Market Data

July 19, 2017

China’s Economy, Steel Production Strong Through Q2

Written by Peter Wright

China’s economic performance through the second quarter continued to be impressive. Chinese growth of steel production lagged the rest of the world in the first months of 2017, but the June output could indicate an unwelcome change.

Once each quarter, we publish the official statistics for Chinese GDP, industrial production, consumer price inflation and fixed asset investment. Currently available data is through the second quarter. Many analysts don’t believe these self-serving Party figures, but we include them in our reports because of the importance of China in the global steel scene, and because these numbers are all there is.

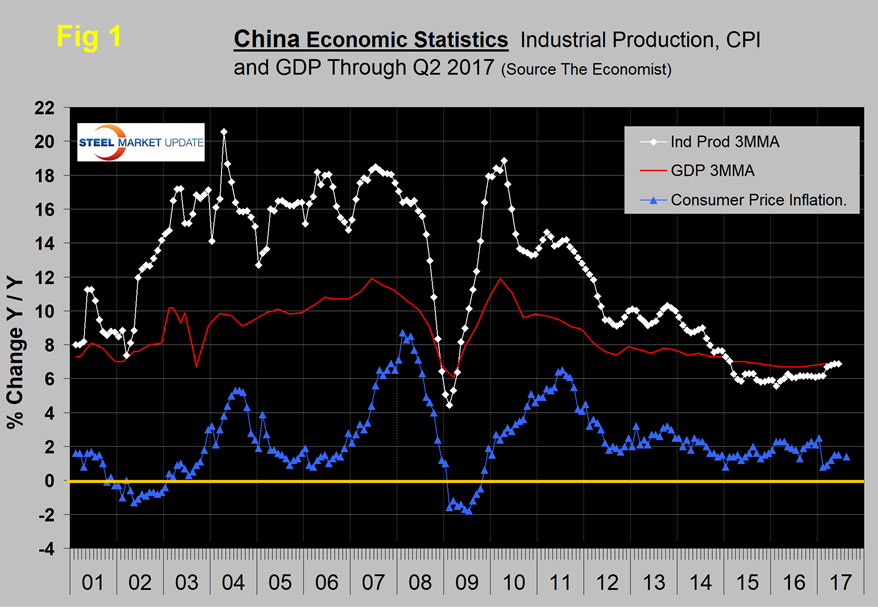

Figure 1 shows published data for the growth of GDP, industrial production and consumer prices through Q2 of 2017.

The GDP and industrial production portions of this graph are three-month moving averages. The growth of GDP was 6.9 percent in both the first and second quarters, up from 6.8 percent in Q4 2016 and from 6.7 percent in the first three quarters of 2016. This slight increase should be viewed in the context of the decline since the peak of 11.9 percent in Q1 2010. Consumer demand has resulted from steady employment growth and strong wage growth. This will ensure inflation remains at the low end of the government’s target by the year end. Consumer price inflation averaged 1.44 percent in 2015, 2.0 percent in 2016 and fell to 1.40 percent in the first half of 2017.

The three-month moving average of the growth of industrial production rose from 6.1 percent in January to 6.9 percent in June. Industrial output was stronger than expected in June, driven by strong global and domestic demand. Tech production is driving manufacturing, and companies are gearing up for the release of new products later this year. The government reported that manufactured product exports made up 57.2 percent of China’s total exports in the first half of the year.

The IMF mission to China report of June 14, 2017, had this to say: “China continues to transition to a more sustainable growth path and reforms have advanced across a wide domain. Our discussions in the past two weeks focused on the policies needed to ensure China’s successful transition, which is vital to its own people and the rest of the world—and the urgency of accelerating the pace of reforms.

“Policy support, especially expansionary credit and public investment, has helped China maintain strong growth. Staff now project growth of 6.7 percent in 2017 and average annual growth of 6.4 percent between 2018 and 2020. China has the potential to safely sustain strong growth over the medium term. As has been widely recognized, this requires deep reforms to transition from the current growth model that relies on credit-fed investment and debt. It is critical to start now while growth is strong and buffers sufficient to ease the transition.

“The Chinese authorities are fully aware of the challenges and have taken crucial and welcome measures. Important supervisory and regulatory action is being taken against financial sector risks. Corporate debt is growing more slowly, reflecting restructuring initiatives and overcapacity reduction. The house price boom is being gradually contained and excess inventory reduced. Local government borrowing frameworks are being improved and a blueprint for reforming central-local fiscal relations has been published. The creation of new businesses has tripled since the 2014 reform. Data weaknesses have been recognized and actions taken to improve integrity.

“While some near-term risks have receded, reform progress needs to accelerate to secure medium-term stability and address the risk that the current trajectory of the economy could eventually lead to a sharp adjustment. This means switching faster from investment to consumption; increasing the role of market forces; implementing a more sustainable macro policies mix, continuing the regulatory tightening; tackling nonfinancial sector debt; and further improving policy frameworks. Our specific recommendations build on the progress achieved and the government’s existing reform agenda.”

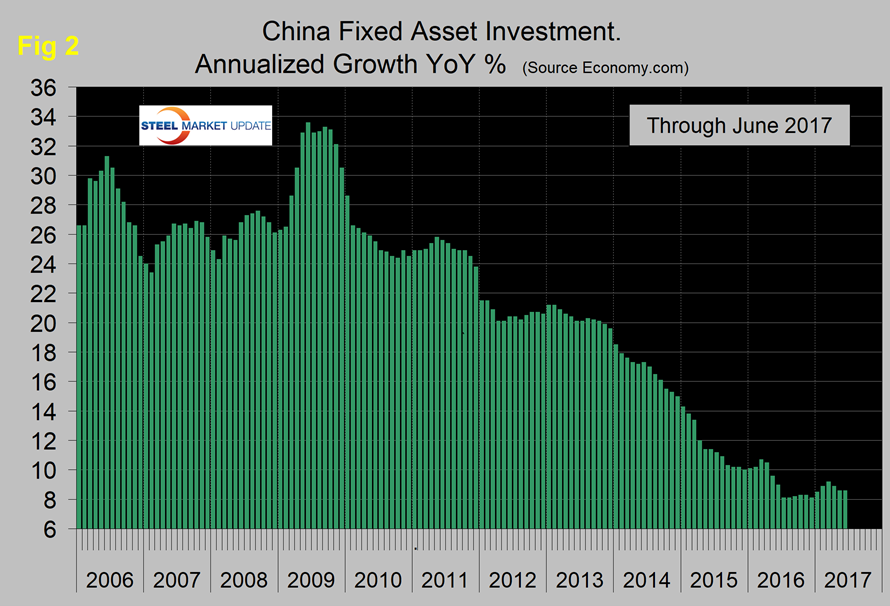

Figure 2 shows the growth of fixed asset investment year over year.

In June, FAI grew at 8.6 percent, down from 9.2 percent in March, but relatively stable for the last 12 months. Economy.com wrote: “The main driver of the rise in fixed asset investment continues to be the manufacturing sector, with electronics and computers being the star performer. This rise is being driven by improving global demand and the continued rise of incomes and spending power among China’s middle class. Investment in the automobile sector has also been strong recently. This may ease somewhat, as subsidies for energy efficient cars have been removed, decreasing demand.”

At SMU, we understand that about half of fixed asset investment is based on real-estate transactions rather than construction expenditures, but even so this rate of growth should eat into China’s overcapacity in steel and cement.

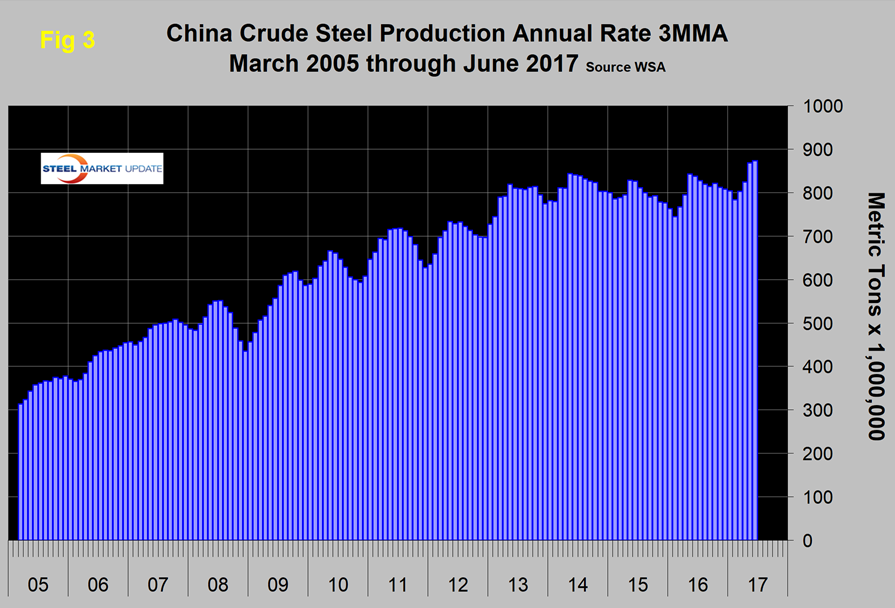

Figure 3 shows the 3MMA of China’s crude steel production through June when it accounted for 50.5 percent of global production.

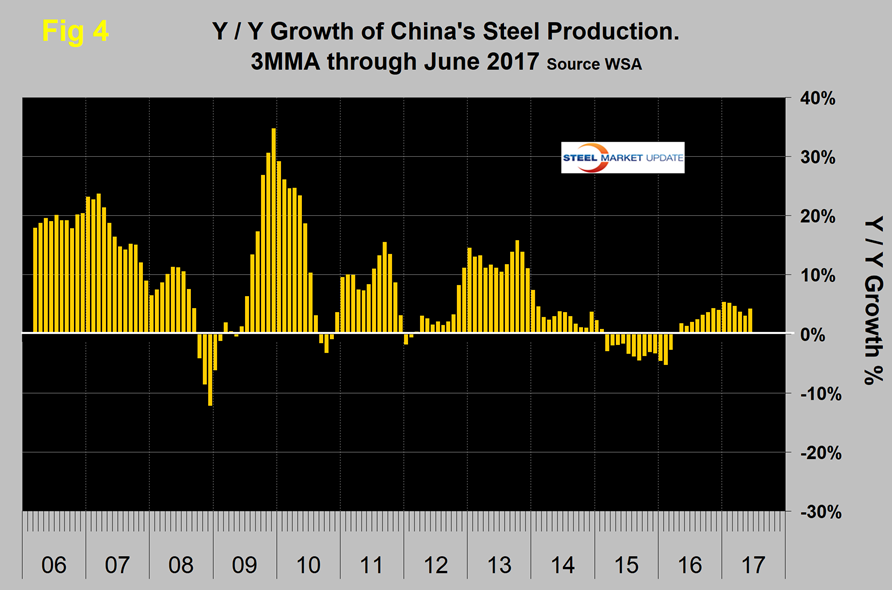

May has been the highest production month for the last few years, but this year June surpassed May with a record volume of 73.2 million metric tons. Another way of looking at the change in growth is shown in Figure 4.

Growth improved from contraction in the 13 months through March last year to positive 5.4 percent in January this year, declining to positive 4.0 percent in June. As Bloomberg reported on July 17: “Steel mills are running at very high rates and electric furnaces are ramping up production with good margins,” said Yu Chen, an analyst with Mysteel Research in Shanghai. “Demand has also beaten expectations. We see property sales, infrastructure, and auto sales all pretty good in June.”

The central government reiterated recently that cutting overcapacity is high on its reform agenda as excess capacity in sectors such as steel and coal has weighed on the country’s overall economic performance.

SMU Comment: China’s steel production has been growing at a slower rate than the world as a whole this year, but the fact that June’s volume was an all-time high could be an unwelcome harbinger of things to come. Strengthening of China’s domestic market, and of fixed asset investment in particular, will absorb some of this increasing volume.