Prices

August 9, 2017

Ferrous Scrap Export Prices Surge/August Settlement Prices

Written by John Packard

SMU scrap sources advised us early this morning of an export sale of an 80/20 mix of ferrous scrap bound for Turkey. Our sources reported the sale price at $350 per metric ton delivered Turkey. The sale price is up approximately $50 per metric ton since early July and $20 per metric ton from last week.

A second source confirmed the sale and told us, “The $350 price has been achieved for October shipment (Sims-Habas). Sentiment overseas is bullish, so exporters are not going to rush into the market with a lot of sales at this point.”

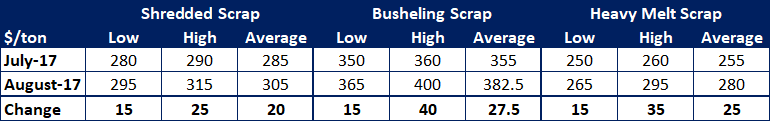

SMU Midwest Ferrous Scrap Pricing for August Delivery

For the month of August, SMU is seeing ferrous scrap prices in the Midwest as mixed with Chicago having the lowest prices and Detroit, Cleveland, Pittsburgh and other areas higher.

The table shown below is for “Midwest” ferrous scrap pricing:

Pig Iron Offers

One of our pig iron sources advised us earlier this week that pig iron offers for October are “roughly $375/MT CFR” with no buyers as of Tuesday. We were also told that the Nucor Louisiana DRI outage was having a bigger effect on scrap than pig iron.

MetalX to Build New Ohio Plant Next to North Star BlueScope

In other scrap-related news, the Fort Wayne newspaper, The Journal Gazette, reports scrap processor MetalX plans to invest $35 million to build a greenfield, state-of-the-art scrap processing plant near North Star BlueScope’s plant in Delta, Ohio. This would be the second Ohio facility for Waterloo, Ind.-based MetalX.

The plant is projected to have an annual volume of 700,000 tons.

The new plant is expected to be operational 12 months after receiving state and local economic and development incentives.