Market Data

August 3, 2017

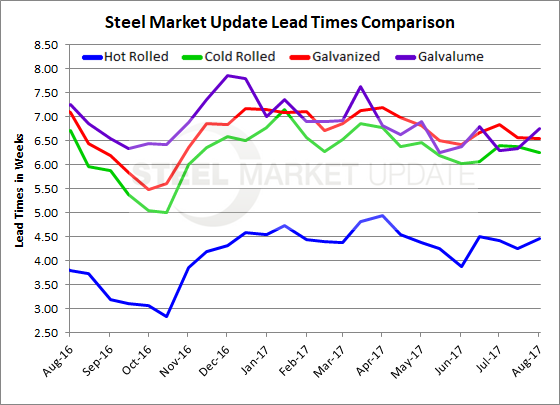

Lead Times Hold Steady

Written by Tim Triplett

Flat rolled lead times have seen little change in the past month.

Twice per month, Steel Market Update conducts an analysis of the flat rolled sheet and plate markets based on responses to a comprehensive questionnaire. When looking at lead times, the analysis is restricted to responses from manufacturers and distributors, who accounted for 84 percent of the total return. Steel mills, trading companies and toll processors are not invited to participate in lead time questions.

Hot rolled lead times continue to be in the low to mid four-week time frame (4.46 weeks). This is slightly longer than what we saw one year ago when lead times were reported to be averaging 3.80 weeks.

Cold rolled lead times are approximately six weeks (6.25 weeks), which has not changed much in the past two months. Last year, the average lead time for cold roll was slightly higher at 6.71 weeks.

Likewise, galvanized lead times have stayed in the mid six-week range (6.54) with only small variation in the past two months. This time last year, galvanized lead times averaged 7.08 weeks.

Galvalume lead times averaged 6.75 weeks in the most recent survey, up from 6.30 weeks a month ago, but down from 7.25 weeks last year.

Note: These lead times are based on the average from manufacturing and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.