Logistics

September 10, 2017

Harvey and Irma Tangle Shipping

Written by Sandy Williams

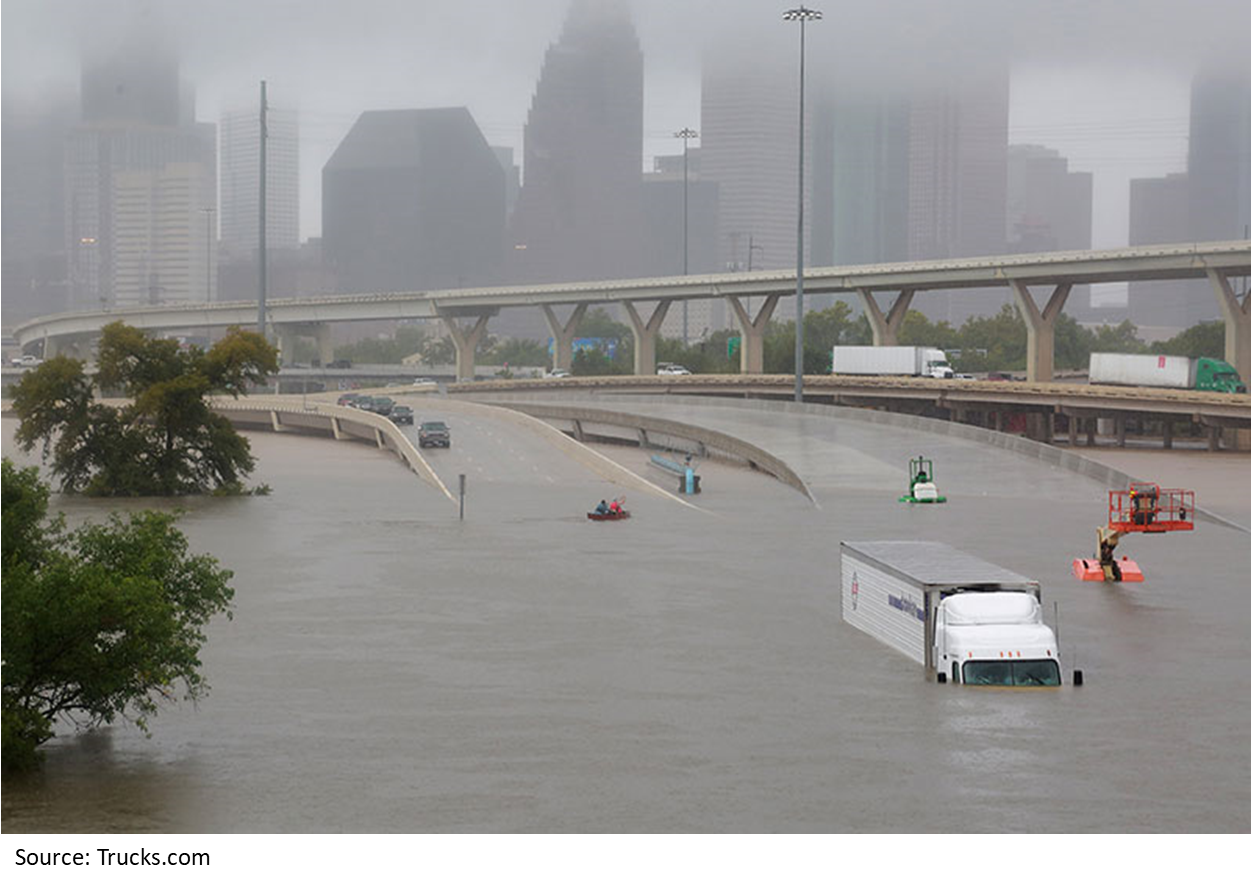

Hurricane related delays continue to frustrate shipping on the Gulf Coast and now on the Eastern Seaboard from Florida to the Carolinas. Port closures, rail delays, truck shortages, and flooded roadways and rail systems are affecting all modes of freight transportation.

Seaborne Freight

The freight market gained steam in July and since then rates have more than doubled for the cape size and panama markets. Daily hire rates in July for cape size were at a low of $6,300 compared to $19,450 this week, while Panamax rates jumped from $4,500 to $10,850. The Supramax and Handysize markets were at $9,900 and $7,350 per day as of Sept. 7.

“The steady improvement in rates over the past 12 months, coupled with regular positional volatility and strong seasonal peaks in the fall and spring, are indicative of the slow and steady improvement in the supply/demand ratio,” said MID-SHIP Group in its Sept. 7 newsletter.

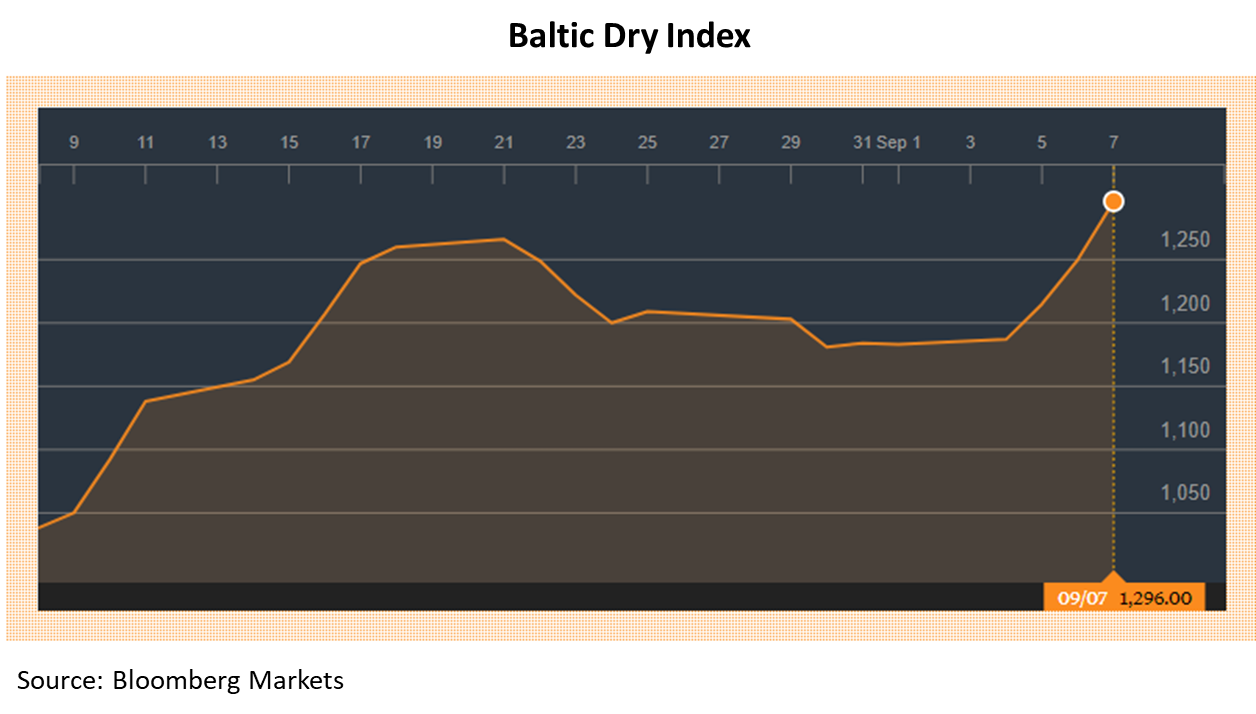

The Baltic Dry Index climbed from the 820 July low to 1,296.0 as of Sept. 7. BDI tracks dry-bulk rates based on vessel size and shipping route and is used as a benchmark for overall trade volume. Dry bulk demand is growing at about 3.5 percent year-over-year on strong demand from China.

River

Ports in Houston are starting to return to operation, but those in Georgia and into the Carolinas are now closed or scheduled to close as Hurricane Irma draws near. The port closures mean delays in loading and unloading of ships, which in turn impacts barge traffic. Barge lines are watching diesel prices closely following the hurricane, but so far there has been no impact to barge rates, said MID-SHIP. Grain shipments were down this past week due to an unscheduled three-day lock closure near St. Louis, which reduced southbound barges on the Mississippi by 33 percent. Most inland river ways are running without issues at this time.

Rail

The Association of American Railroads reports combined U.S. carload and intermodal originations in August 2017 were 2,744,486, up 2.6 percent, or 69,219 carloads and intermodal units, from August 2016. Carloads decreased 0.3 percent in August, while containers were up 5.6 percent from the same month last year.

Florida railroads are making preparations in advance of the expected flooding and damage from Irma, while those in the Houston region are cleaning up from Harvey.

“Unfortunately, floods, tornadoes and hurricanes are a fact of life, and railroads have long experience dealing with them and their aftermath,” said AAR Senior Vice President John T. Gray. “Railroads know that the quicker they can safely restore service, the quicker affected communities can obtain food, water and other necessities; that supplies needed for rebuilding can be brought in; that debris can be removed; and that rail customers can return their operations to normal. In this regard, for railroads, there is no alternative to long hours of very hard work in very difficult conditions, and that’s what railroads have been putting in.”

Trucking

Truck capacity has been strained in the South as trucking companies volunteer for relief efforts. Flooding continues to be a challenge to traffic in some areas in the Texas coastal regions. Delays to regular shipping will be exacerbated by the landfall of Hurricane Irma. Diesel fuel jumped up 15.3 cents to $2.758 per gallon in the week ending Sept. 5. Shippers can expect to see fuel surcharges range from $.37 to $.39 per one way miles, said MID-SHIP.

DAT Trendlines reports the national average for flatbeds to increase 2 cents to $2.20 per mile

Trucking firms are concerned about the impact of back-to-back hurricanes on shipping in the Southeast. Storm damage to Georgia or North Carolina is especially worrisome for national distribution centers in Atlanta and Charlotte. With fewer trucks available for freight, regional bottlenecks could last until January, said Troy Cooper, chief operating officer of XPO Logistics, Inc.

“Freight and vehicles where Irma hits will have to be replaced,” Steve Tam, vice president of ACT Research, told Trucks.com. “So there will be an increase in the amount of work, but not in the number of vehicles. That will put upward pressure on rates, but it’s impossible to know how much and for how long.”