Market Segment

September 19, 2017

Electrode Shortage Limited in U.S.

Written by Sandy Williams

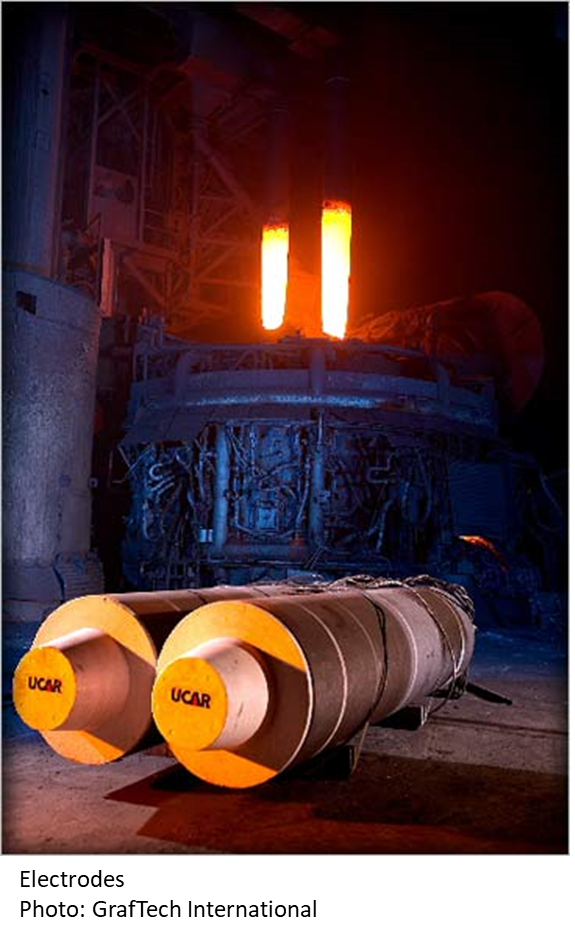

European steel producers are worried about tight supply conditions for carbon graphite electrodes used in electric arc furnace steelmaking, but it may not be as big a problem in the U.S. A global shortage of high quality needle coke has spiked prices and squeezed supply of electrodes in Europe in recent months, said Axel Eggert, director general of the European Steel Association (EUROFER).

“This global shortage has been caused by the idling of global production capacity over the past few years, followed by production stoppages recently enforced by the Chinese authorities as a result of additional environmental standards,” said Eggert. Electrodes are produced in a limited number of regions that include China, India, Japan, Europe and the U.S.

Electrodes are used in EAF, ladle furnace and blast-furnace basic oxygen furnace operations. About 226,000 metric tons of electrodes are consumed by European steelmakers each year with almost 60 percent of the smaller ladle furnace type rods coming from China. As a result, both primary and secondary steel production could be seriously hampered by continued shortage and supply volatility, said Eggert.

Electrodes are used in EAF, ladle furnace and blast-furnace basic oxygen furnace operations. About 226,000 metric tons of electrodes are consumed by European steelmakers each year with almost 60 percent of the smaller ladle furnace type rods coming from China. As a result, both primary and secondary steel production could be seriously hampered by continued shortage and supply volatility, said Eggert.

Chinese spot pricing has been over $30,000 per metric ton recently, well above 2017 contract prices of $4,000 to $7,000, reported Platts.

Electrode pricing has been rising for U.S. steelmakers as well, but due to long-term contracts the shortage has yet to impact production. About 66 percent of U.S. raw steel is manufactured by the EAF process, according to the American Iron and Steel Institute.

The Steel Manufacturers Association has been watching the situation since March or April when U.S steel producers noticed higher pricing and tighter supply, said Philip Bell, SMA president.

Electrode suppliers to the U.S. have dwindled in recent years, with primary participants now Showa Denko (SDK), GrafTech, Sangraf and UKCG. U.S.-based GrafTech International reportedly declared force majeure at its needle coke manufacturing facility in Port Lavaca, Texas, following disruption by Hurricane Harvey. GrafTech did not respond to inquiries by SMU.

A source at Steel Dynamics said inventory procurement is fine at this time due to SDI’s excellent long-term relationships with electrode suppliers, but the company expects a significant rise in pricing in 2018. Spot buyers are likely to have the most difficulty, he said.

“The real shortage is in smaller-diameter ladle metallurgy furnace electrodes, so this affects both minimill and integrated steel producers,” said SDI. “Larger-diameter electric arc furnace electrodes are not nearly as impacted.”

Sean Kennan, vice president, supply chain, for SSAB America, agreed that production disruptions for EAFs will be limited. “Like all other EAF steel producers, SSAB Americas utilizes graphite electrodes in our steelmaking process,” he said. “We source these electrodes through a number of suppliers. To date, the current shortage of electrodes in the global market has not impacted our production, nor do we anticipate any impact to production in the near future. We will continue to work with our suppliers to mitigate any risks to disruption of our supply in 2018 and beyond.”

SMU will conduct the next Steel 101 workshop in conjunction with SSAB America. We will tour the SSAB minimill near Mobile, Ala., at the end of January. More details about this workshop will be forthcoming. In two weeks, SMU will conduct a Steel 101 workshop in Fort Wayne, Ind., where we will tour the SDI Butler minimill, as well as Paragon Steel, a flat rolled service center on the campus of SDI. This workshop has been sold out for about a month.