Market Data

October 19, 2017

SMU Steel Buyers Sentiment Index: A Bottoming of the Cycle?

Written by Tim Triplett

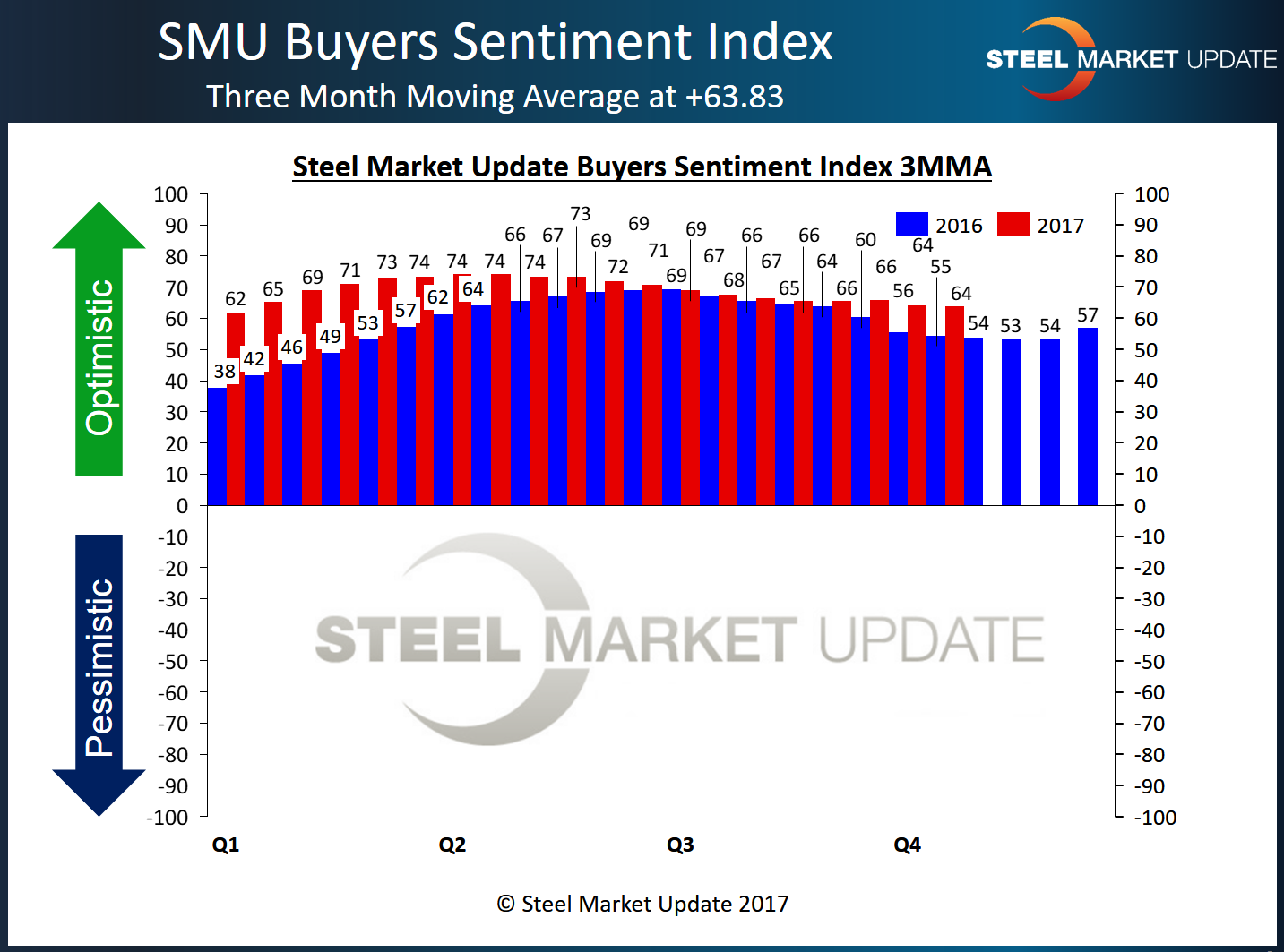

The Steel Market Update (SMU) Steel Buyers Sentiment Index market cycle appears to have bottomed as buyers and sellers of flat rolled steel were slightly more optimistic than what we collected at the beginning of the month. We measured the single data point for those responding to our flat rolled steel market trends questionnaire this week as +61, up +5 points from early October, which was the lowest reading of this calendar year. What has been interesting about 2017 is our Sentiment Index has reached higher highs earlier this year than what we measured last year. The Index also appears to be bottoming at slightly more optimistic readings than what we saw last year, as well (see graphic below).

If the seasonality of the trend continues, we should see an uptick in our Current Sentiment Index into 2018. The key is most buyers and sellers of flat rolled steel remain optimistic about their company’s ability to be successful in the current market environment, as well as three to six months into the future, according to data from this week’s Steel Market Update market trends questionnaire.

As a single data point, Current Sentiment measured +61, a slight rebound from +55 two weeks ago, but still 5 points below mid-September’s level. One year ago, Current Sentiment as a single data point was +53.

SMU’s preference is to look at the data based on a three-month moving average (3MMA), which smooths out the index and provides a better look at the true trend. The Current Sentiment 3MMA is at +63.83, down slightly from +65.83 one month ago. Our 3MMA is +9.33 points higher than our 3MMA reported during the middle of October 2016.

Future Steel Buyers Sentiment Index

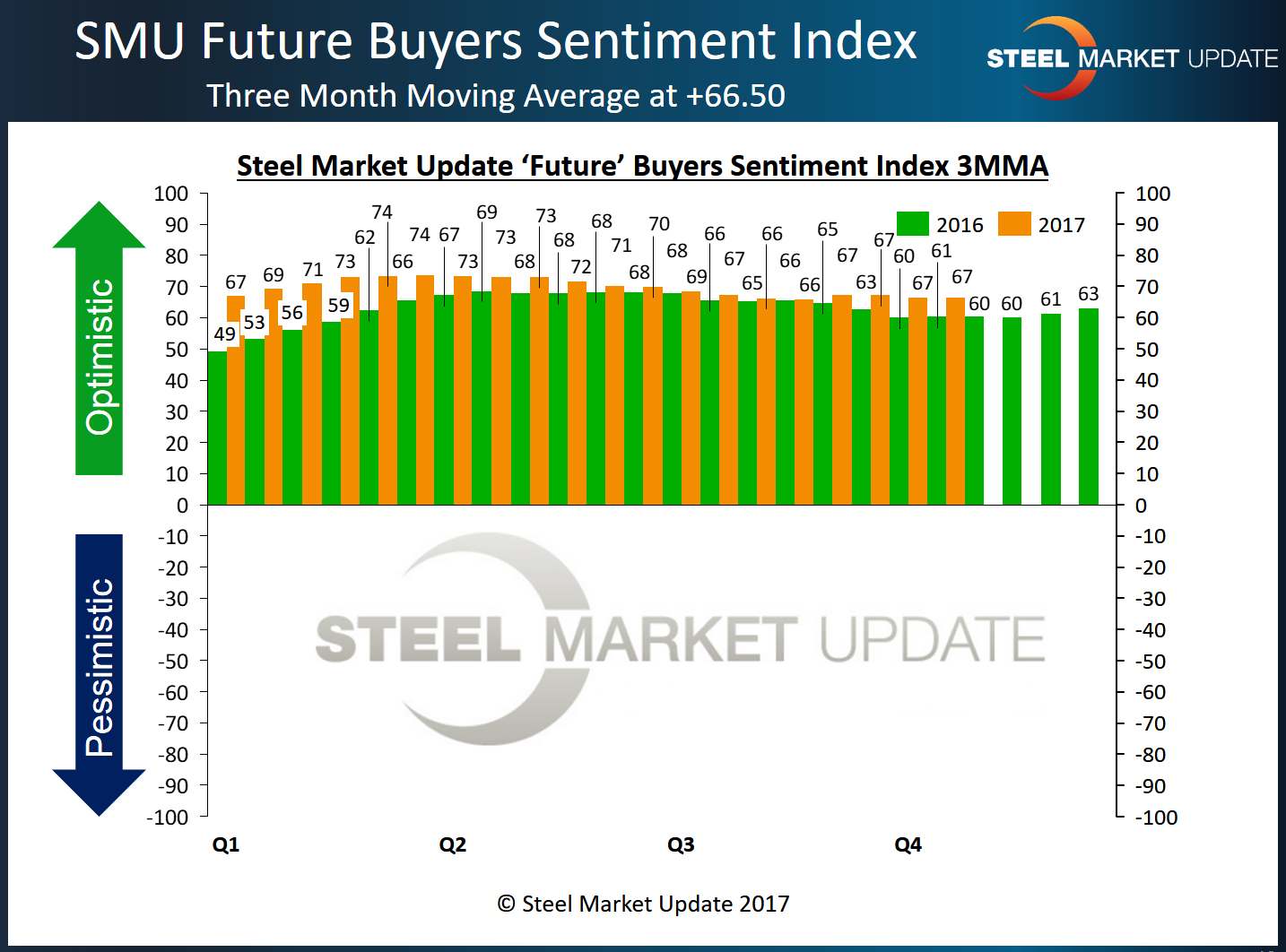

SMU also asked respondents how they feel about their company’s ability to be successful three to six months in the future. Future Sentiment indexed as a single data point registered +64, a small turnaround from the +60 two weeks ago, but still below the average since mid-year.

However, as you review the graphic provided below, you can clearly see a break in the trend from one year ago as this week’s respondents are slightly more optimistic than what we saw last year. As a three-month moving average, Future Sentiment registered +66.50, down slightly from +67.33 a month ago. Last year our Futures Sentiment Index was at +60.50.

According to SMU’s analysis, the moving averages for both current and future sentiment have been gradually moving toward a less optimistic outlook going back to the peak of optimism, which was achieved in mid-March 2017.

The price increase announcements did not impact our data from this week as 95 percent (or more) of our respondents had completed the questionnaire prior to the ArcelorMittal USA announcement, which was made late in the day on Tuesday.

What Respondents are Saying

Respondents’ comments reflect generally positive views of market conditions:

· “I am more optimistic that business conditions will continue to improve as demand for commercial construction seems to be set for a very good year in 2018.” Trading Company

· “Inquiries have been strong, our order book is good.” Service Center/Wholesaler

· “Certain regions are good (Midwest and Northwest), while Southwest and Southeast are slowing.” Service Center/Wholesaler

· “We’re optimistic yet realistic. There’s [still] much uncertainty on future trade action.” Trading Company

· “Activity level is off somewhat but not in a significant way.” Steel Mill

The market is not without its challenges:

· “We’re losing market share to Asian-based manufacturers.” Manufacturer/OEM

· “Some customers continue to demand low numbers.” Steel Mill

· “Our ‘ability to be successful’ is always excellent. It’s what plays out that is usually ‘awful.’ Time will tell.” Service Center/Wholesaler

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 110-150 companies. Of those responding to this week’s survey, 38 percent were manufacturers and 46 percent were service centers/distributors. The balance was made up of steel mills, trading companies and toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.