Analysis

August 16, 2017

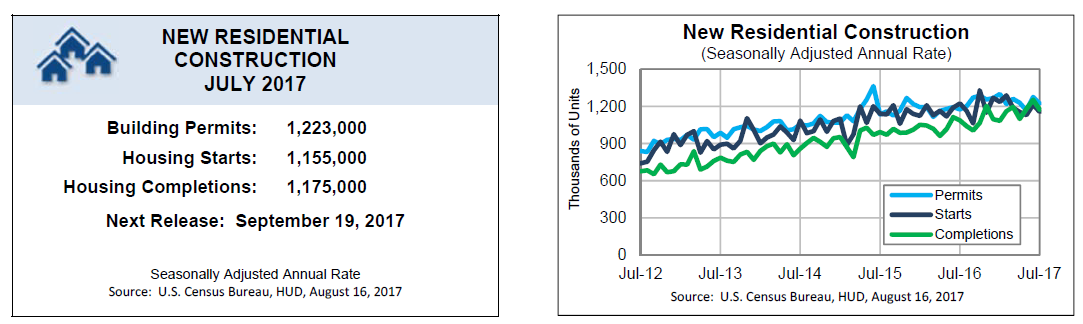

Housing Starts Disappoint in July

Written by Sandy Williams

June’s rebound in housing starts was short-lived, according to data from the Department of Commerce on Wednesday. Housing starts dipped in July to a seasonally adjusted annual rate of 1,155,000, 4.8 percent lower than the June estimate and 5.6 percent below the July 2016 rate.

Construction of single-family homes was relatively steady, slipping just 0.5 percent from last month, while housing of five units or more plummeted 17.1 percent.

“The overall strengthening of the single-family sector is consistent with solid builder confidence in the market,” said Granger MacDonald, chairman of the National Association of Home Builders (NAHB). “The sector should continue to firm as the job market and economy grow and more consumers enter the housing market.”

Lack of available building lots and a shortage of qualified construction workers continue to restrain the single-family sector. NAHB Chief Economist Robert Dietz said new home production numbers are still in line with NAHB forecasts. Starts for single-family housing fared much better than multifamily housing in July. “We saw multifamily production peak in 2015, and this sector should continue to level off as demand remains solid,” said Dietz.

The Northeast and Midwest saw the largest slippage of new home starts, sliding 15.7 percent and 15.2 percent, respectively. The South was nearly flat with a gain of 0.6 percent, while starts in the West edged down 1.6 percent.

Permit authorization also fell in July, down 4.1 percent from June, while increasing 4.1 percent from 2016. Single-family housing starts were flat, while multi-unit starts dropped 12.1 percent.

Regionally, permit authorizations plunged 17.4 percent in the Midwest, 7.9 percent in the West and 1.4 percent in the South. The Northeast was the only region to make gains in July, jumping 19.2 percent on strength of multi-unit dwellings.