Analysis

July 19, 2017

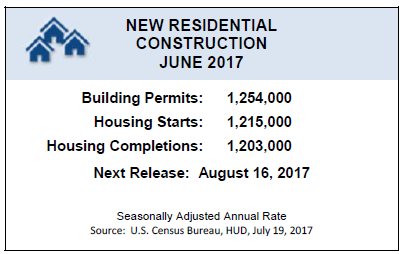

Housing Starts Rebound in June

Written by Sandy Williams

Housing starts in June jumped 8.3 percent to a seasonally adjusted annual rate of 1,215,000 and were 2.1 percent higher than in June 2016, said the Department of Commerce on Wednesday. The increase follows three months of decline and was driven by new construction in the Northeast and Midwest.

Permit authorization, an indicator of future construction, grew 7.4 percent from May and 5.1 percent from a year ago for a seasonally adjusted annual rate of 1,254,000. Multi-family housing of five units or more outpaced single-family permits with a gain of 14.6 percent versus 4.1 percent.

Permit authorizations dropped 13.9 percent in the Northeast indicating that the jump in starts for the region will be short-lived. Midwest authorizations were up 19.7 percent, South 6.9 percent, and West 9.9 percent.

A June National Association of Home Builders survey showed builder confidence slipped to its lowest reading since November 2016. Builders expressed concern over rising material prices, especially lumber. NAHB Chairman Granger MacDonald said, “This is hurting housing affordability even as consumer interest in the new-home market remains strong.”