Market Segment

August 15, 2017

Flat Rolled Inventories Rise While Daily Shipment Rate Falls

Written by John Packard

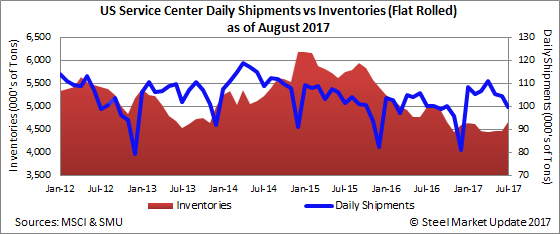

Based on the Metals Service Center Institute’s (MSCI) July metals activity report, carbon flat rolled inventories rose in July while the daily shipment rate dropped resulting in an increase in the number of months’ supply being held at flat rolled steel service centers.

Total Steel Shipments

Total shipments of all steel products equaled 2,960,700 net tons in July, MSCI reported. This is a 1.4 percent improvement over last year, but down 462,800 tons from June, which had 22 shipping days versus the 20 days in July.

The daily shipment rate was 148,000 tons, down from 155,600 tons in June and better than the 145,900 tons reported for July 2016.

Total steel shipments for the first seven months of 2017 were 23,049,300 tons, which is 3.3 percent better than the first seven months 2016.

Total steel inventories at distributors closed the month at 7,542,400 tons, down 3.9 percent year-over-year and almost 10,000 tons lower than what was reported at the end of June 2017. The number of months’ supply (not seasonally adjusted) is now at 2.5 months, up from 2.1 months at the end of June.

Carbon Flat Rolled

Carbon flat rolled shipments totaled 1,990,500 tons, which was 0.40 percent below year ago levels. The daily shipment rate was 99,500 tons per day.

Year-to-date, carbon flat rolled shipments totaled 15,550,900 tons, which is 2.6 percent better than the first seven months 2016.

Inventories ended the month of July at 4,646,200 tons, which is 6.6 percent below year-ago levels. The number of months’ supply on hand as of the end of July was 2.3 months (not seasonally adjusted).

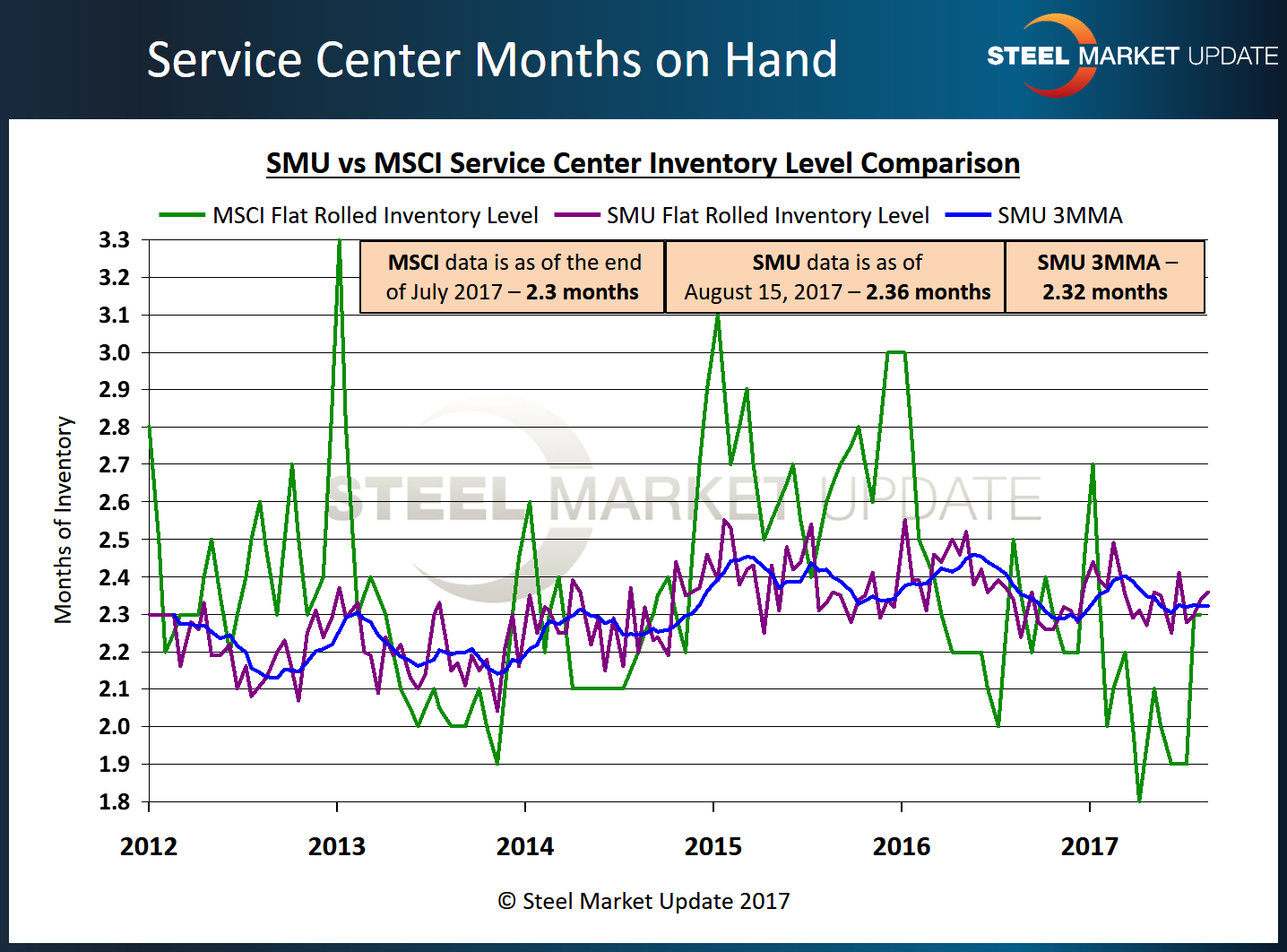

SMU Flat Rolled Inventory Levels

Steel Market Update is working on our mid-August flat rolled steel market trends analysis. Part of the analysis concerns flat rolled steel inventory levels. As of this afternoon, with about 90 percent of the service centers reporting, steel distributor inventories averaged 2.36 months of supply on their floors. We will update this graphic (see below) later this week when all of the data has been analyzed.

SMU Analysis – Distributor Inventories at 2.80 Months

Last week, Steel Market Update worked with 20 service centers who provided SMU with their inventory levels as of the end of July. Based on the 20 service centers, which cover medium to large service center groups, the number of months’ supply was 2.80 months. We will continue to work with and expand the number of service centers canvassed in the months to come.

Carbon Plate

Carbon plate shipments totaled 260,800 tons during July. The shipment rate was 13,000 tons per day, down from 13,900 tons in June, but well above the 12,300 tons per day reported last July.

Year-to-date plate shipments total 2,065,400 tons, which is 6.4 percent better than the first seven months of 2016.

Inventories of plate products stood at 835,200 tons. Inventories grew by 25,100 tons between the end of June and the end of July. However, inventories are 2.6 percent lower than year-ago levels.

The number of months on hand was 3.2 months, according to MSCI. This is not a seasonally adjusted number.

Carbon Pipe & Tube

Pipe and tube shipments totaled 163,800 tons during July. This is 5.5 percent below year-ago levels and well below the 192,400 tons shipped the prior month. The shipment rate was 8,200 tons per day for the month.

Pipe and tube shipments during the first seven months of 2017 totaled 1,316,900 tons or 5.7 percent below the same time last year.

Inventories of pipe and tube totaled 453,400 tons as of the end of the month. This is 11.2 percent below levels held at the end of July 2016. The number of months on hand was 2.8 months unadjusted, according to MSCI.