Prices

August 31, 2017

SMU Price Ranges & Indices: A Mixed Week

Written by John Packard

We did not review pricing earlier this week due to all of our staff being at the SMU Steel Summit Conference in Atlanta. During the conference, we did not want to discuss pricing in an open format. We did check on pricing today and found mixed results depending on the product. Within the data, we also found there were regional differences with those close to integrated steel mills seeing higher spot base pricing than those closer to electric arc furnace (EAF) minimills.

Our hot rolled average rose by $5 per ton and we are seeing a large portion of the data coming in around $31.50/cwt. We have had steel buyers tell us some of the mills have given up already on collecting higher prices on cold rolled and coated. But, that is by no means a universal opinion.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $600-$660 per ton ($30.00/cwt-$33.00/cwt) with an average of $630 per ton ($31.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to one week ago, while the upper end increased $20 per ton. Our overall average is up $5 per ton compared to last week. Our price momentum on hot rolled steel is pointing to Neutral indicating prices are expected to remain steady over the next 30-60 days.

Hot Rolled Lead Times: 3-6 weeks

Cold Rolled Coil: SMU price range is $790-$840 per ton ($39.50/cwt-$42.00/cwt) with an average of $815 per ton ($40.75/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged compared to one week ago. Our price momentum on cold rolled steel is pointing to Neutral indicating prices are expected to remain steady over the next 30-60 days.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU base price range is $38.50/cwt-$42.50/cwt ($770-$850 per ton) with an average of $40.50/cwt ($810 per ton) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to one week ago, while the upper end increased $10 per ton. Our overall average is down $5 per ton compared to last week. Our price momentum on galvanized steel is pointing to Neutral indicating prices are expected to remain steady over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU price range is $848-$928 per net ton with an average of $888 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-10 weeks

Galvalume Coil: SMU base price range is $40.00/cwt-$41.50/cwt ($800-$830 per ton) with an average of $40.75/cwt ($815 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range declined $10 per ton compared to last week. Our overall average is down $10 per ton compared to one week ago. Our price momentum on Galvalume steel is pointing to Neutral indicating prices are expected to remain steady over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,091-$1,121 per net ton with an average of $1,106 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-8 weeks

Plate: SMU price range is $680-$740 per ton ($34.00/cwt-$37.00/cwt) with an average of $710 per ton ($35.50/cwt) FOB delivered. Both the lower and upper ends of our range remained the same compared to one week ago. Our overall average is unchanged compared to last week. Our price momentum on plate steel is pointing to Neutral indicating prices are expected to remain steady over the next 30-60 days.

Plate Lead Times: 4-6 weeks

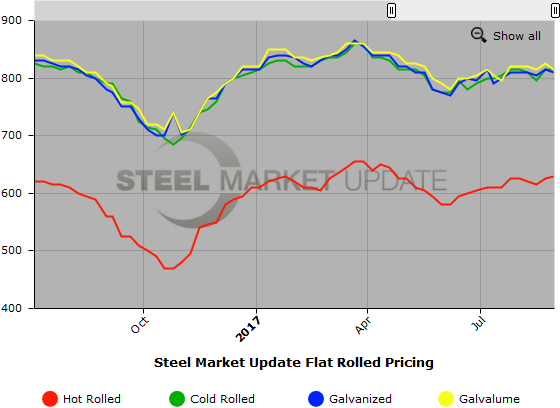

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. We will add plate prices to this graph once we have gathered a few months of data. To use the graph’s interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.

Written by John Packard, John@SteelMarketUpdate.com