Analysis

August 1, 2017

July Auto Sales Drop As Expected

Written by Sandy Williams

Automotive sales dropped sharply for most manufacturers in July. Edmunds and WardsAuto estimate total sales for the month to be 1.42 million units. The seasonally adjusted annual rate for July is expected to be 16.9 million, according to WardsAuto.

“July is historically a strong month, but with disappointing sales and inventories still building, something needs to give,” said Jessica Caldwell, Edmunds executive director of industry analysis in advance of Tuesday’s reports. “A lot is riding on late-summer sales events to help move vehicles before 2018 models start arriving at dealer lots.”

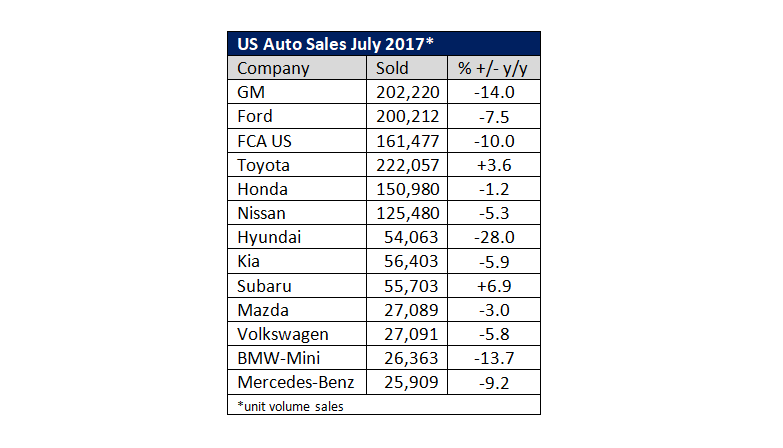

Of the top five auto manufacturers in the U.S., only Toyota had a year-over-year increase, squeezing out a 3.6 percent gain from July 2016. General Motors and FCA U.S. had double-digit losses of 14.0 percent and 10.0 percent, respectively. Ford sales fell 7.5 percent in July.

“There’s no denying the ongoing drop in auto sales, but this is a drop from record levels to near-record levels, unlike what happened in 2009,” said Karl Brauer, executive publisher for Autotrader and Kelley Blue Book. “After seven years of perpetual growth, it’s a tough wake-up call for some brands to face flat or slightly declining sales numbers.”

General Motors Chief Economist Mustafa Mohatarem said he expects to see sales pick up in the second half of the year.

“U.S. auto sales continue to moderate from last year’s record pace, but key U.S. economic fundamentals remain supportive of strong vehicle sales,” said Mohatarem. “Under the current economic conditions, we anticipate the second half of 2017 will be much stronger than the first half.”