Market Data

August 17, 2017

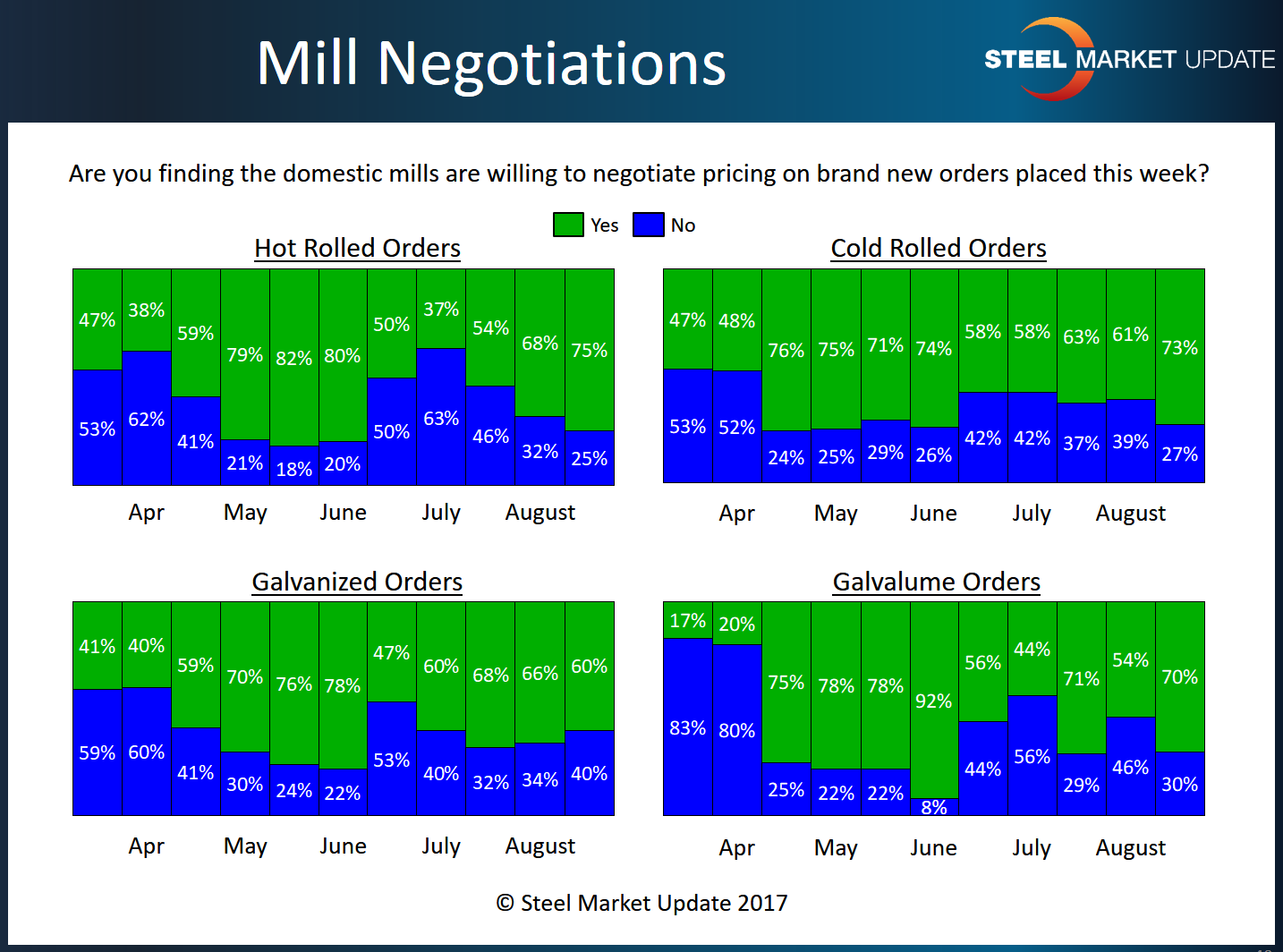

Negotiations: Mills Talking Price Despite Price Increase Announcements

Written by Tim Triplett

Steel buyers and sellers reported mills slightly more open to steel price discussions, based on responses this week from Steel Market Update’s flat rolled market trends questionnaire, possibly reflecting the seasonal slowdown in sales activity. What makes the results collected on mills willingness to negotiate pricing especially interesting is the domestic steel mills began announcing price increases on flat rolled on Tuesday of this week after raising plate prices on Monday.

Over the course of this week, SMU has canvassed active participants in the flat rolled steel markets to capture any changes in market trends. The more than 100 responses to this week’s questionnaire offer a snapshot of how steel mills are handling price negotiations.

As in the last report, respondents continue to see mills sending mixed signals on their willingness to negotiate steel prices. The majority of buyers, 59 percent, say mills are open to negotiation, up from 53 percent of buyers two weeks ago. Another 33 percent—down slightly from 37 percent in the last report— say mill order books are weaker than expected and some mills do tend to be open to price discussions. Only 8 percent have found that mill order books are full and negotiation is off the table, down from 10 percent of buyers who said mills were holding the line two weeks ago.

By product category, 75 percent of manufacturing and service center respondents saw mills willing to negotiate hot roll orders, up from 68 percent in the last report. In cold roll, the percentage jumped to 73 percent who found the price negotiable, from 61 percent two weeks ago. Galvanized saw a slight dip to 60 percent from 66 percent, while Galvalume jumped to 70 percent from 54 percent, indicating more willingness to talk price on coated products.

Comments from respondents indicate the level of willingness to talk price depends on the mill and the product. Order books are weaker than advertised, observed one service center executive, adding, “Orders shipping early is not a bullish indicator.” Said a manufacturer, “It’s still a seller’s market, but the momentum is slowing down a bit until Section 232, 301 and 337 are front and center again. Perhaps in 2018.”

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.