Market Data

October 19, 2017

Steel Mill Negotiations: Everyone Was Dancing Prior to Price Announcements

Written by Tim Triplett

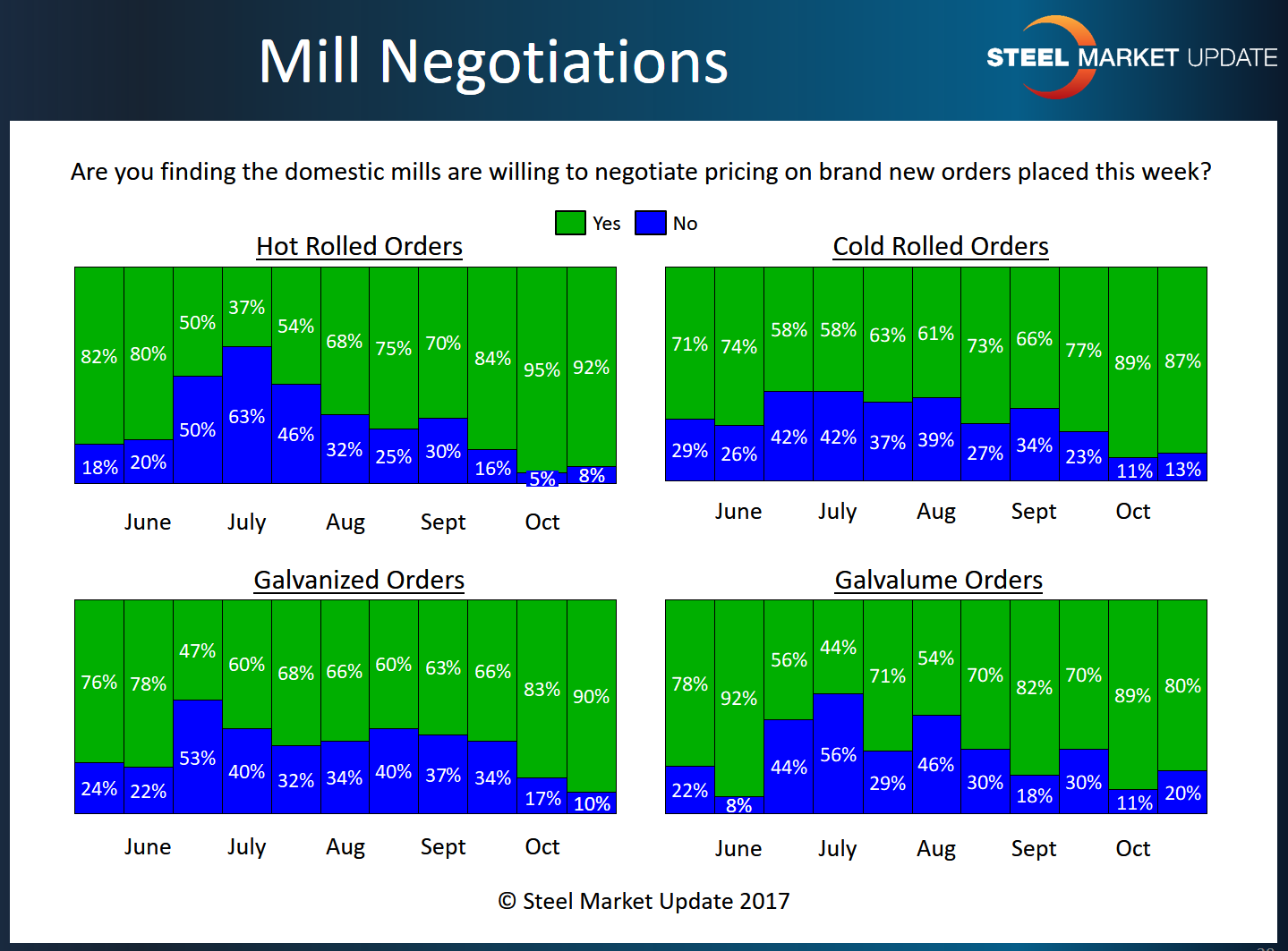

On Monday of this week, Steel Market Update began collecting data for our mid-October flat rolled steel market trends analysis. We invited over 600 companies to participate in our questionnaire. The vast majority of the respondents are either service centers or manufacturing companies. Based on the data collected we found that prior to any of the steel price announcements, the vast majority of buyers and sellers of steel were reporting the steel mills as willing to negotiate hot rolled, cold rolled, galvanized and Galvalume steel pricing.

Steel buyers’ perceptions of their suppliers’ attitudes offer a snapshot of how steel mills are currently handling price negotiations. We will not know if the steel mills will significantly alter their negotiation stances until our next market trends analysis is conducted during the first week of November. We are going to refer to two data collection points from this week’s questionnaire as we look at price negotiations.

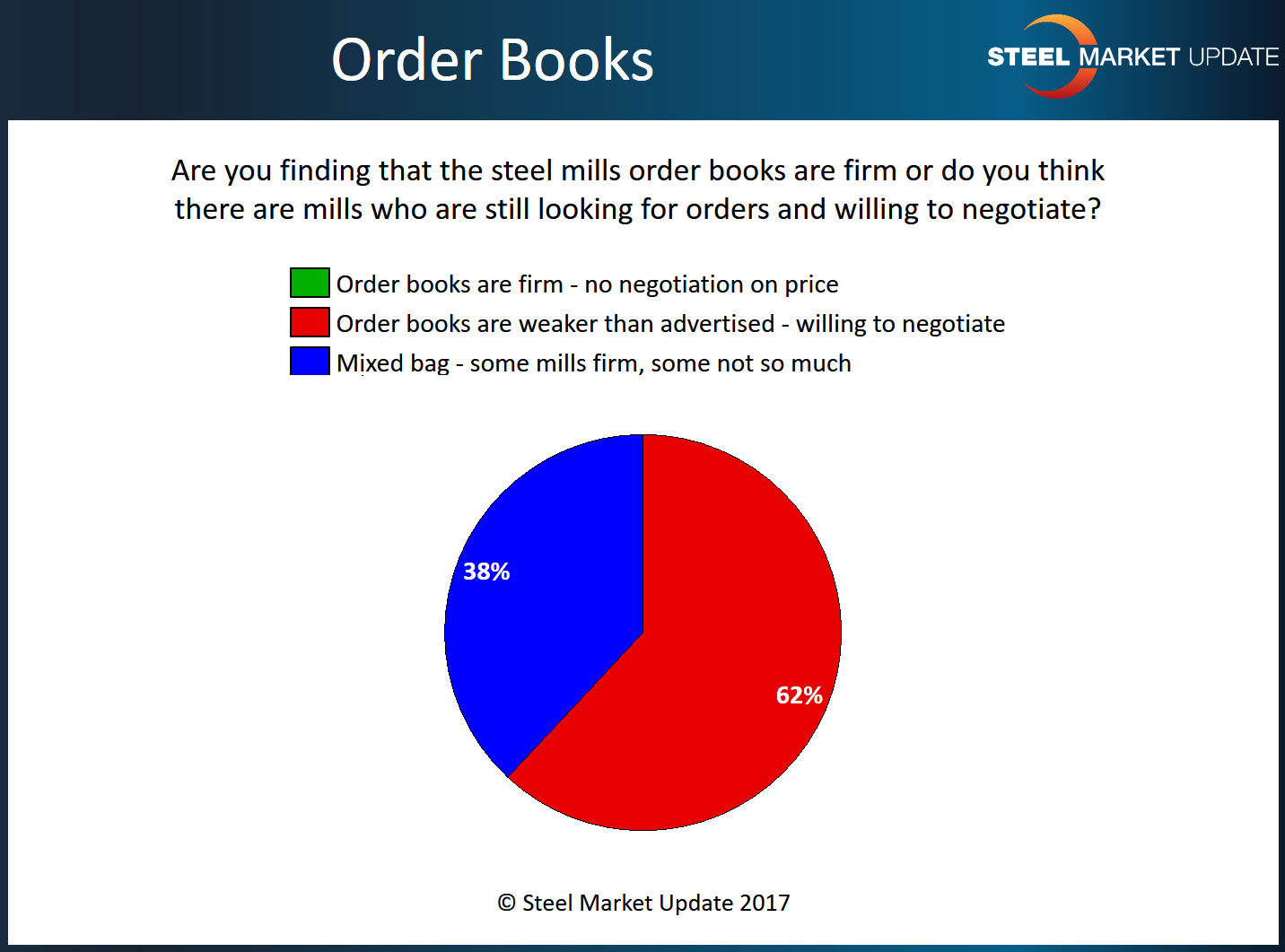

Nearly 62 percent of respondents agreed that mill order books are weaker than expected and most suppliers are open to price discussions. The other 38 percent characterized the market as mixed, with some mills flexible on price and others firm. Two weeks ago, the ratio was about 70/30. So, we have picked up a slight increase in the percentage of our respondents reporting “mixed” results. However, zero percent of the respondents reported order books as “firm.” This will be important to watch in the coming weeks as it will impact whether the announced price increases will stick, or fail. Note: More than 90 percent of the responses were made prior to ArcelorMittal announcing a price increase.

By product category, 92 percent of manufacturing and service center respondents saw mills willing to negotiate hot roll orders, down from 95 percent two weeks ago. In cold roll, 87 percent reported prices as negotiable, down from 89 percent in early October. In the Galvalume market, 80 percent reported a willingness among mills to talk price on coated products, down from 89 percent two weeks prior. Galvanized was the exception, increasing to 90 percent from 83 percent.

“They were willing to negotiate until this morning,” commented one service center. “Willingness to negotiate is directly linked to a mill’s lead time right now,” said another service center exec. “Deals are there if you want to make them,” added a trader.

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.