Market Data

July 21, 2017

SMU Flat Rolled Steel Market Trends Analysis

Written by John Packard

Twice per month, Steel Market Update (SMU) conducts a detailed analysis of the flat rolled steel market. We invite 650 individuals representing approximately 625 different companies to participate by taking an online questionnaire. The questions cover a wide variety of topics that are germane to their unique industry segment. The two main groups asked to participate are manufacturing companies (ultimate end users/fabricators of the steel) and steel service centers and wholesalers. In the analysis conducted last week, 84 percent of the participants were from these two industry groups. To round out the participants, we also invite steel trading companies (8 percent last week), steel mills (4 percent) and toll processors (4 percent). We feel this provides a well-rounded view of the industry.

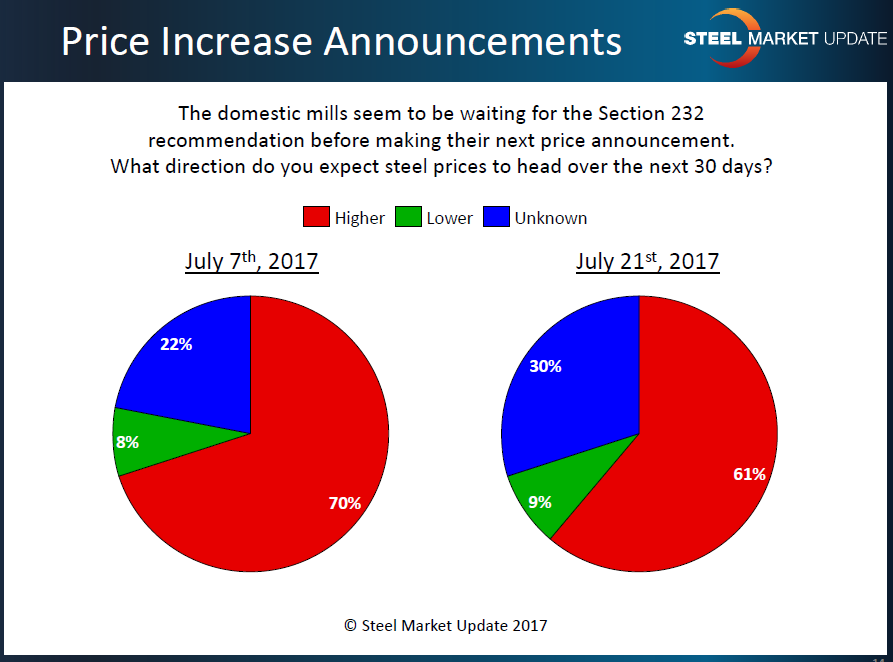

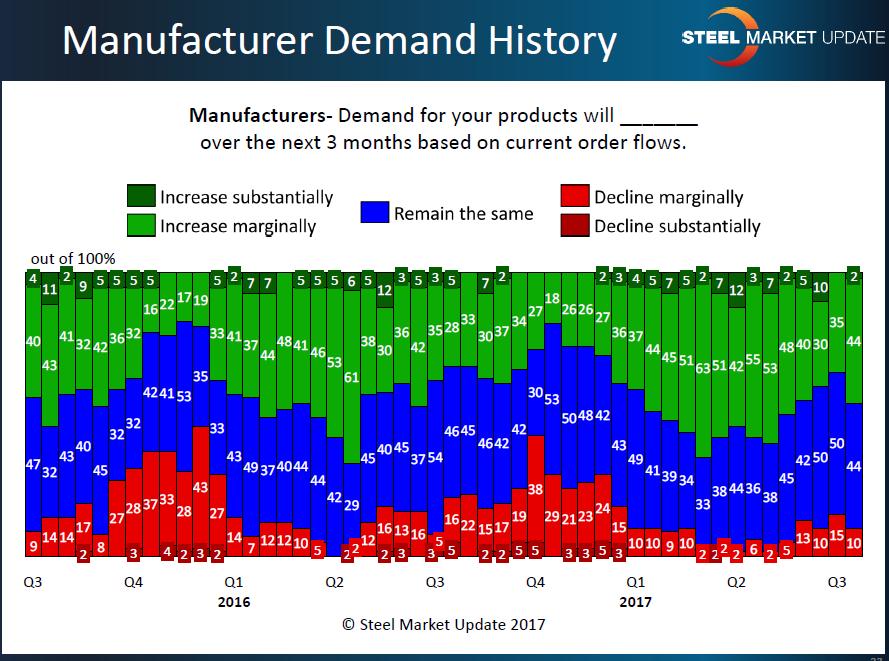

During the first segment of the questionnaire, we ask everyone to participate in a group of questions that are impacting today’s decisions. This includes our questions that result in our SMU Steel Buyers Sentiment Index, as well as questions regarding demand, reaction to price announcements, Section 232 related questions and one related to steel mill order books.

From there our participants are funneled to specific market segments where they are asked questions pertaining to their industry’s participation in the flat rolled and plate steel markets. It is here that we ask specific pricing questions of the manufacturing and service center groups (we do not ask pricing questions of steel mills or toll processors). We also get deeper involved in demand, inventories, buying patterns, foreign steel purchases, spot prices from the perspective of manufacturing companies and service centers, mill lead times and mills’ willingness to negotiate spot prices.

As we share this information with our Premium level members, we try to show as much detail about the single data point as possible and then put it into a historical context so our Premium level members can see for themselves the cycles and where we are in the current market cycle.

We ask trading companies questions about foreign steel pricing, changes in the amount of requests for quotes and other issues that affect their ability to provide supply and competitive pricing to their U.S. and Canadian customers.

We package a great many of the responses provided into a PowerPoint presentation format and then provide those who participated in the questionnaire a link. At the same time, we post the presentation on our website so it can be accessed at any time by those who are Premium members of Steel Market Update. Premium members can find the past and current surveys under the Analysis tab on our website.

If you are currently an Executive level member and would like to become a Premium member, please contact us at info@SteelMarketUpdate.com. If you would like a trial of Premium, which includes Premium supplemental issues of SMU as well as complete access to our website, please send a note to Brett@SteelMarketUpdate.com.

Premium level rates begin at $2,095.00 for one person ($3,095 for two), while our current Executive level rates are $1,195.00 for one person ($1,300 for two). For information about corporate rates, please contact us at info@SteelMarketUpdate.com.