Market Data

September 7, 2017

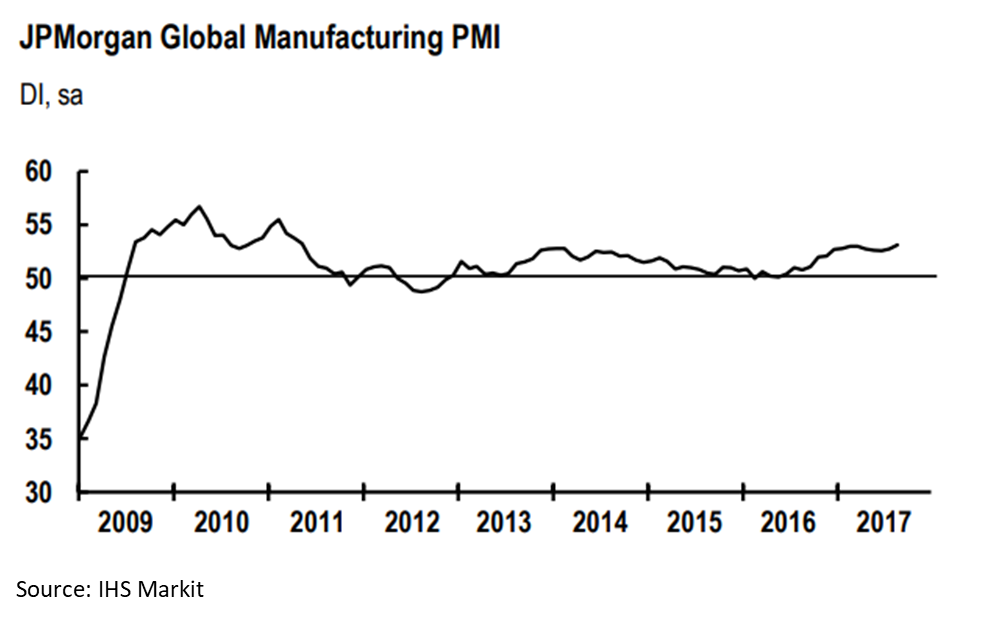

Global Manufacturing Robust in August

Written by Sandy Williams

Global manufacturing rose to a 75-month high in August. The J.P. Morgan Global Manufacturing PMI climbed to 53.1 from 52.7 in July. Most components of the PMI increased in August and at a faster rate. Future output was the only measure to remain the same as July, at a strong 63.5.

Developed nations on average led emerging markets in August with growth especially marked in the Eurozone and United Kingdom.

Developed nations on average led emerging markets in August with growth especially marked in the Eurozone and United Kingdom.

“The upturn in the global manufacturing sector is gathering pace in the third quarter, with August seeing the Manufacturing PMI rise to its highest level in over six years,” commented David Hensley, director of Global Economic Coordination at J.P. Morgan. “Rates of expansion in output and new orders also accelerated, underpinning a further solid bounce in job creation. Although price pressures and supply-side constraints are rising, the sector should have sufficient momentum to sustain its current robust expansion.”

Eurozone

Manufacturers in the Eurozone benefited from robust growth in demand and rising employment in July. The IHS Markit PMI posted a score of 57.4 for a 74-month high. Germany, Austria and the Netherlands led the region with steep increases in output and new orders. Manufacturing output grew at an annual rate of 4 percent on burgeoning demand and surging export orders.

“Capacity issues are translating into both higher input costs and rising factory gate prices as demand exceeds supply for many products,” commented Chris Williamson, chief business economist at IHS Markit. The key question for policymakers is the extent to which these price pressures will feed through to consumers and wages.”

China

Chinese manufacturing reached its second highest level of the year in August. The Caixin China General Manufacturing PMI rose 0.5 points to 51.6 in August as production dipped slightly and new orders expanded. Prices for inputs and outputs were higher with output prices at an eight-month high. Inventories of finished goods diminished at a quicker pace, but raw materials inventories continued to grow.

“Overall operating conditions of the manufacturing sector improved further as market demand strengthens, but if prices rise too quickly the profitability of companies in the middle of a supply chain may be under pressure,” commented Dr. Zhengsheng Zhong, director of macroeconomic analysis at CEBM Group.

Russia

Manufacturers in Russia saw business activity slow from July levels. The PMI fell about one point to 51.6 in August. Domestic demand increased during the month, but export orders continued to contract, although at a slower pace. Higher input prices were passed on to clients, but overall price pressures were muted and weak compared to historical averages. Russian manufacturers’ optimism slipped to its lowest level since January 2016 as a result of uncertainty about the pace of consumer demand recovery.

Japan

Manufacturing remained steady in Japan at a PMI reading of 52.2 in August compared to 51.1 in July. Demand at home and abroad improved during August and an uptick in production helped manufacturers to replenish finished goods inventories. Anecdotal comments indicated a supply and demand imbalance for metals and electronics inputs. Manufacturers remained optimistic in August, but confidence regarding economic conditions weakened to the lowest level since March 2017.

Canada

The IHS Markit Canada Manufacturing PMI dipped slightly from July to 54.6, but continued to indicate gains in production and new orders, albeit weaker yet still above historical averages. A bump in hiring was the most marked since October 2010, extending new-job creation for the 11th successive month. Input costs were somewhat higher and were passed along to customers. Manufacturers are confident production growth will be maintained over the next 12 months.

Mexico

Mexican manufacturers have seen sustained growth in business for the past 47 months. The PMI gained one point to register 52.2 in August. Production was up for the fourth month as new orders gained momentum. Export sales were helped by a favorable exchange rate. With backlogs growing, job creation remained strong to keep up with demand. Manufacturers were confident that production will continue to grow in the coming year.

U.S.

New orders helped to keep U.S. manufacturing conditions improving. The IHS Markit U.S. Manufacturing PMI dropped slightly from July’s reading of 53.3 to 52.8 in August. Production increased at a weaker pace along with orders. Export orders were essentially unchanged in August compared to the previous month. Backlogs increased leading to expansion in employment. Higher raw material prices, especially steel and electrical components, added to input cost burdens. Firms passed higher costs on to clients in higher factory gate charges. Future sentiment was strong, although slipping slightly from July.

“Although still above the 50 ‘no change’ level, the decline in the PMI shows signs of a renewed stuttering of the manufacturing economy during August,” said Chris Williamson at IHS Markit. “The latest reading indicates one of the weakest improvements in the overall health of the sector seen over the past year, and translates into disappointing signals for comparable official data. The drop in the output index indicates that manufacturing could act as a drag on the economy in the third quarter, with exports dampening order book growth. The survey brings more encouraging signs of improved domestic demand, however, with orders for both consumer goods and investment goods such as plant and machinery on the rise, boding well for the wider economy to continue to expand as we move through the second half of 2017.”