Analysis

October 20, 2017

Existing Home Sales Increase Slightly

Written by Sandy Williams

Existing home sales picked up slightly in September following three months of declines, said the National Association of Realtors. However, ongoing supply shortages and recent hurricanes muted overall activity and caused sales to fall back on an annual basis, said the association. Total transactions rose 0.7 percent from August to a seasonally adjusted annual rate of 5.39 million. Sales were 1.5 percent below the September 2016 rate.

“Home sales in recent months remain at their lowest level of the year and are unable to break through, despite considerable buyer interest in most parts of the country,” said Lawrence Yun, NAR chief economist. “Realtors this fall continue to say the primary impediments stifling sales growth are the same as they have been all year: not enough listings – especially at the lower end of the market – and fast-rising prices that are straining the budgets of prospective buyers.”

Added Yun, “Sales activity likely would have been somewhat stronger if not for the fact that parts of Texas and South Florida – hit by Hurricanes Harvey and Irma – saw temporary, but notable declines.”

The median existing home price increased by 4.2 percent from a year ago. Inventory rose 1.6 percent to 1.90 million existing homes for sale. The sales rate was 6.4 percent lower than a year ago and has dropped for 28 months in a row. At the current sales rate, inventory is at a 4.2 month supply.

NAR says buyers have found climbing prices a deterrent to purchasing a new home in 2017.

Single-family home sales climbed 1.1 percent from August to a SAAR of 479 million, but were 1.1 percent below sales a year ago. Median price for a single-family was up 4.2 percent year-over-year to $246,800.

Condo and co-op sales declined 1.6 percent to an annual rate of 600,000 units, 3.2 percent below September 2016. Median condo prices were 4.1 percent higher than a year ago at $231,300.

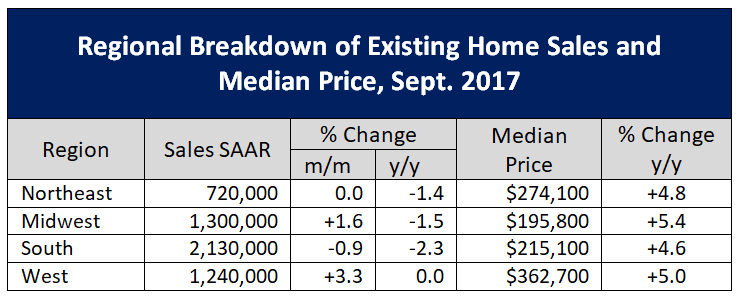

Regionally, Northeast sales were unchanged from August, Midwest sales rose 1.6 percent, and the West increased 3.3 percent. The South slipped 0.9 percent to an annual rate of 2.13 million, 2.3 percent below last year’s rate.