Prices

October 22, 2017

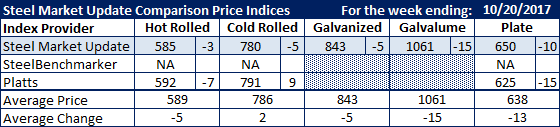

Comparison Price Indices: Split Between Platts and SMU

Written by John Packard

Many of the domestic steel mills raised prices on Tuesday and Wednesday of this past week. ArcelorMittal USA lead the way by announcing specific “minimum” base prices on hot rolled ($625 per ton), and cold rolled and galvanized steels ($825 per ton each). The other mills all announced $40 per ton price increases (which to SMU indicates most mills were averaging $585 per ton spot pricing prior to the announcement).

Platts is the first index to take hot rolled and cold rolled spot prices higher, after moving lower earlier in the week. They took prices up at the end of this week. After posting $587 hot rolled (-$12 from prior week), they took HRC up to $592.25 per ton on Friday. Steel Market Update (SMU) took our price down $3 per ton to $585 per ton on Tuesday. We have not yet made a move higher since there were a number of mills that booked tonnage at the old numbers for existing customers/outstanding quotes. We will see where the numbers are on Tuesday of this week. We did move our SMU Price Momentum Indicator to Neutral on Wednesday after Nucor joined AMUSA with a flat rolled steel price announcement of their own. SteelBenchmarker did not produce their indices this week (they only produce numbers twice per month).

Cold rolled saw similar action out of Platts. After taking their CRC average to $774 per ton earlier in the week (down $9 from prior week), on Friday they took their average to $791 per ton. SMU was down $5 per ton to $780 and we will wait and see where prices are on Tuesday.

Galvanized prices were down $5 per ton on .060″ G90 while Galvalume was down $15 per ton on .0142″ AZ50, Grade 80 material.

Both Platts and Steel Market Update saw plate prices as being lower for the week with SMU down $10 and Platts down $15 by the end of the week to $625 per ton. There is one fundamental difference between the Platts numbers and Steel Market Update. Our numbers include freight to customers (FOB Delivered) while Platts are FOB Mill.

SMU Note: Galvanized prices include $78 in extras for a .060″ G90 product. Galvalume prices include $291 in extras for a .0142” AZ50 Grade 80 product.

FOB points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Plate price FOB points are different for each of the indexes:

SMU: FOB Delivered to the Customer (includes freight)

Platts: FOB Southeaster Mill (does not include freight)

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers, we will include them in the average. The weeks where they do not produce numbers (NA = not available), we will not include their outdated numbers in the CPI average.