Market Data

September 29, 2017

U.S. GDP Growth ‘Steady, Unspectacular’

Written by Peter Wright

The growth of U.S. Gross Domestic Product in second-quarter 2017 was the strongest since first-quarter 2015. On Thursday, the Bureau of Economic Analysis released the third estimate of GDP growth in the second quarter. Growth was reported to be 3.06 percent quarter on quarter and 2.21 percent year on year.

Economy.com had this to say about the third estimate of second-quarter GDP: “GDP data suggest the U.S. economy is growing at a steady, if unspectacular, pace and economic prospects through the remainder of this year and next are good despite increased threats from hurricanes, political brinkmanship and North Korea. Stronger growth in the second quarter offset a weak first quarter and confirmed the view of continued growth. Real GDP is on track to come in just above 2 percent this year, and well over 2 million jobs will be created. This is about the same growth experienced since the expansion began more than eight years ago and is above the economy’s current potential. Unemployment and underemployment continue to steadily decline and are now consistent with most estimates of full employment.”

In July, the Congressional Budget Office updated its Budget and Economic Outlook: 2017 to 2027 and summarized as follows: “CBO projects that over the next decade, if current laws remained generally unchanged, budget deficits would eventually follow an upward trajectory in relation to the nation’s economic output, and federal debt would rise. Economic growth is projected to remain modest, averaging slightly above 2.0 percent through 2018 and averaging somewhat below that rate for the rest of the period through 2027. The budgetary and economic trends discussed in this report are similar to those CBO described in January, when the agency issued its previous estimates.”

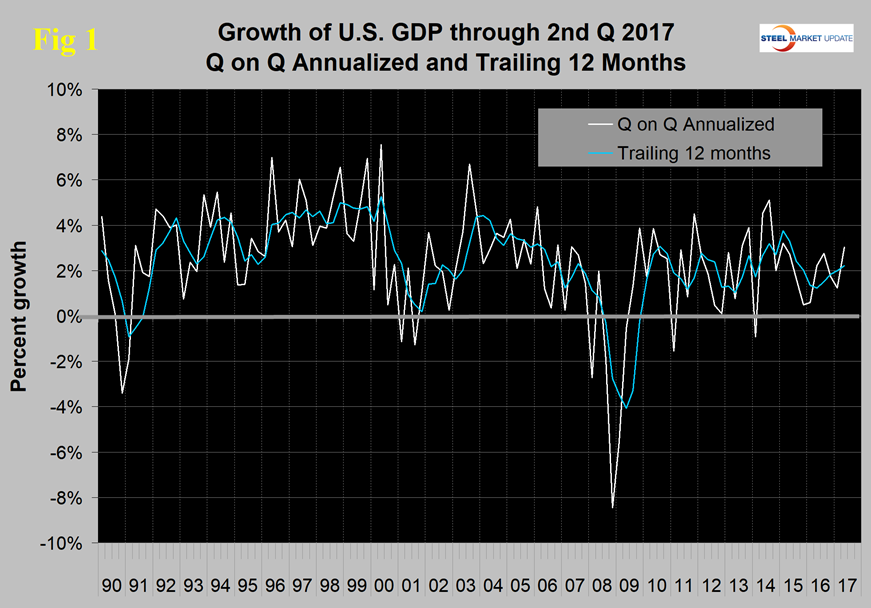

The headline report of GDP growth in the second quarter came in at 3.06 percent, which was a slight upward revision from 3.0 percent in the second estimate and from 2.6 percent in the first estimate. GDP is measured and reported in chained 2009 dollars, and in the second quarter was $17.031 trillion annualized. This was the first time the economy exceeded $17 trillion. The growth calculation is misleading because it takes the quarter-over-quarter change and multiplies by four to get an annualized rate. This makes the high quarters higher and the low quarters lower. Figure 1 clearly shows this effect.

The blue line is the trailing 12 months growth and the white line is the headline quarterly result. On a trailing 12-month basis, GDP was up by 2.21 percent in the second quarter, which was close to the 2.13 percent average in 30 quarters since first-quarter 2010. Therefore, we conclude that the current growth of U.S. GDP is in line with its average for the last seven years.

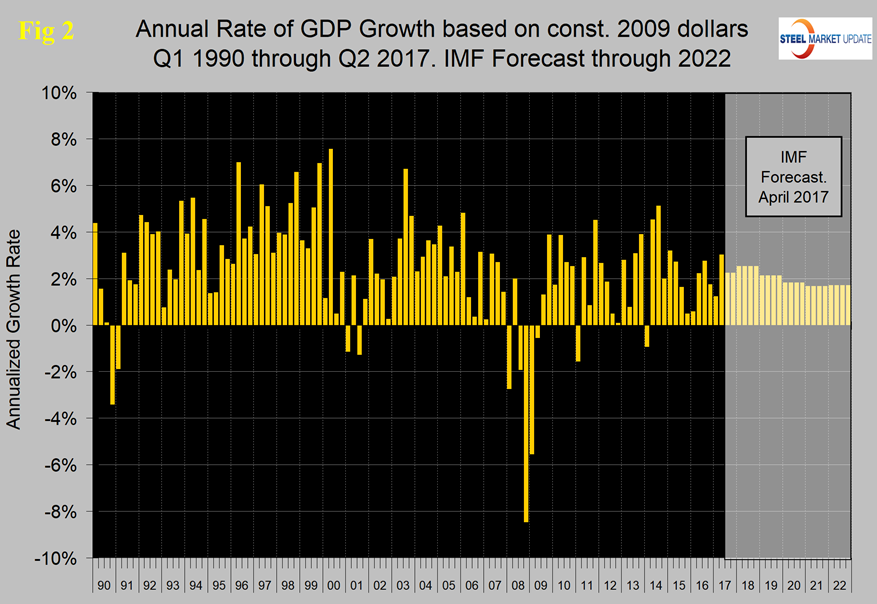

Figure 2 shows the headline quarterly results since 1990 and the April IMF forecast through 2022. In their April revision, the IMF raised their forecast of U.S. growth in 2017 from their October 2016 estimate of 2.2 percent to 2.31 percent and for 2018 from 2.10 percent to 2.52 percent. The next estimate by the IMF will be released in early October.

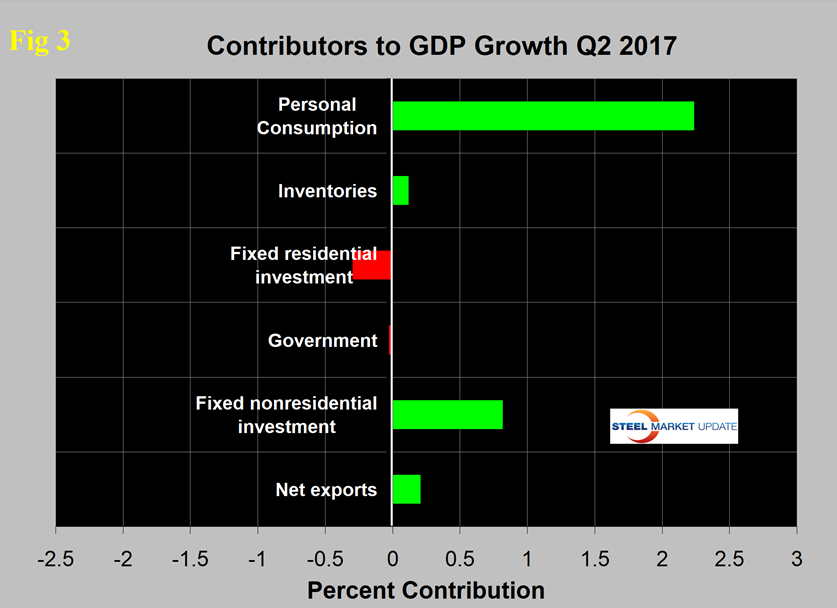

Figure 3 shows the change in the six major subcomponents of GDP in second-quarter 2017. Normally, personal consumption is the dominant growth driver, and this continued to be the case in the second quarter. Personal consumption includes goods and services, the goods portion of which includes both durable and non-durables.

The contribution of inventories was almost breakeven in the second quarter at positive 0.12 percent, an improvement from negative 1.46 percent in the first quarter. Declining inventories have a negative effect on the overall GDP. Over the long run, inventory changes are a wash and simply move growth from one period to another. Fixed residential investment declined from a positive contribution of 0.41 percent in the first quarter to negative 0.30 in the second quarter, suggesting a slowing housing market. Nonresidential investment has made a positive contribution in each of the last five quarters. Net exports have made a positive contribution in five of the last six quarters, influenced by the decline in the value of the dollar.

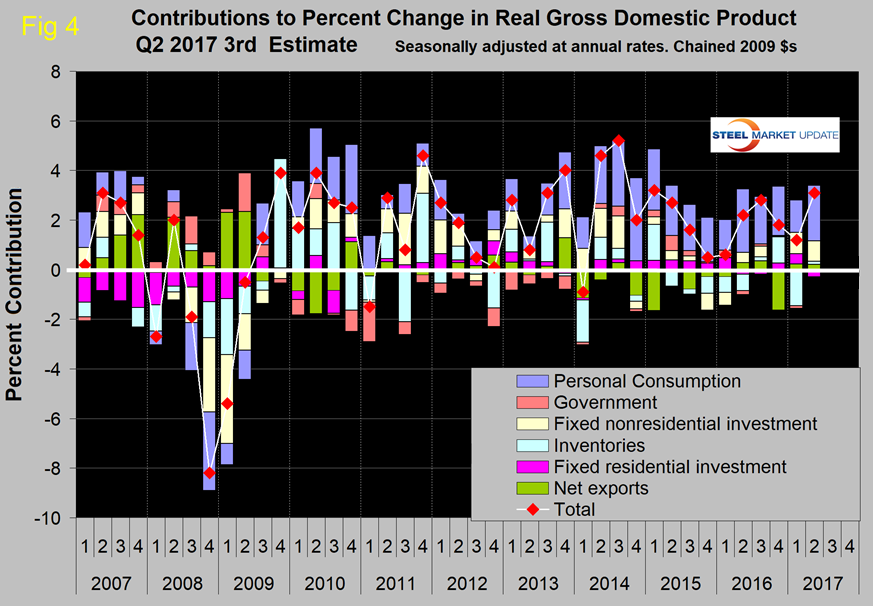

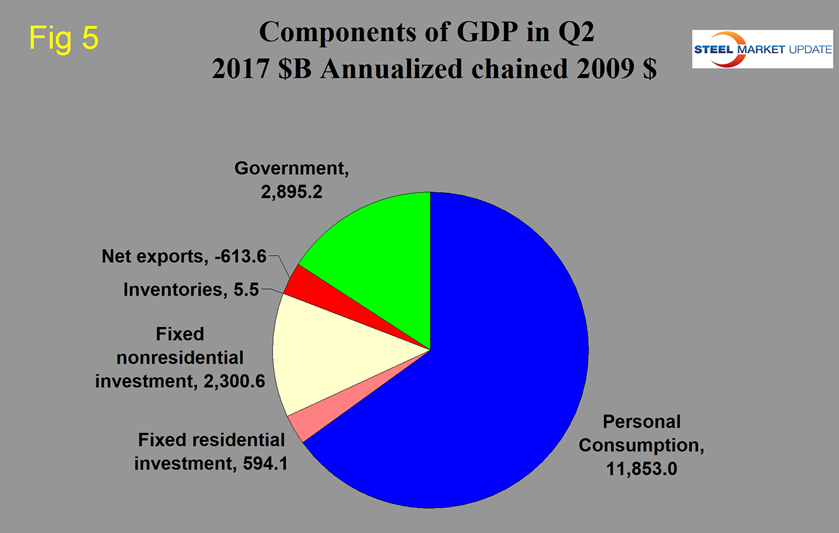

Figure 4 shows the quarterly contributors of the six major subcomponents to GDP since first-quarter 2007. This chart clearly shows the whipsaw effect of inventory changes. Government expenditures have made a slightly negative contribution in the first half of 2017. Figure 5 shows the breakdown of the $17 trillion economy.

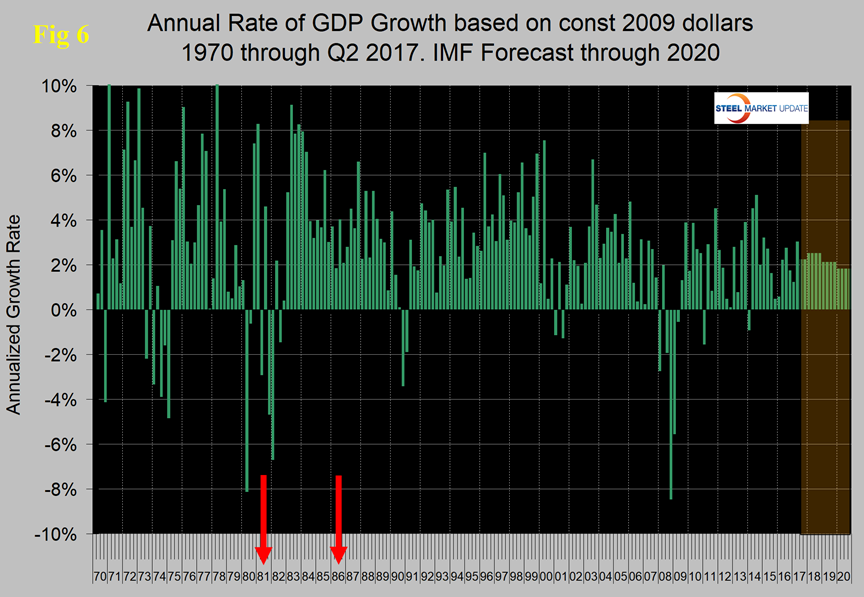

SMU Comment: The important fact to realize, in our opinion, is that GDP growth on a year-over-year basis has been very consistent in the last eight quarters, during which period it has ranged from 1.23 percent to 2.40 percent. There have only been two quarters when the year-over-year growth exceeded 3.0 percent since third-quarter 2010. In July, the Congressional Budget Office forecast much of the same for the next decade. At present, the political debate is moving to tax reform, so we thought we would take a trip back in time to see what effect the Reagan tax cuts had on GDP. Figure 6 shows the headline growth of quarterly GDP since 1970 with the years of the Reagan tax cuts in 1981 and 1986 marked with red arrows. These were the Economic Recovery Tax Act of 1981 and the Tax Reform Act of 1986.

Various parts of the 1981 program phased in over three and five years. Based on Figure 6, it looks as though there was a strong positive effect on GDP in 1983 that declined in 1984. The 1981-82 recession was severe, and it is evident that the recovery was stronger than what we experienced after the last recession. The 1986 act was revenue neutral and, based on Figure 6, had little effect on economic growth.

Definition of GDP from the Bureau of Economic Analysis: Gross domestic product (GDP) is the value of the goods and services produced by the nation’s economy less the value of the goods and services used up in production. GDP is also equal to the sum of personal consumption expenditures, gross private domestic investment, net exports of goods and services, and government consumption expenditures and gross investment.