Prices

August 20, 2017

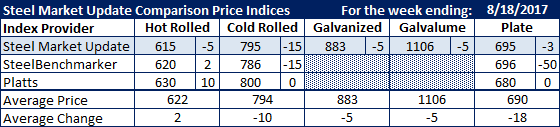

Comparison Price Indices: No Rush to Higher Prices - Yet

Written by John Packard

The three steel indexes followed by Steel Market Update reporting this past week saw prices differently. Steel Market Update, which gathered its pricing information on Monday through Wednesday of this past week, found prices to be lower on all flat rolled products and plate. Platts, on the other hand, reported hot rolled prices higher late on Friday, while their other indices remained the same as the prior week. SteelBenchmarker, which only produces their prices twice per month, was mixed with hot rolled up $2 and cold rolled down $15. They also took plate prices down a whopping $50 per ton.

The hot rolled spread from low (SMU $615) to high (Platts $630) expanded slightly. Cold rolled average price averages ranged from a low of $786 per ton (SteelBenchmarker) to $800 per ton (Platts) with SMU seeing CRC prices down $15 to $795 per ton.

Galvanized .060” G90 and Galvalume .0142” AZ50, Grade 80 benchmark prices were $5 per ton lower for the week.

Platts and SteelBenchmarker saw their plate averages as being $680 and $696 per ton FOB the mill. SMU had our plate average down $3 per ton to $695 Freight Prepaid (Delivered).p

SMU Note: Galvanized prices include $78 in extras for a .060″ G90 product. Galvalume prices include $291 in extras for a .0142” AZ50 Grade 80 product.

FOB points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Plate price FOB points are different for each of the indexes:

SMU: FOB Delivered to the Customer (includes freight)

Platts: FOB Southeaster Mill (does not include freight)