Market Data

September 10, 2017

Negotiations: ‘Mixed Messages’ on Price

Written by Tim Triplett

Steel buyers and sellers report that most mills are still open to price discussions, even after recent price increase announcements, based on responses from Steel Market Update’s latest flat rolled market trends questionnaire. Over the course of the past week, SMU canvassed active participants in the manufacturing and service center segments of the flat rolled steel markets to capture any changes in market trends. The more than 100 responses to this week’s questionnaire offer a snapshot of how steel mills are handling price negotiations.

Steel Market Update uses a number of questions during the survey process in order to better quantify our results. Perception is important when dealing with price negotiations, so it is important to understand how steel buyers are looking at their mill suppliers.

About 41 percent of respondents say order books are apparently weaker than expected and mills are open to price discussions, up from 33 percent who reported mills willing to talk price two weeks ago. Another 50 percent have found negotiations to be a mixed bag, with some mills firm and others flexible. Only 9 percent say their suppliers are holding the line on price.

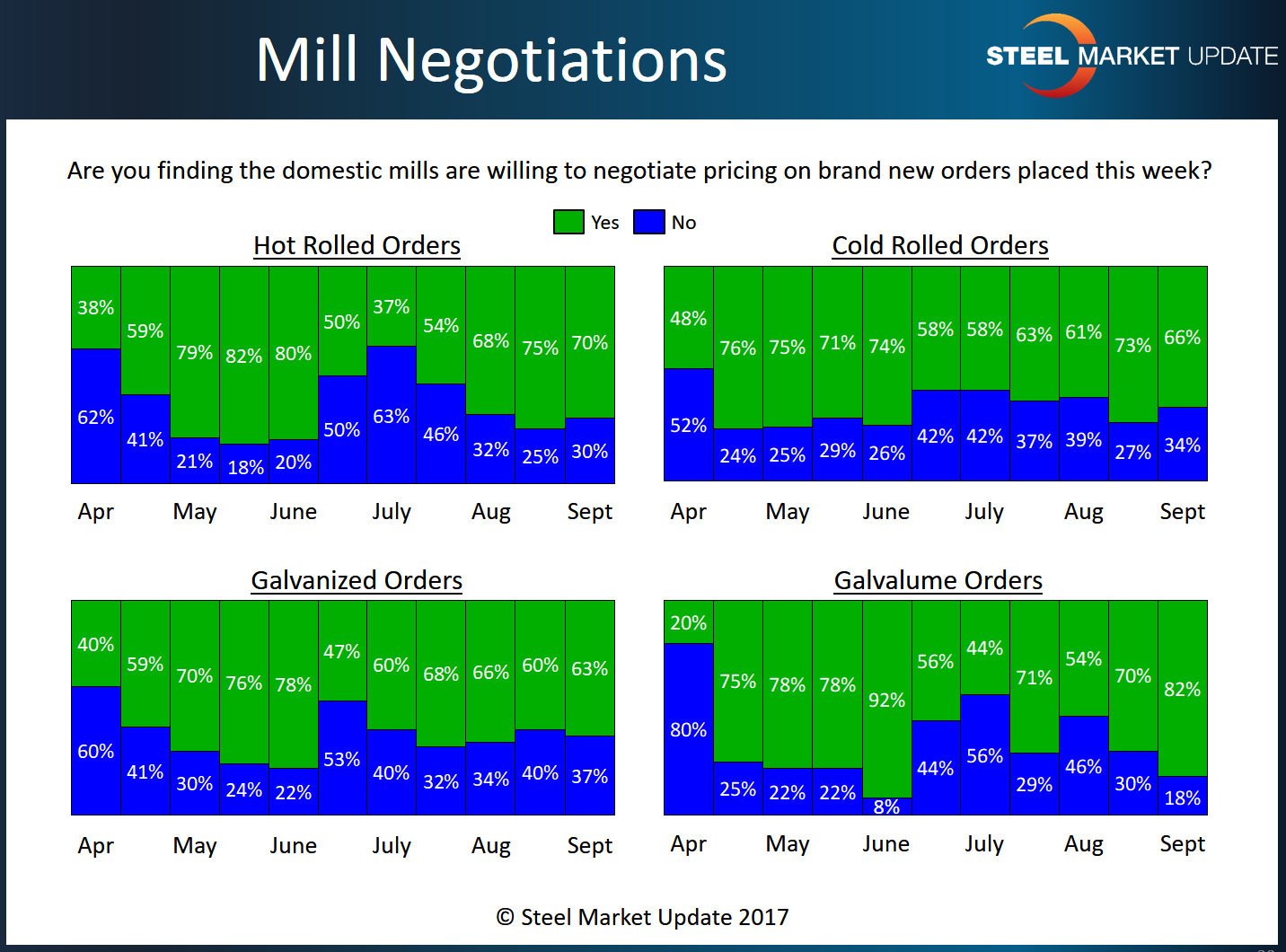

As one service center executive commented, “We’re getting mixed messages by region and product.” By product category, 70 percent of manufacturing and service center respondents saw mills willing to negotiate hot roll orders, down from 75 percent in the last report. In cold roll, the percentage dipped to 66 percent who found the price negotiable, down from 73 percent last month. “There is always room for some negotiation, but other than cold roll that room is very small,” said another wholesaler. Galvanized saw a slight increase to 63 percent from 60 percent, while Galvalume jumped to 82 percent from 70 percent, indicating more willingness to talk price on coated products.

“There hasn’t been much change from the previous month,” observed a trader, “but the cost push will make people get off the sidelines and buy if they need it. But we’re coming to the end of the year, so [demand] might be softer still.”

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.