Distributors/Service Centers

July 25, 2017

SMU Analysis: Service Center Inventories

Written by John Packard

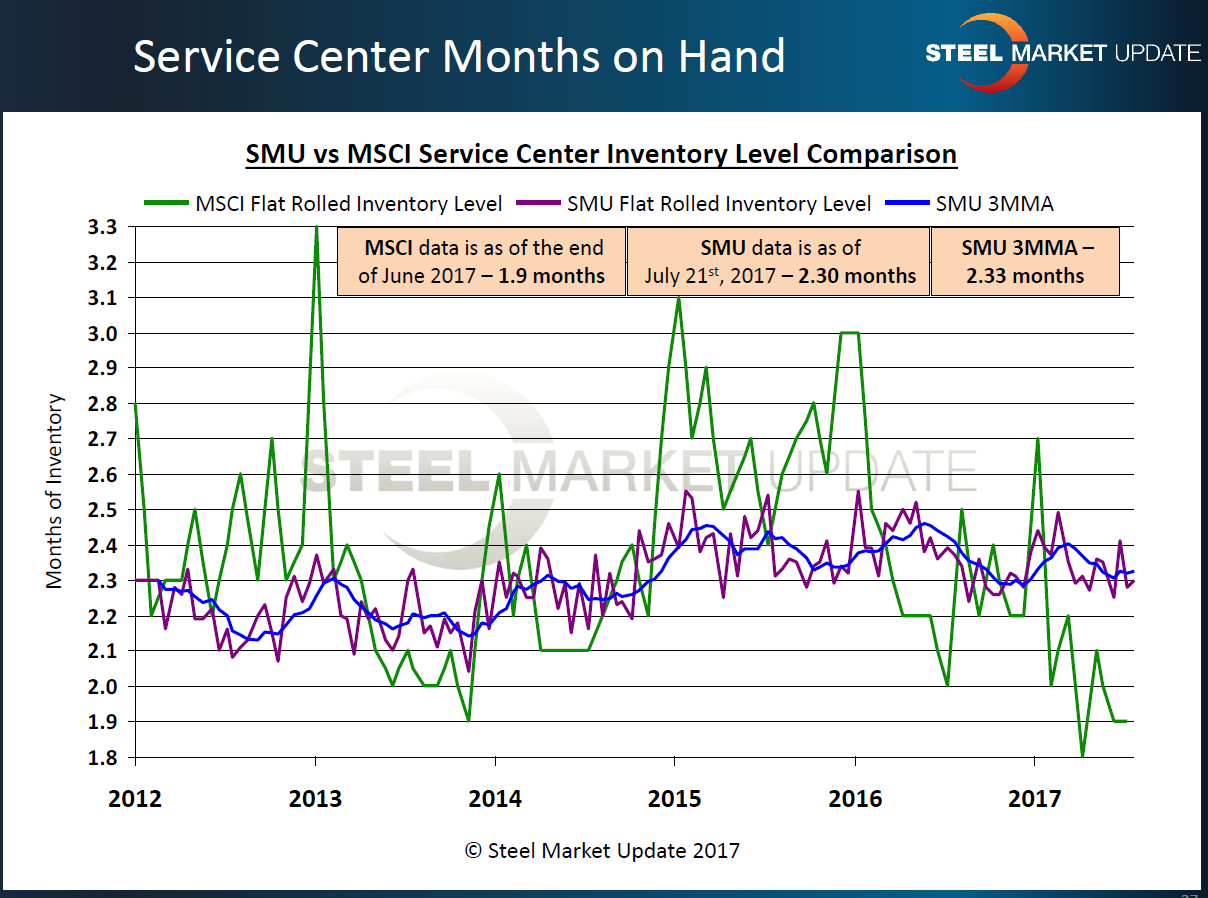

Last week, the MSCI reported carbon flat rolled inventories as being 1.9 months of supply as of the end of June 2017. Steel Market Update (SMU) conducted a detailed analysis of steel service center inventories last week via our survey and our results had flat rolled inventories as averaging 2.3 months.

The data provided in our graphic above is from 48 individuals associated with flat rolled and plate distribution. We consider each company as being equal with all of the other companies and our 2.30 months is the average of all of the responses we received.

We know the issue of inventories is an important one when considering whether distributors need to buy steel or if they are able to sit back and wait for the market to provide pricing direction.

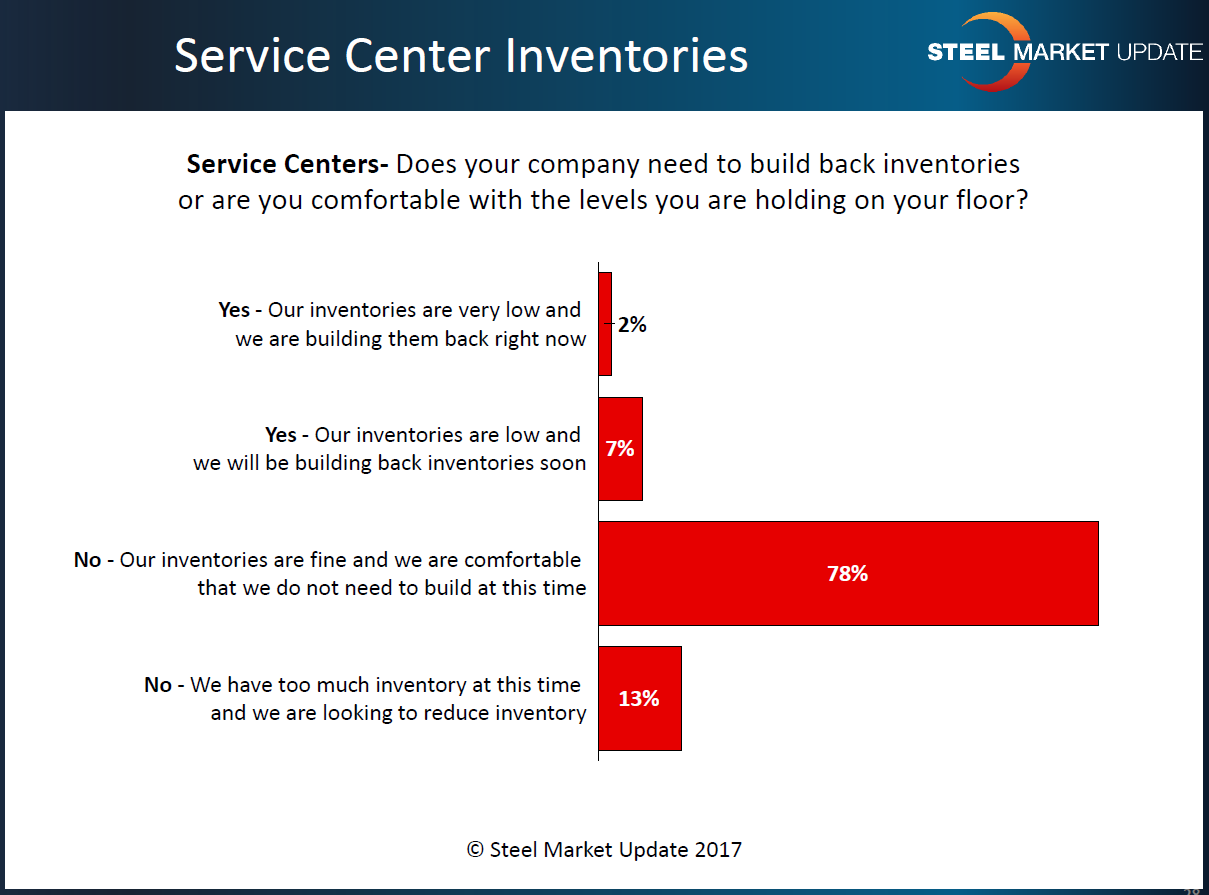

Steel Market Update has begun asking questions we hope will assist in better understanding whether service centers need to buy or if they are able to wait. Ninety-one percent of those same 48 service center respondents reported their inventories as being balanced or having excessive steel. Only 9 percent reported their inventories as being too low.

Over the past two days Steel Market Update has been canvassing flat rolled steel service centers and wholesalers to see how much inventory they had on the floor at the end of June. We received information from 13 companies. Inventory levels ranged from a low of 1.5 months to over 4.0 months. When averaged together these 13 service centers were holding 2.61 months of carbon flat rolled at the end of June. We will continue to expand the number of service centers being canvassed at the end of each month in an effort to provide a new index that can be used by the steel community.

Another question asked during the survey process is what about “off the books” inventories? This would be those inventories that may be on a roll-and-hold program or are being held elsewhere and not yet invoiced on the distributor’s books. Most service centers (63 percent last week) are reporting they do not have any “off the books” inventories. The remaining 37 percent do have inventories out there that may not be getting measured.