Market Data

October 22, 2017

China’s Economy Still Drives Steel

Written by Peter Wright

China’s economy continues to show robust growth, and in August recorded its highest-ever share of total global steel production.

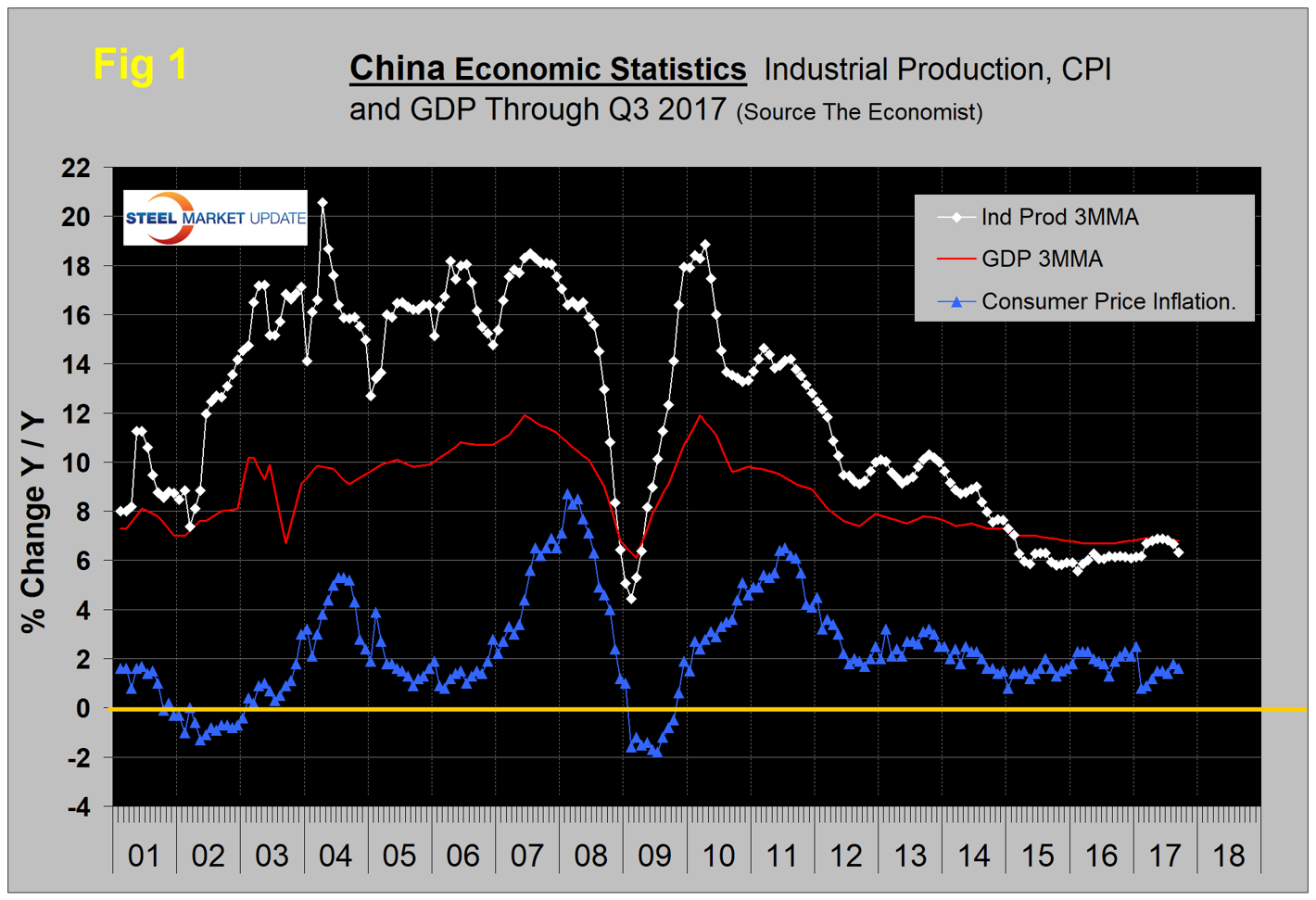

Once each quarter, we publish the official statistics for Chinese GDP, industrial production, consumer price inflation and fixed asset investment. Currently available data is through the third quarter. Many analysts don’t believe these self-serving Party figures, but we include them in our reports because of the importance of China in the global steel scene, and these numbers are all there is. Figure 1 shows published data for the growth of GDP, industrial production and consumer prices through the third quarter of 2017. The GDP and industrial production portions of this graph are three-month moving averages.

China’s economy grew 6.8 percent year over year in the third quarter, down slightly from 6.9 percent in the second quarter. Manufacturing accelerated, driven by the global tech upswing. Consumer demand remains healthy, thanks to continued wage and employment growth. The economy is set to meet the government’s targets for the year and hence policy is expected to remain unchanged for the foreseeable future.

The three-month moving average (3MMA) of the growth of industrial production rose from 6.1 percent in January to 6.9 percent in June before falling back to 6.3 percent in September. The third quarter was negatively affected by the August result of 6.0 percent growth. This is a rare instance where the use of a 3MMA obscures the trend. In the single month of September, IP grew by 6.6 percent year over year.

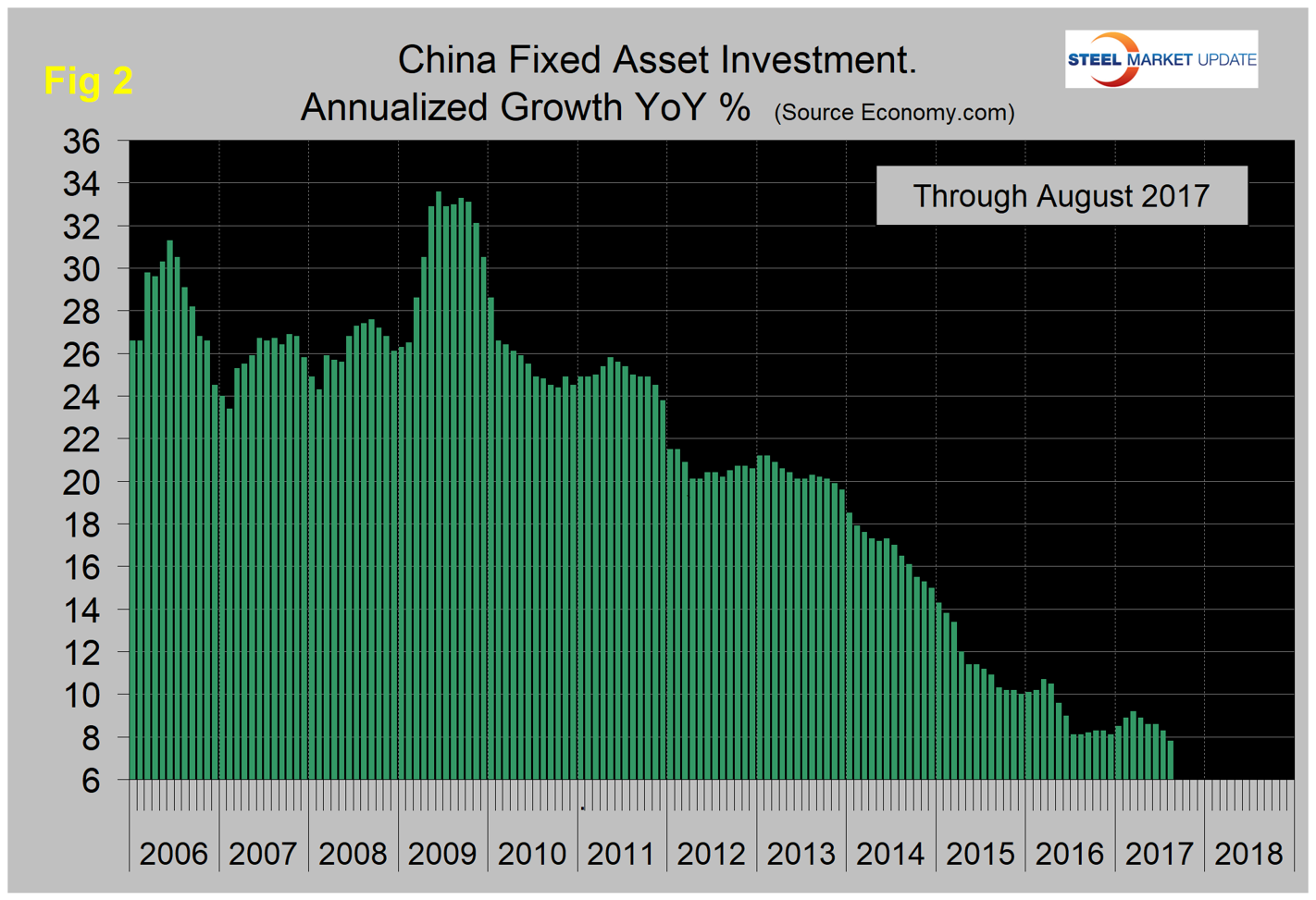

Figure 2 shows the growth of fixed asset investment year over year. In August (latest data available), FAI grew at 7.8 percent, with a steady decline from 9.2 percent in March.

According to Economy.com: “Investment in China underwhelmed in August, with annual growth decelerating for the second straight month. Indeed, the 7.8 percent year-over-year growth rate was the slowest since December 1999. Mining-related investment has been declining for over a year now. Overcapacity in heavy industries, and efforts to reduce this, are behind the slump. Given the central government’s continued efforts to reduce inefficiencies within the economy, mining investment will not pick up to its previous levels. Price growth for houses in the largest cities has been slowing throughout 2017, and this is starting to drag on construction. The main driver of the rise in fixed asset investment continues to be the manufacturing sector, with electronics and computers being the star performers.”

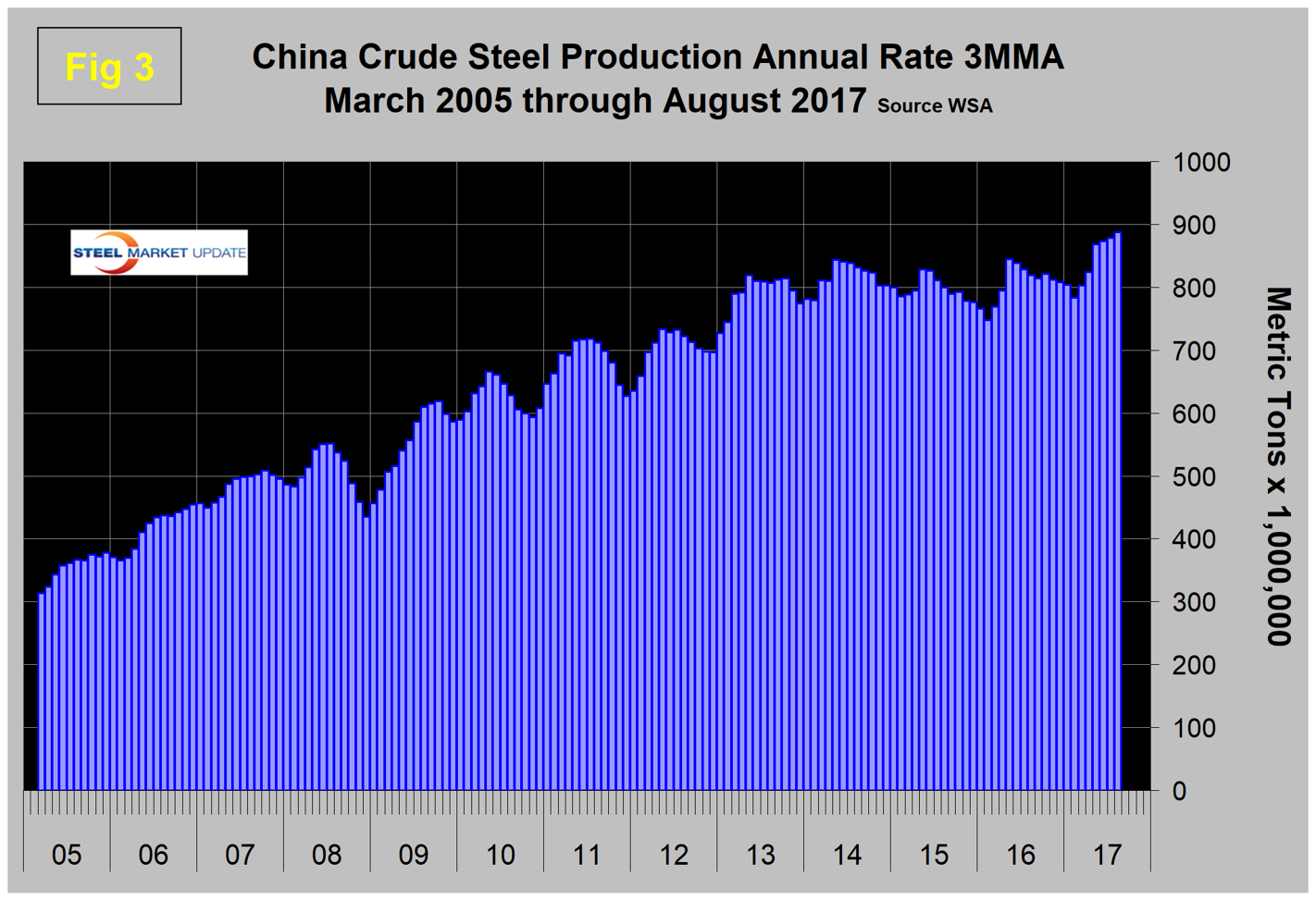

Figure 3 shows the 3MMA of China’s crude steel production through August when it accounted for 52.0 percent of global production. Each month, May through August have set another all- time high for Chinese steel production, reaching 74.6 million metric tons in August.

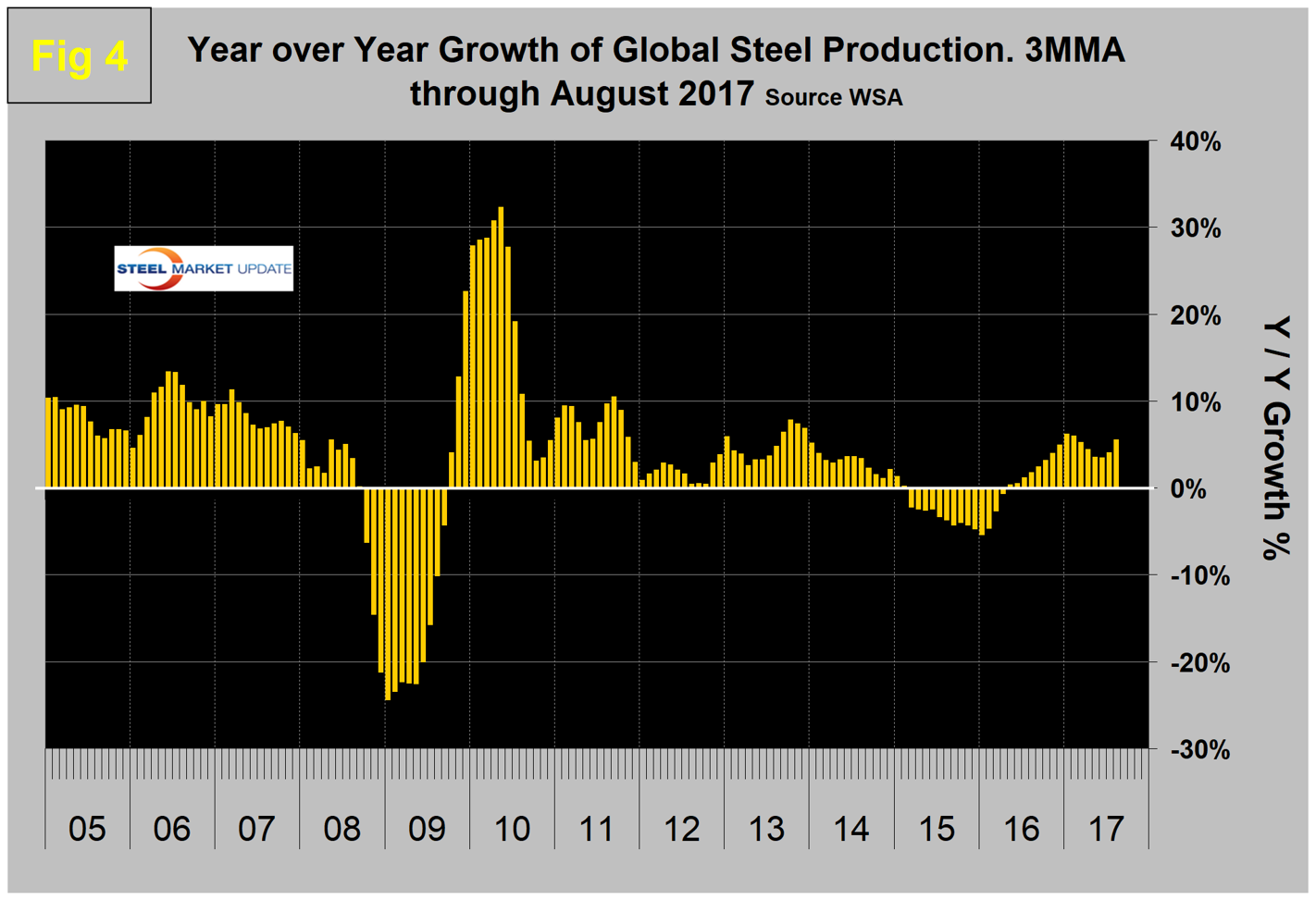

Another way of looking at the change in growth is shown in Figure 4. Growth improved from contraction in the 13 months through March last year to positive 8.4 percent in August this year. The central government reiterated recently that cutting overcapacity is high on its reform agenda as excess capacity in sectors such as steel and coal has weighed on the country’s overall economic performance.

In its short-range forecast released in October, the World Steel Association had this to say: “The Chinese economy, which has been gradually decelerating, is increasingly supported by consumption while investment continues to decelerate. However, government stimuli, particularly a moderate boost to the construction program, contributed to increased GDP growth in 2017. China’s steel demand is expected to increase by 3.0 percent in 2017, an upward revision over the previous forecast. The recent closure of induction furnaces will lead to a one-off jump in measured steel use in 2017 to 12.4 percent. (This counter intuitive result arises because induction furnace output, which was previously not captured, is now being produced by the mainstream industry for which data collection is better). The outlook for China’s steel demand in 2018 remains subdued, showing no growth over 2017 as the government resumes and strengthens its efforts on economic rebalancing and environmental protection.”

SMU Comment: China’s steel production growth in December 2016 through May 2017 was weaker than the world as a whole, but in the three months June through August that changed. In August, the 3MMA of China’s steel production grew 2.8 percent more than the rest of the world. In August, China had the highest ever share of global steel production at 52.0 percent. The strengthening of China’s domestic market, and of fixed asset investment in particular, will absorb some of this increasing volume.