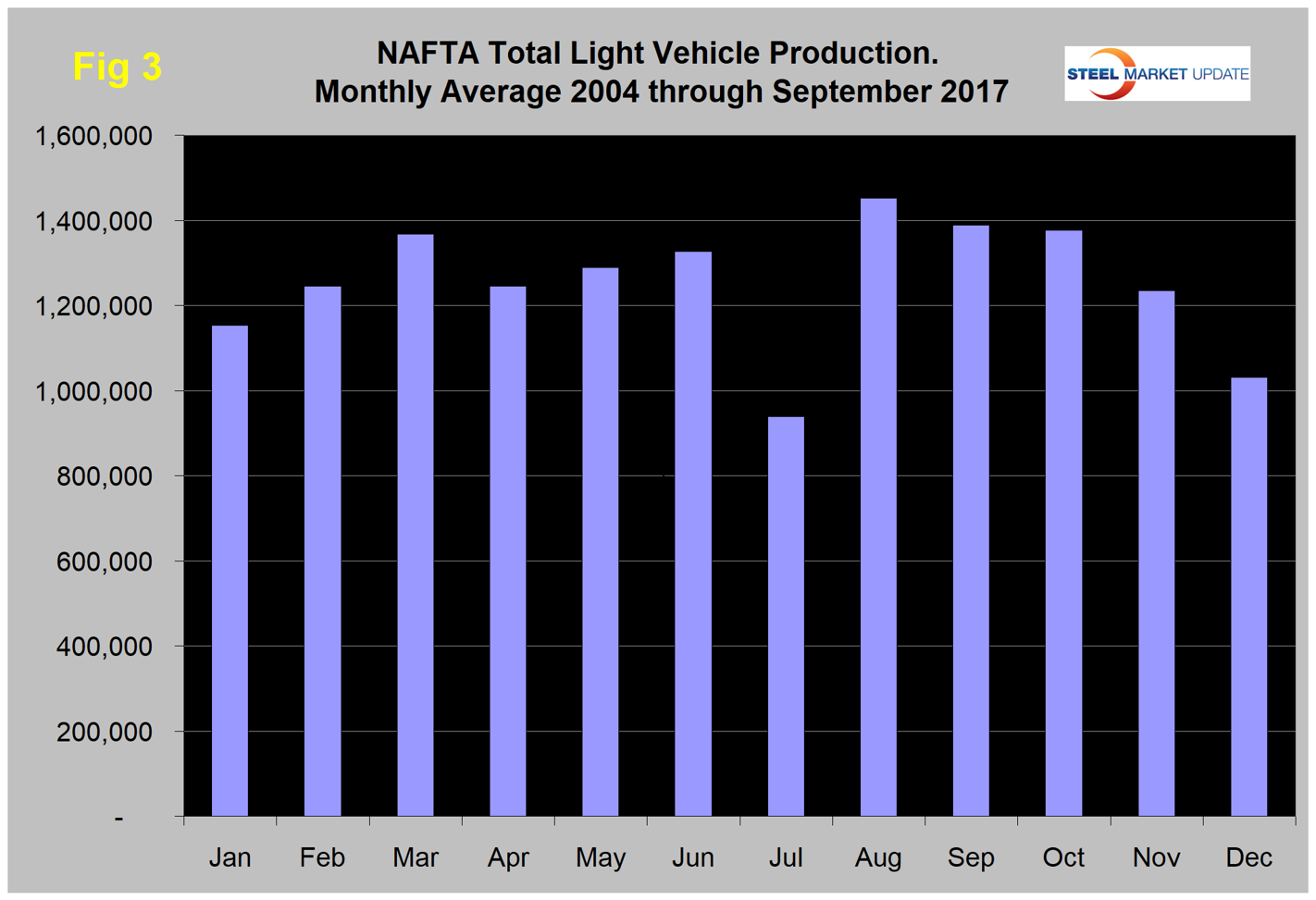

NAFTA Vehicle Assemblies: Total light vehicle (LV) production in NAFTA in September was at an annual rate of 16.018 million units, down from 18.407 million in August. On average since 2004, September’s production has been down by 4.4 percent from August. This year, production was down by 13.0 percent, therefore weaker than normal (Figure 3).

There was some giveback here because August was better than expected. Year to date through September, production was down by 4.0 percent from the same period in 2016. Note that production numbers are not seasonally adjusted; the sales data reported above are seasonally adjusted. Another consideration to note is that auto assemblies in NAFTA are a complex mix of parts and subassemblies moving both ways between nations and particularly across the southern border. We are reporting on the point of final assembly and have no data to assess how the trade in parts affects the total value mix between nations.

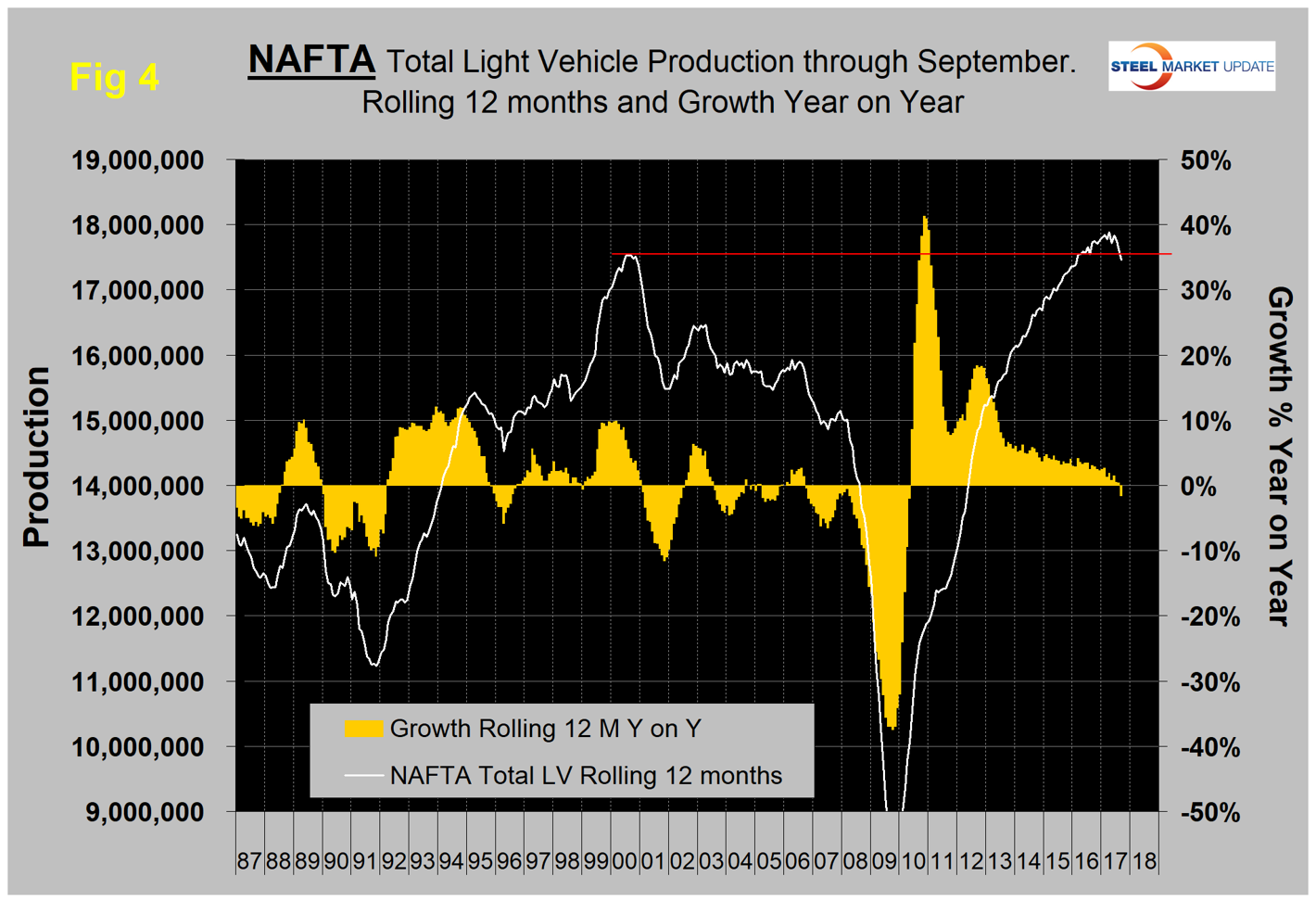

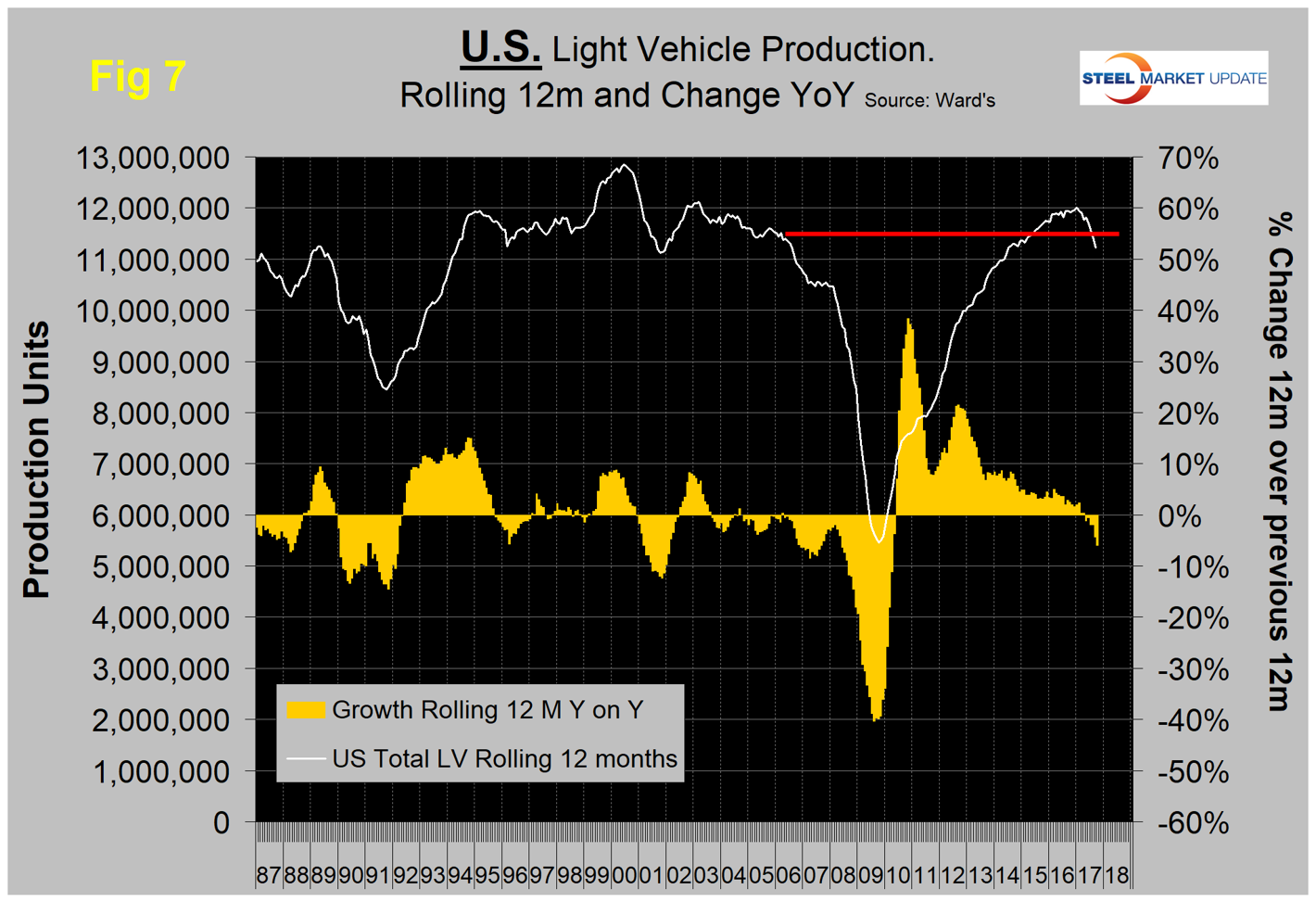

On a rolling 12-month basis year over year through September, LV production in NAFTA decreased by 1.5 percent, which was the first decrease since May 2010. There has been a very gradual slowdown in growth for the last three years as indicated by the brown bars in Figure 4. Up until this latest data, production was higher than the previous all-time high every month since early 2016, but that has now changed.

Like a broken record, we repeat here what we have been reporting for a while—from the U.S. point of view the news is not good. It now seems irrefutable that we are in the midst of a huge shift in assembly volume of both autos and light trucks from the U.S. to Mexico with Canada on the sideline. On a rolling 12-month basis year over year, total light vehicle production in the U.S. declined by 18.6 percent and Canada declined by 8.9 percent, while Mexico was up by 2.3 percent. The comparison is worse for the U.S. looking at the latest three months year over year, which show the U.S. down by 31.8 percent, Canada down by 11.5 percent and Mexico down by 12.5 percent (Table 1).

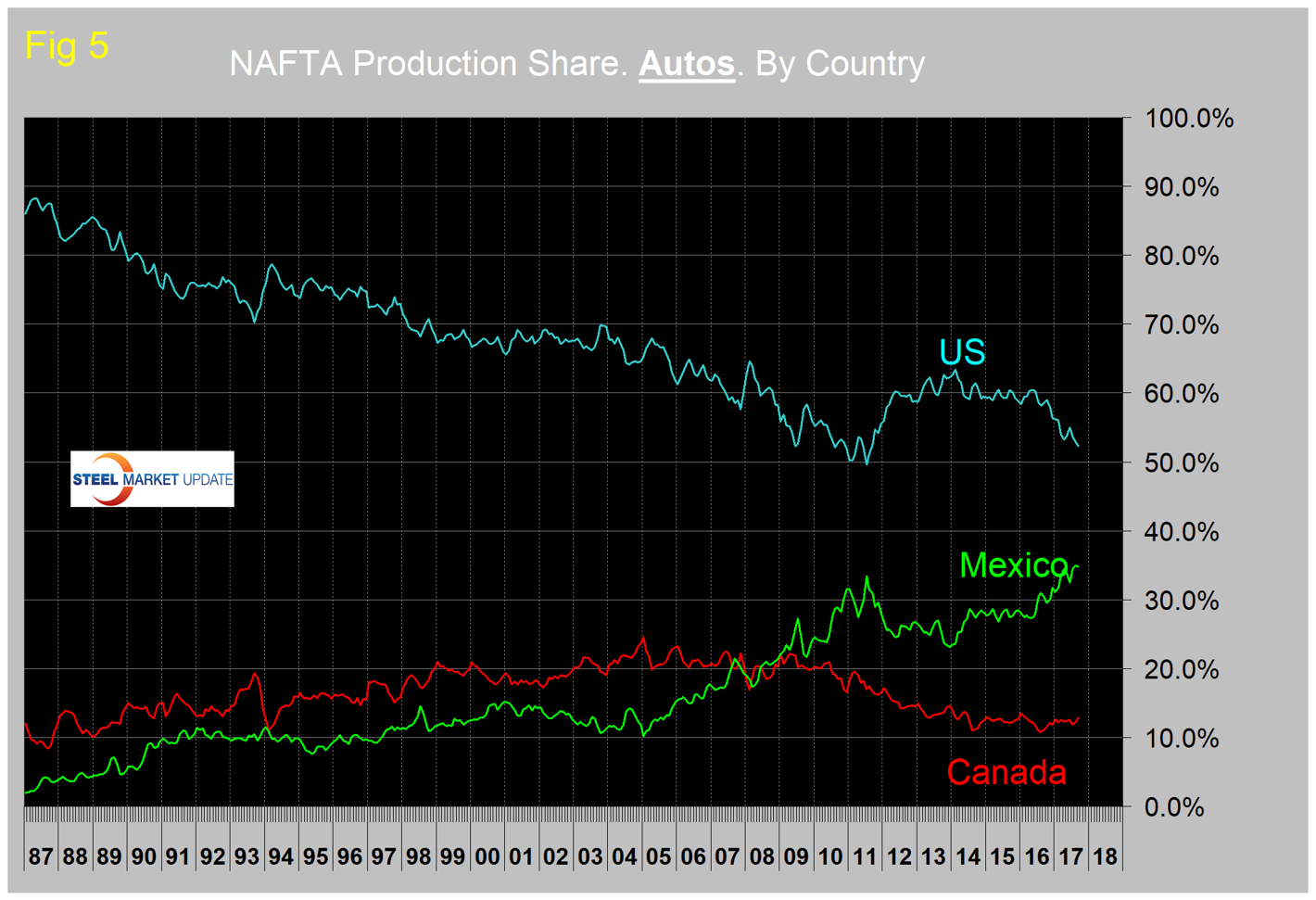

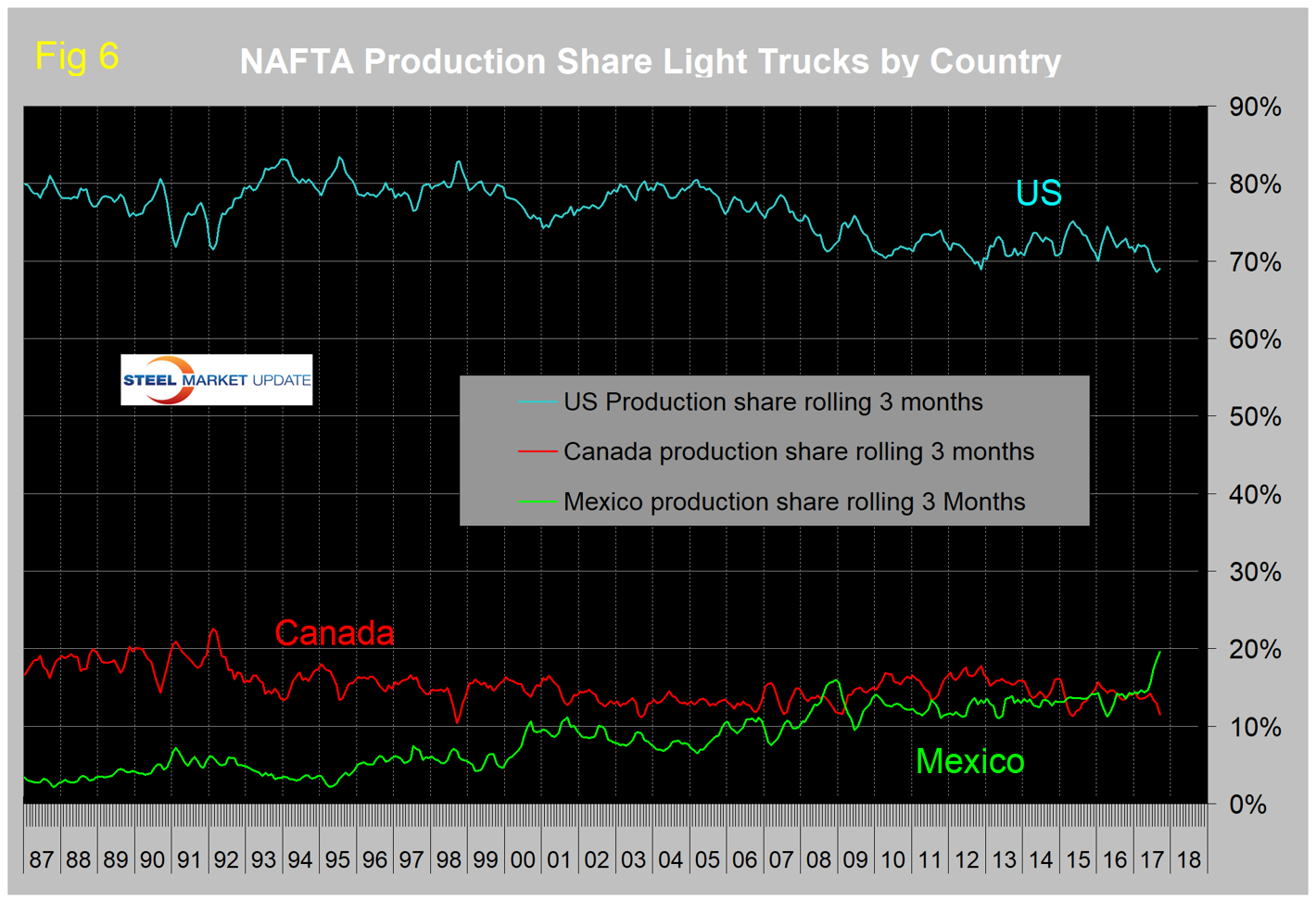

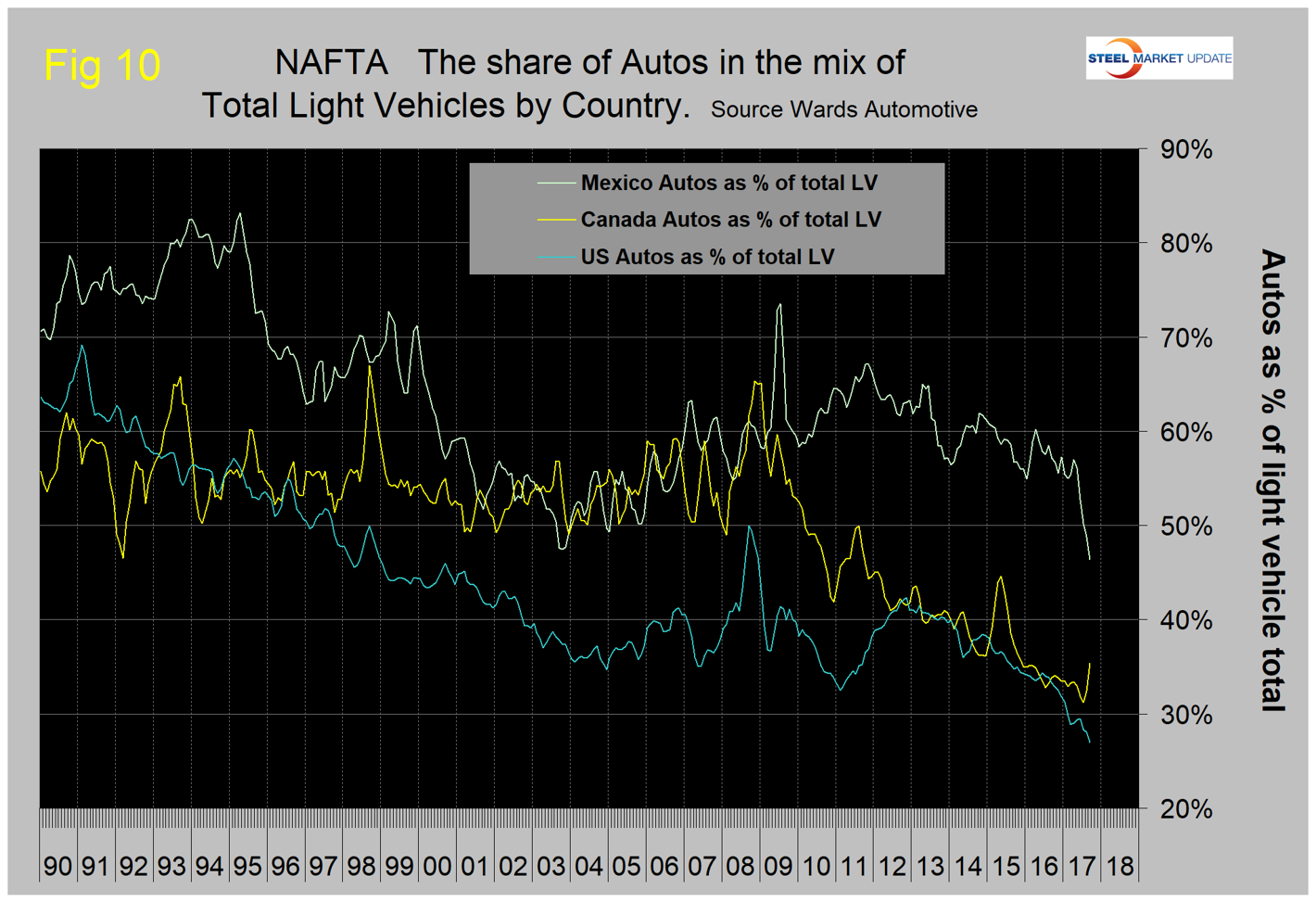

The shift south of the border is most pronounced for autos as shown by a comparison of Figures 5 and 6. The U.S. now has a market share for autos of 52.3 percent, Mexico has 34.8 percent and Canada has 12.9 percent.

Up until this year, the U.S. market share of light trucks hadn’t changed much since mid-2009, but in 2017 there has been a sharp increase in Mexico’s share at the expense of both the U.S. and Canada. The U.S. share is now 69.0 percent, Mexico’s is 19.6 percent and Canada’s is 11.4 percent. These are the highest ever shares for Mexico of both autos and light trucks. In three months through September year over year, Mexico’s production of light trucks grew by 34.5 percent. The U.S. contracted by 7.8 percent and Canada contracted by 17.2 percent.

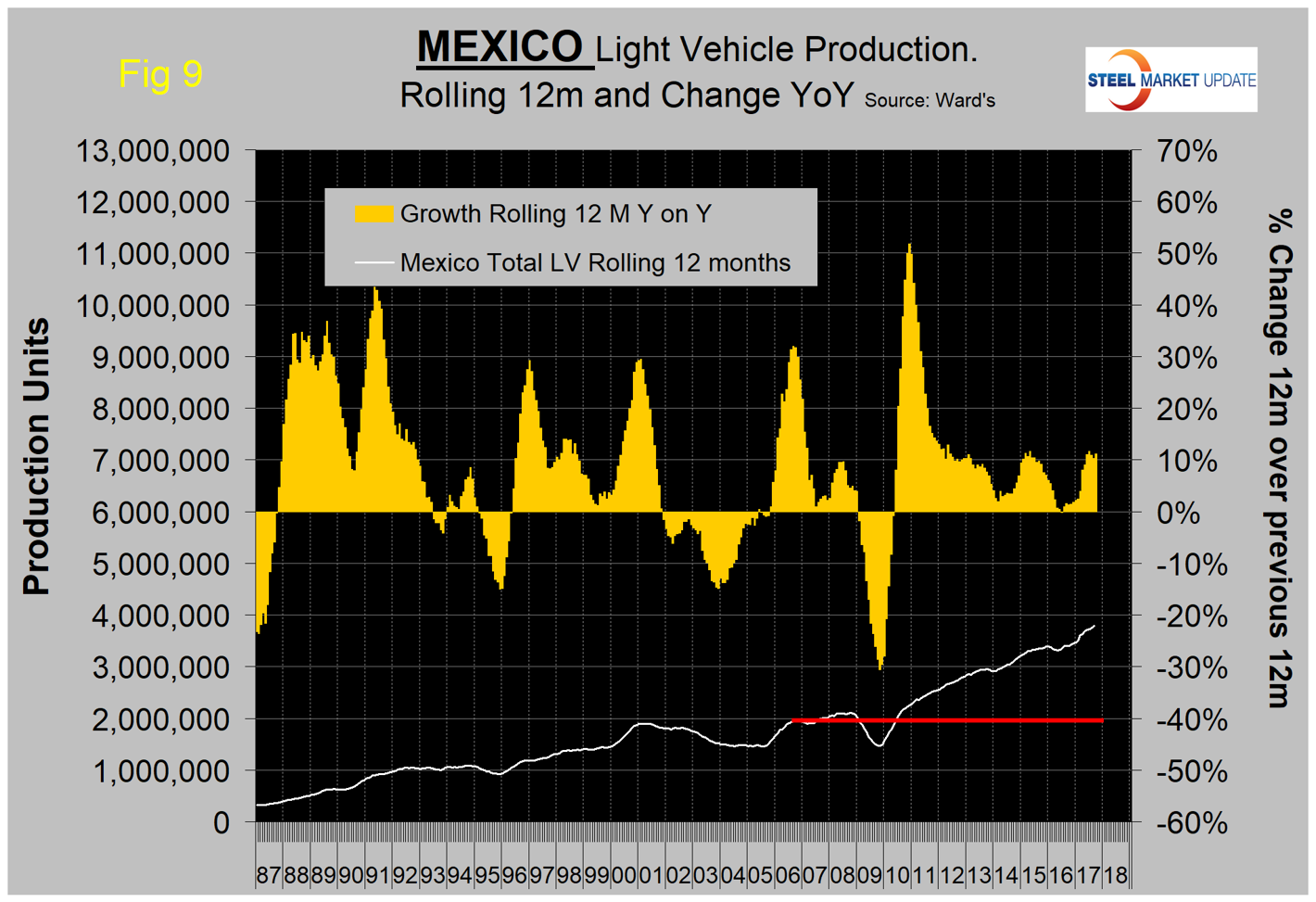

The Mexican light vehicle production target for 2020 is 5.0 million units, according to Eduardo Solis, president of the Mexican Automotive Industry Association. In the 12 months through September, Mexico’s LV production totaled 3.784 million units, up from 3.403 million in 12 months through September 2016. This means that Mexico is almost exactly tracking with Sr. Solis’ target.

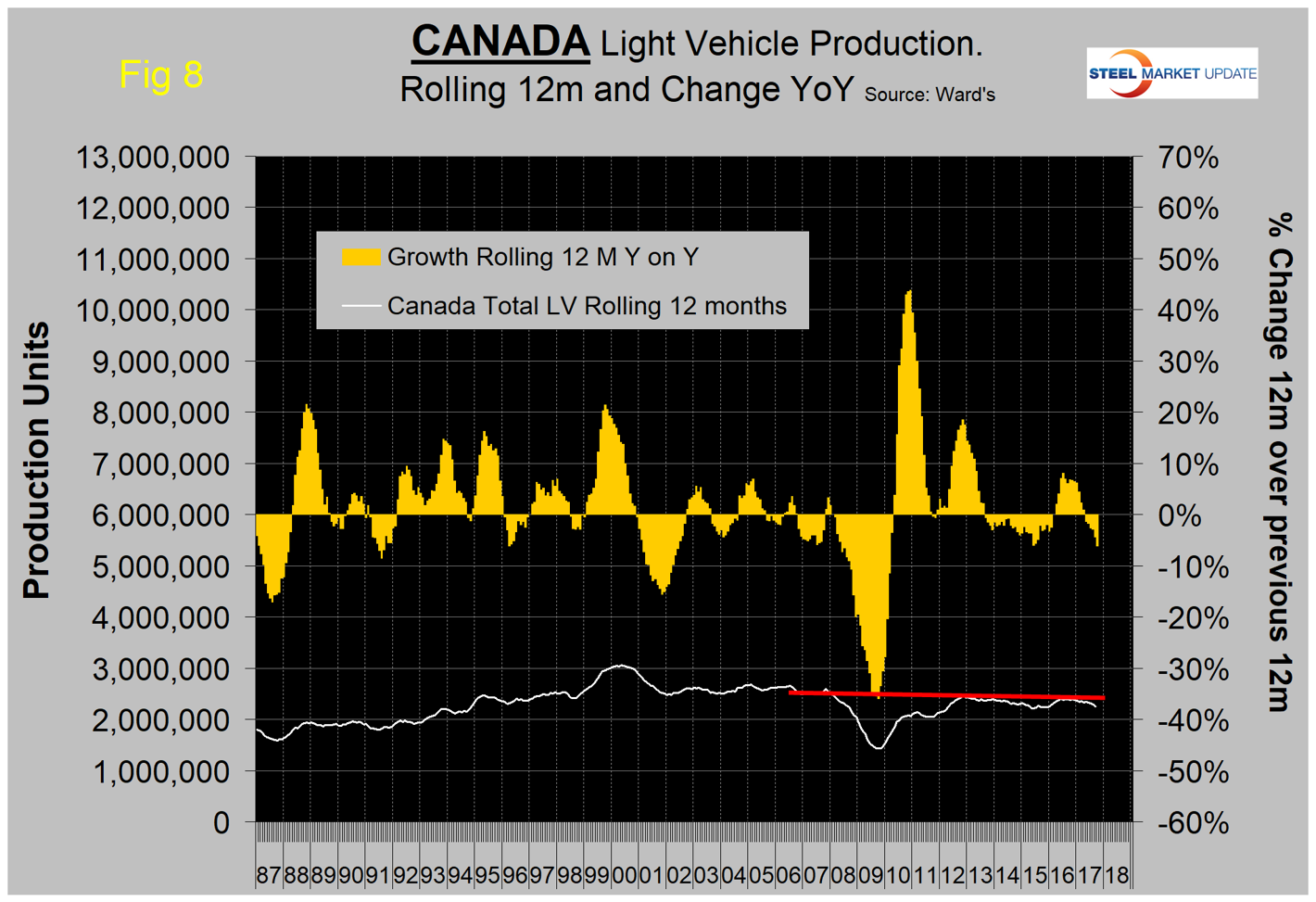

Figures 7, 8 and 9 show total LV production by country. The brown bars are the respective growth rates and they tell the whole story. The red line on each chart shows the change in production since Q2 2006. Note the scales are the same to give true comparability and that Mexican growth has surged in 2017. Mexico currently exports about 80 percent of its LV production. The U.S. and Canada are the top two destinations with 61.5 percent and 7 percent of the total, respectively.

On Oct. 19, Reuters reported that under NAFTA, at least 62.5 percent of the material in a car or light truck made in the region must be from North America to be able to enter the marketplace tariff-free. The administration of President Donald Trump has proposed raising the amount of NAFTA content in autos to 85 percent and securing 50 percent of the total for the United States. The demand to reserve the lion’s share of automotive manufacturing for the United States helped cast a pall over a fourth round of talks to revamp the 23-year-old NAFTA accord underpinning $1.2 trillion in annual trilateral trade. Solis, at Mexico’s auto industry association, called the U.S. proposal for country-specific content unacceptable, saying it would violate World Trade Organization rules.

Figure 10 shows that the percentage of autos in the light vehicle mix has been declining for all three countries since 2012. In general, car sales—including four door sedans, two-door coupes, station wagons, and hatchbacks—continue to substantially underperform their SUV, crossover and pickup truck counterparts.

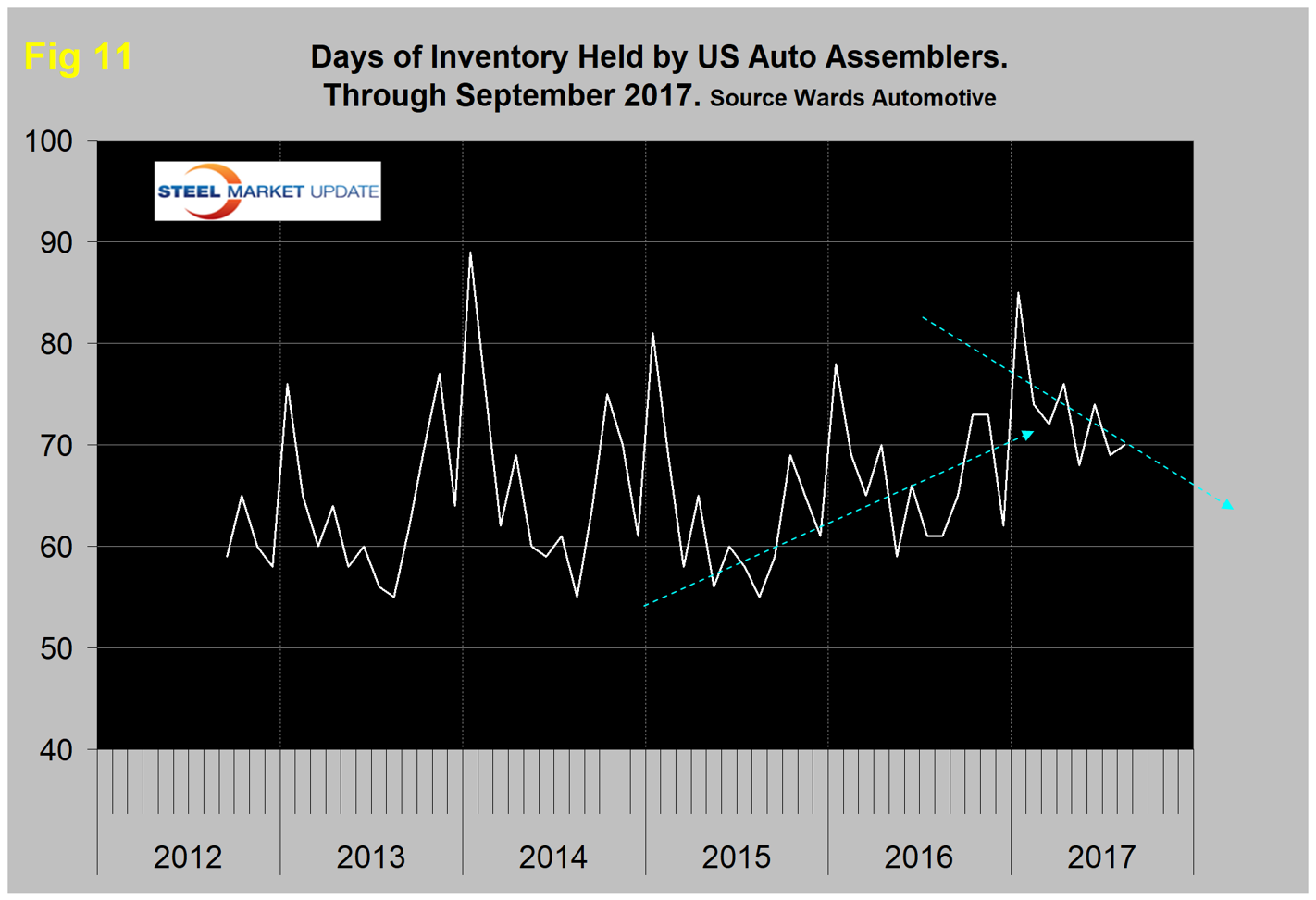

Ward’s Automotive reported this week that total light vehicle inventories in the U.S. were 64 days at the end of September, down from 70 days at the end of August. Month over month, FCA’s (Fiat Chrysler Automotive) inventory declined from 77 to 76 days, GM was down from 87 to 76 days, and Ford was down from 81 to 72 days. To put those results into perspective, Toyota was down from 50 to 47 days. Figure 11 shows that in 2017, the auto companies have reversed a two-year trend of rising inventories.

The SMU data file contains more detail than can be shown here in this condensed report. Readers can obtain copies of additional time-based performance results on request if they wish to dig deeper. Available are graphs of auto, light truck, medium and heavy truck production, as well as growth rates and production share by country.