Market Data

August 31, 2017

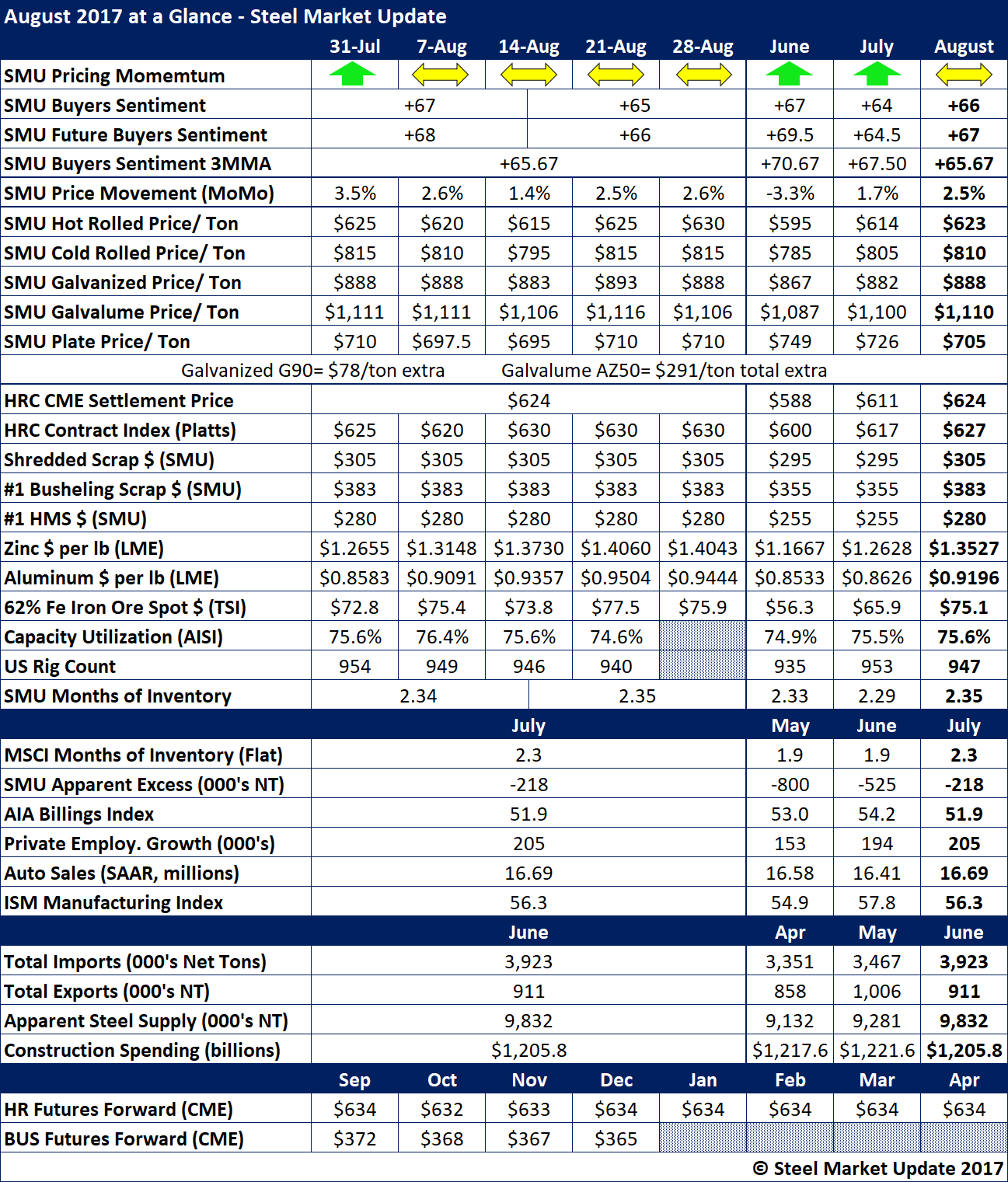

August 2017 at a Glance

Written by John Packard

The following table is for the month of August 2017. Most of the data speaks for itself. We produce this information at the end of every month. There are a number of data points or reference points that are proprietary to Steel Market Update. These include our SMU Price Momentum Indicator which, at the end of August, was referencing prices as being Neutral. With a new round of price increases out of the domestic mills, we have not yet seen momentum move in a forceful way and we remain in Neutral.

We also have proprietary price indices on hot rolled, cold rolled, galvanized, Galvalume and plate steel, as well as ferrous scrap (Midwest). Another proprietary product is our service center inventories indices and analysis.

There are many other proprietary products that are not listed in the table below and you can find out more about them on our website under Premium level products.