Analysis

August 2, 2017

Construction Spending’s Expanding… Slowly

Written by Peter Wright

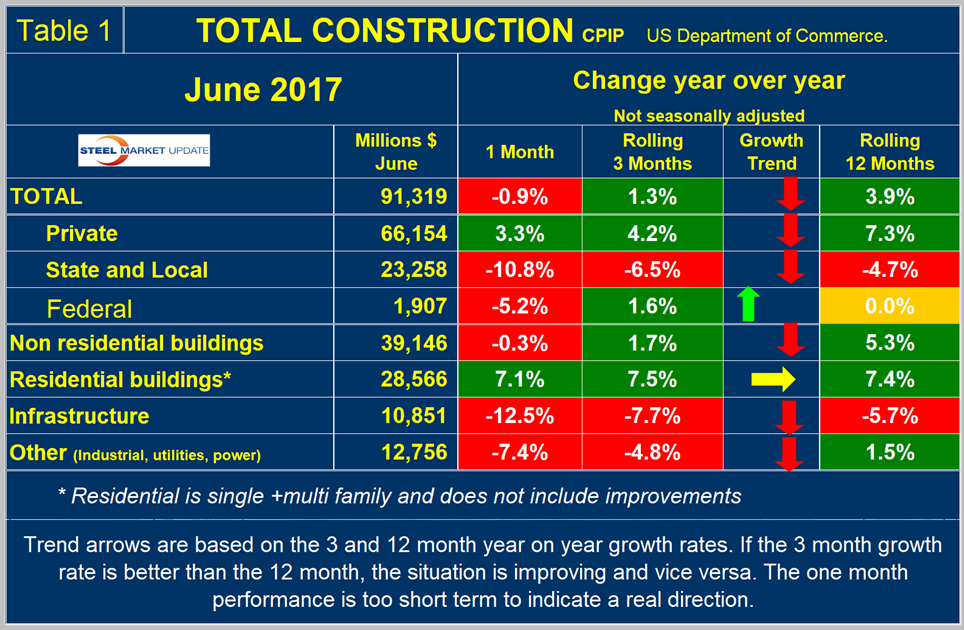

Total construction expenditures are expanding slowly, but the contraction of infrastructure expenditures is accelerating, according to June data for construction put in place (CPIP) released by the U.S. Department of Commerce on Aug. 1.

Total construction still shows positive growth, but slowed to 1.3 percent year/year in the latest three months of data. Privately funded projects are the growth engine as state/local and infrastructure are both contracting. All three financing categories have negative momentum. Construction is extremely seasonal, therefore the growth or contraction that we report in this analysis has had seasonality removed by considering only year/year comparisons.

At SMU, we analyze the CPIP data with the intent to provide a clear description of activity we believe accounts for over 30 percent of total steel consumption. Please see the end of this report for more detail on how we perform this analysis and structure the data. Note that we present NO seasonally adjusted numbers. Much of what you will see in the press may differ from our presentation because others are basing their comments on adjusted values. Our rationale is that construction is highly seasonal and our businesses function in a seasonal world. Also, we don’t understand how the adjustments are made, nor do we trust them.

Total Construction

Total construction grew by 1.3 percent in three months through June year over year and by 3.9 percent in 12 months year over year. This was the 62nd consecutive month of positive growth. However, since the 3-month growth rate is lower than the 12-month, we conclude that the rate of growth is slowing as indicated by negative momentum.

June total construction expenditures equaled $91.3 billion, which breaks down to $66.2 billion of private work, $23.3 billion of state and locally (S&L) funded work, and $1.9 billion of federally funded work (Table 1).

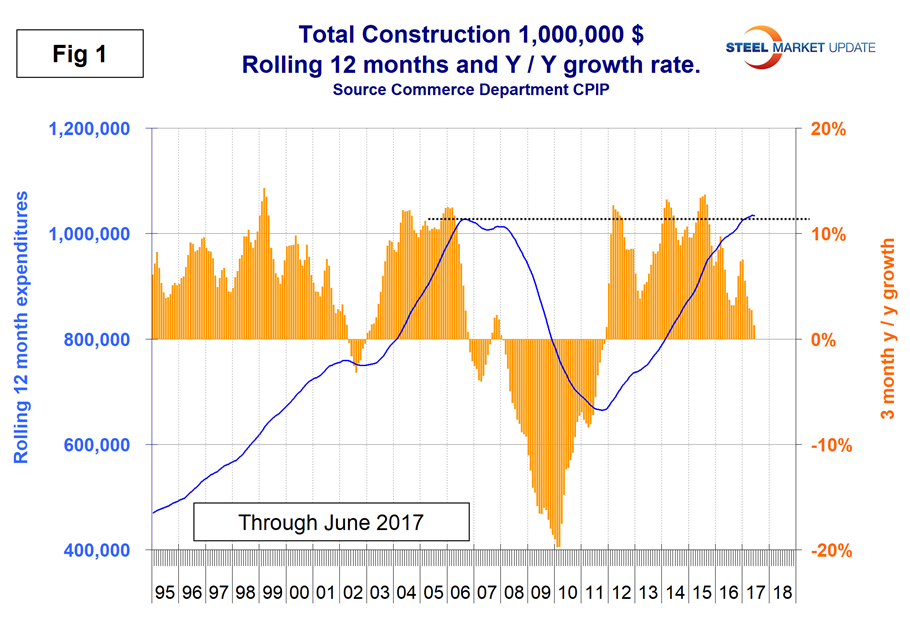

The red and green arrows in all four tables in this report show momentum. Figure 1 shows total construction expenditures on a rolling 12-month basis as the blue line and the rolling 3-month year-over-year growth rate as the brown bars. Figures 1 through 4 in this analysis have the same format, the result of which is to smooth out variation and eliminate seasonality.

We consider four sectors within total construction. These are nonresidential, residential, infrastructure and other. The latter is a catchall and includes industrial, utilities and power. All four of these sectors except residential construction had negative momentum in this latest data. The pre-recession peak of total construction on a rolling 12-month basis was $1.028 trillion through August 2006. The low point was $665.1 billion in 12 months through April 2011. August 2016 through June 2017 on a rolling 12-month basis were the first months to exceed the trillion-dollar level since June 2008. In 12 months through June, construction expenditures totaled $1.034 trillion.

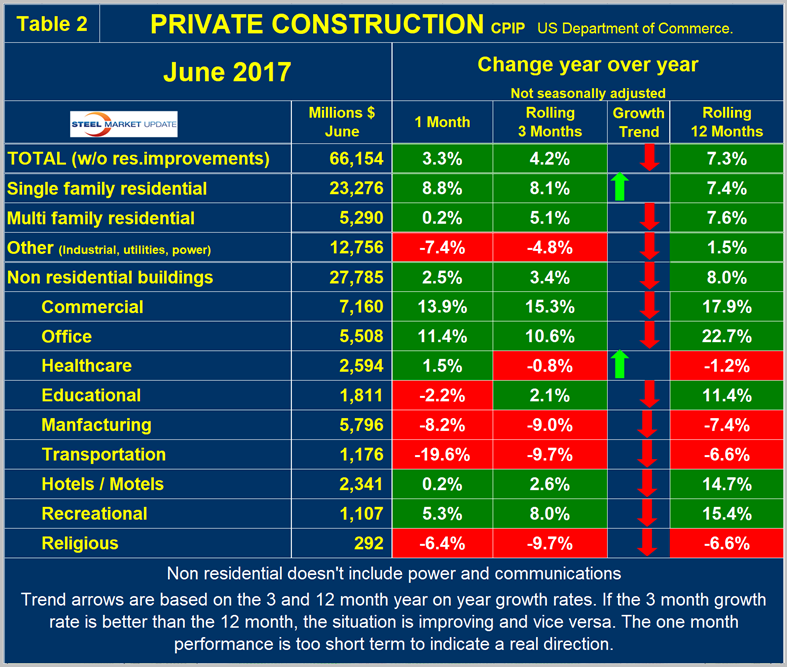

Private Construction

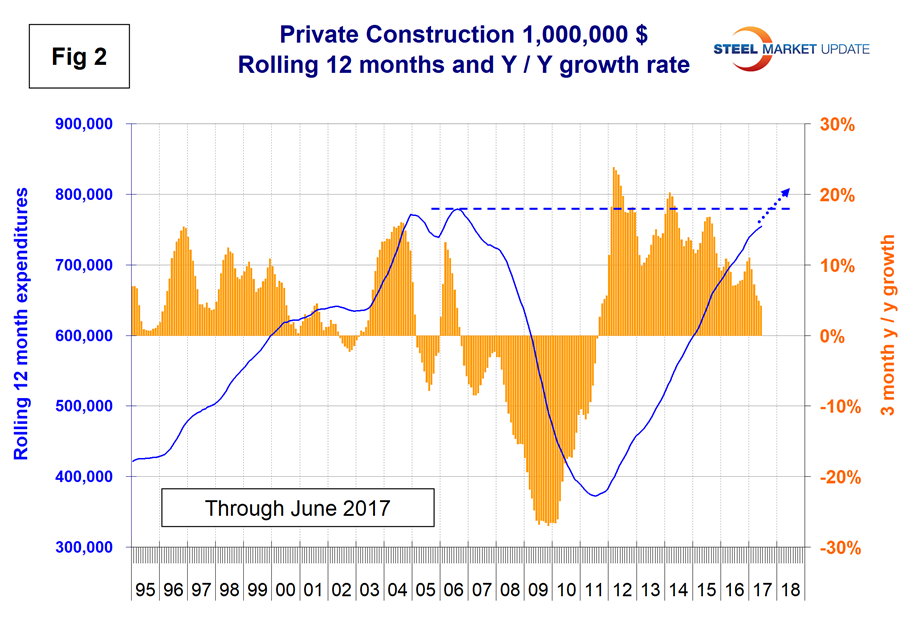

Table 2 shows the breakdown of private expenditures into residential and nonresidential and subsectors of both.

The growth rate of private construction was 4.2 percent in the three months through June, down by about half since January as shown by the brown bars in Figure 2. Total private expenditures are projected to reach the pre-recession high at about the end of this year. Excluding property improvements, our report shows that single-family residential grew by 8.1 percent and multi-family residential by 5.1 percent in three months through June year over year. Single-family has positive momentum, but multi-family is slowing. The growth rate of multi-family construction expenditures reported here is different from the construction starts reported by the Census Bureau. (In the starts data, the whole project is entered into the data base when ground is broken). Single-family starts grew at 8.9 percent in 3 months through June, therefore similar to CPIP, but multi-family starts contracted by 15.3 percent. Multi-family starts have been in a severe downtrend since April. Within private nonresidential buildings, almost all the positive growth is coming from commercial and office projects, which are growing by double digits. Health care was the only sector to have positive momentum; all other sectors are slowing. The third-quarter Federal Reserve Senior Loan Officer Survey indicated that there is currently a net decrease in demand for construction and land development loans, and terms for such loans are tightening. The Fed survey reviews changes in the terms of, and demand for, bank loans to businesses on a quarterly basis based on the responses from 73 domestic banks and 24 U.S. branches and agencies of foreign banks.

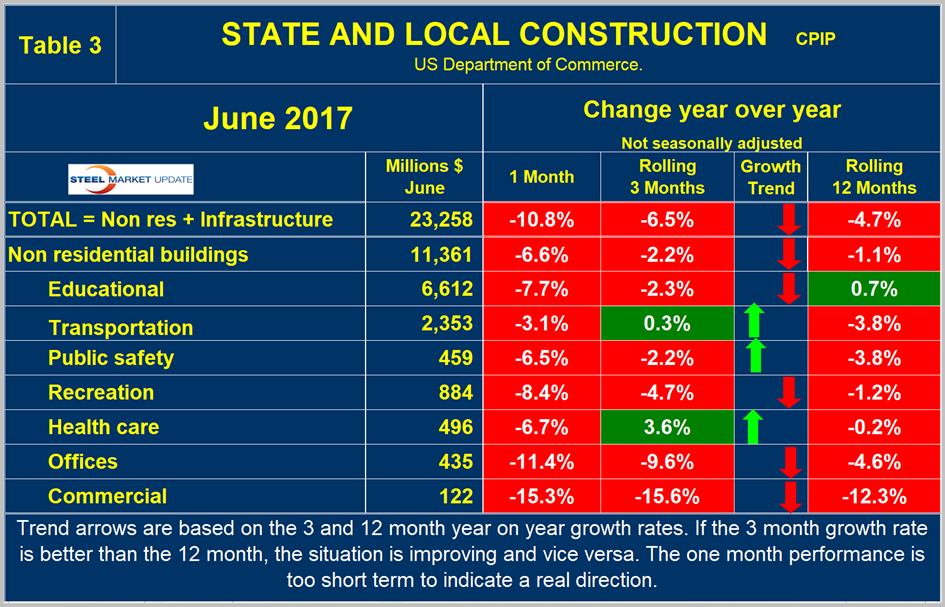

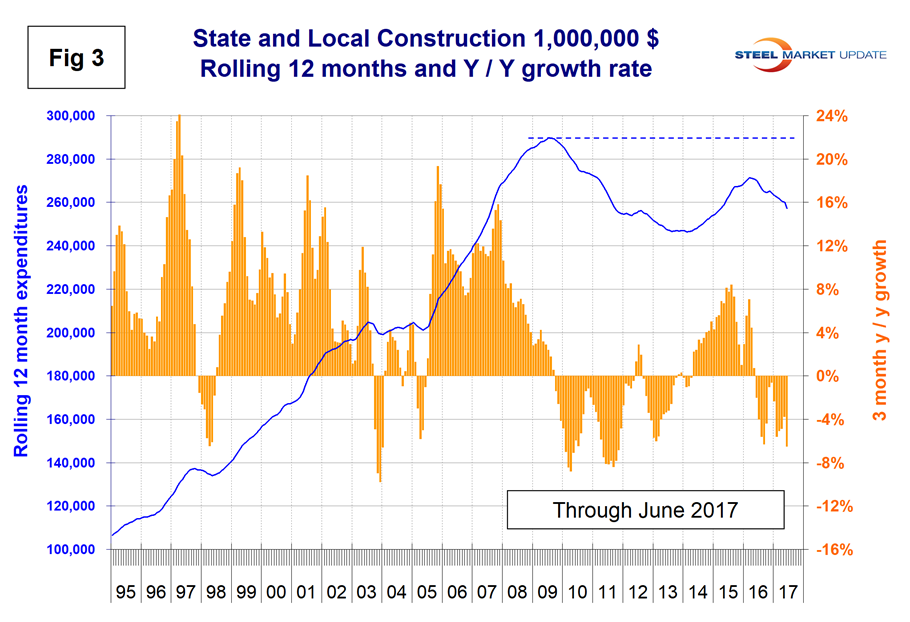

State and Local Construction

S&L work contracted by 6.5 percent in the rolling three months through June year/year with negative momentum (Table 3). Note this includes infrastructure. April 2016 was the last month in which S&L expenditures had positive y/y growth. Figure 3 shows growth as the brown bars and the rolling 12- month total of expenditures as the blue line. Educational buildings are by far the largest subsector of S&L nonresidential buildings at $6.6 billion in June when on a 3MMA basis y/y growth was negative 2.3 percent with negative momentum. Comparing Figures 2 and 3 shows that S&L construction did not have as severe a decline as private work during the recession and that private work bounced back faster. Private expenditures have a good chance to reach the pre-recession high in 2017, but the downturn in S&L (including infrastructure) means that a full recovery won’t be achieved in this decade.

Drilling down into the private and S&L sectors as presented in Tables 2 and 3 shows which project types should be targeted for steel sales and which should be avoided. There are also regional differences to be considered for which data is not available from the Commerce Department.

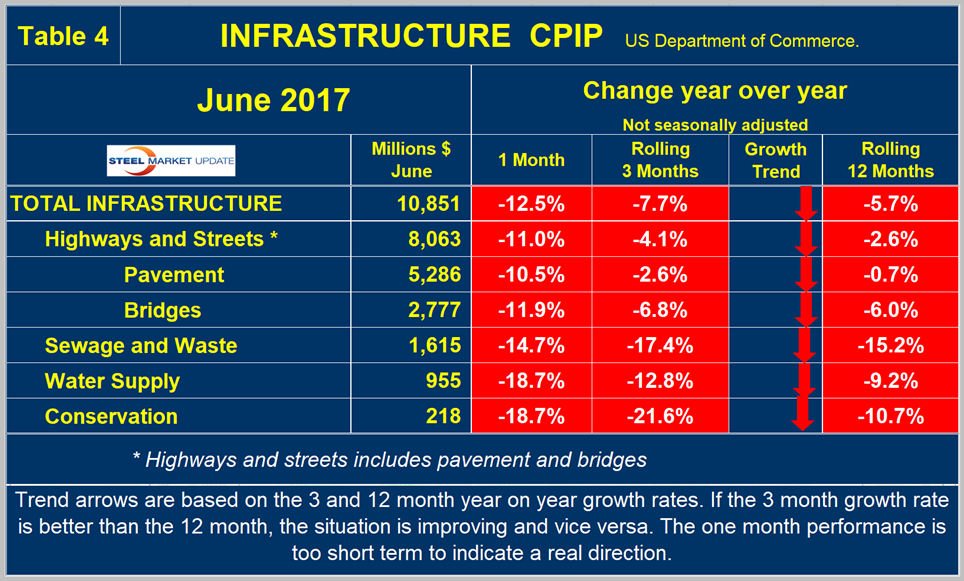

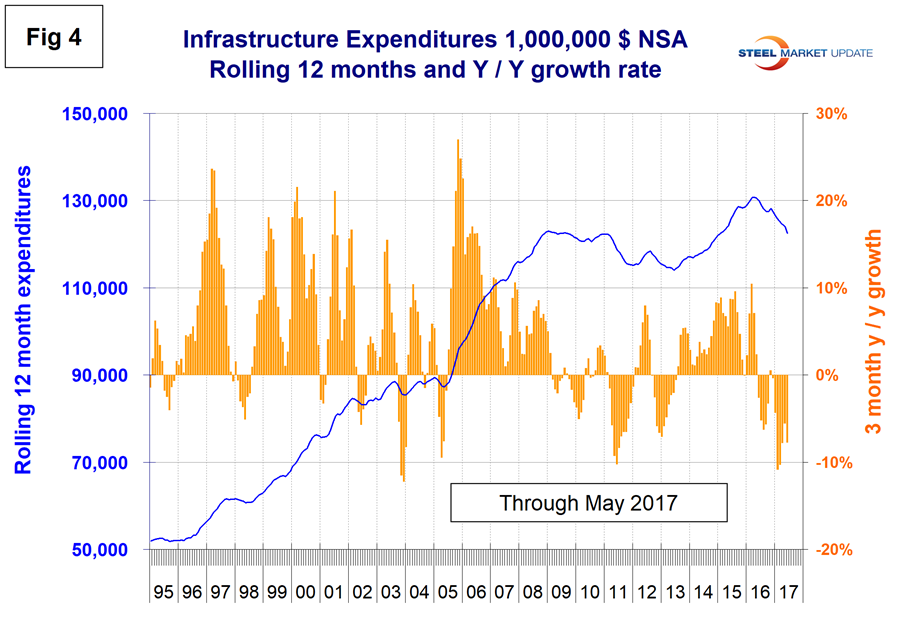

Infrastructure

Infrastructure expenditures had positive growth in the first five months of last year and have had only one slightly positive month since then. In the June data, every subsector of infrastructure contracted with negative momentum. Highways and streets, including pavement and bridges, account for about two-thirds of total infrastructure expenditures. Highway pavement is the main subcomponent of highways and streets and had a 2.6 percent contraction in three months through June. Bridge work contracted by 6.8 percent (Table 4).

Infrastructure expenditures have exceeded the pre-recession high every month since June 2015, but in the last 14 months have been in a downturn (Fig 4). There is still no sign that the December 2015 congressional bill authorizing $305 billion to fund roads, bridges and rail lines has begun to take effect. The long lead time for approvals and project design slows the application of available infrastructure funds, but it seems now that there must be some other drag on progress. The 2015 five-year infrastructure bill was the largest reauthorization of federal transportation programs approved by Congress in more than a decade, ending an era of stopgap bills and half-measures that left the Highway Trust Fund nearly broke and frustrated local governments and business groups.

Total Building Construction Including Residential

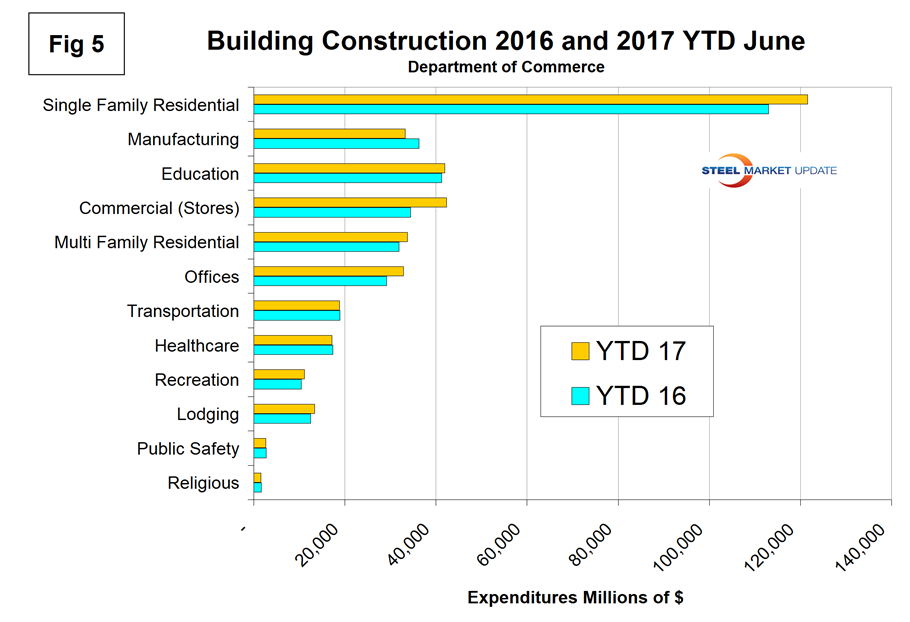

Figure 5 compares year-to-date expenditures for building construction for 2016 and 2017.

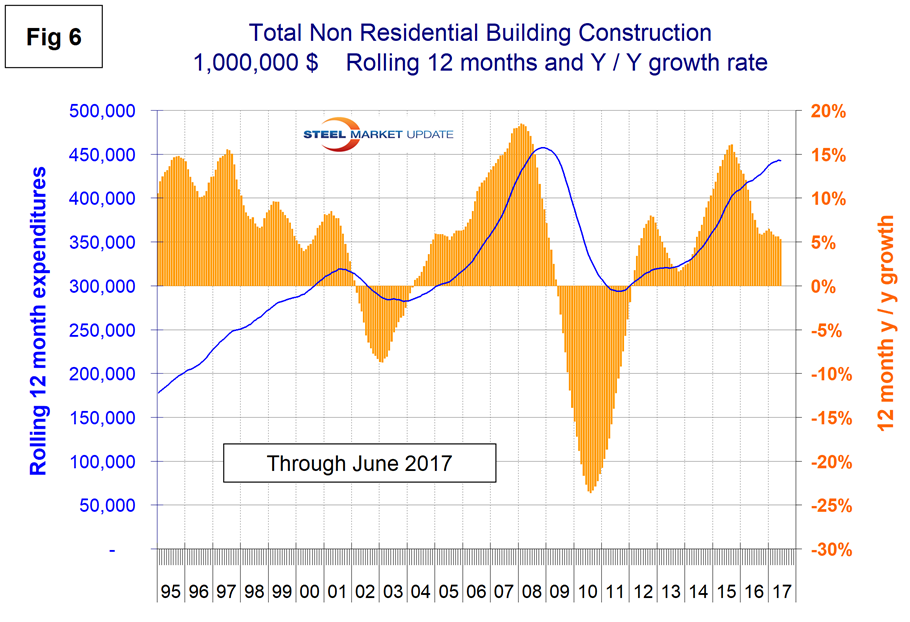

Single-family residential is dominant, and in the 12 months of 2016 totaled $243 billion, up from $233 billion in 2015. In the first six months of 2017, year/year, all project segments except manufacturing, public safety and religious had positive growth led by commercial (mainly stores), up by 23.1 percent, and offices, up by 12.8 percent. Figure 6 shows total expenditures and growth of nonresidential building construction. Growth has been slowing this year and was down to 5.3 percent in three months through June year/year.

Explanation: Each month, the Commerce Department issues its construction put in place (CPIP) data, usually on the first working day covering activity one month and one day earlier. Construction put in place is based on spending work as it occurs, estimated for a given month from a sample of projects. In effect, the value of a project is spread out from the project’s start to its completion. This is different from the starts data published by the Census Bureau for residential construction, by Dodge Data & Analytics and Reed Construction for nonresidential and Industrial Information Resources for industrial construction. In the case of starts data, the whole project is entered to the data base when ground is broken. The result is that the starts data can be very spiky, which is not the case with CPIP.

The official CPIP press release gives no appreciation of trends on a historical basis and merely compares the current month with the previous one on a seasonally adjusted basis. The background data is provided as both seasonally adjusted and non-adjusted. The detail is hidden in the published tables, which we at SMU track and dissect to provide a long-term perspective. Our intent is to provide a route map for those subscribers who are dependent on this industry to “follow the money.” This is a very broad and complex subject, therefore to make this monthly writeup more comprehensible we keep the information format as consistent as possible. In our opinion, the absolute value of the dollar expenditures presented are of little interest. What we are after is the magnitude of growth or contraction of the various sectors. In the SMU analysis, we consider only the non-seasonally adjusted data. We eliminate seasonal effects by comparing rolling three-month expenditures year over year. CPIP data also includes the category of residential improvements, which we have removed from our analysis on the rationale that such expenditures are minor consumers of steel.

In the four tables included in this analysis we present the non-seasonally adjusted expenditures for the most recent data release. Growth rates presented are all year over year and are the rate for the single-month result, the rolling 3 months and the rolling 12 months. We ignore the single-month year/year result in our writeups because these numbers are preliminary and can contain too much noise. The arrows indicate momentum. If the rolling 3-month growth rate is stronger than the rolling 12 months, we define this as positive momentum, and vice versa. In the text, when we refer to growth rate, we are describing the rolling 3 months year over year rate. In Figures 1 through 4, the blue lines represent the rolling 12-month expenditures and the brown bars represent the rolling 3-month year-over-year growth rates.