Canada

July 13, 2017

U.S., Canada Autoworkers Speak Out on NAFTA

Written by Sandy Williams

Autoworkers in the U.S. and Canada say any renegotiation of the North American Free Trade Agreement must lead to higher wages for all three countries, reverse trade deficits with Mexico, and create new manufacturing jobs in the U.S. and Canada.

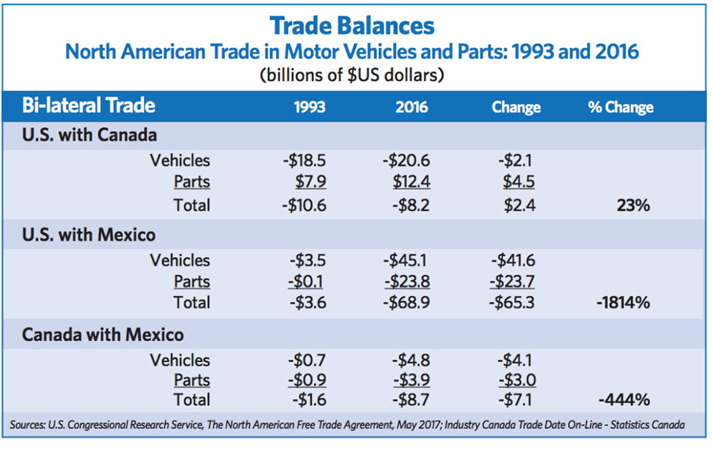

In a joint statement, the United Autoworkers and Canadian association UNIFOR noted that the trade deficit for motor vehicles and parts between 1993 and 2016 has grown dramatically with Mexico. The overall automotive trade deficit for the U.S. rocketed from 3.5 billion to $45.1 billion during the period, while the deficit for Canada with Mexico jumped from $1.6 billion to $8.7 billion.

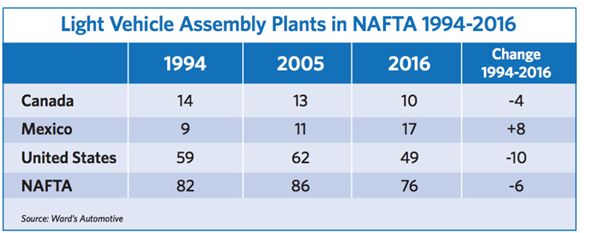

Behind the staggering increase is the inequality in wage growth and labor conditions between the U.S. and Canada and its southern partner Mexico. The average autoworker in Mexico makes around $3.95 per hour despite record growth for the industry. Unenforced labor laws and pro-management unions have led to abuse of worker rights, said the unions in their statement. Lower wages and benefits have resulted in making Mexico an attractive production site for automakers, disrupting the balance of automotive production and exports within NAFTA.

UAW and UNIFOR together represent 245,000 workers in the North American auto assembly and parts supplier segment and more than one million auto industry retirees. UNIFOR and the UAW said of their joint statement, “We would have welcomed the participation of representatives from Mexican free trade unions in the auto sector, but there are none that can speak for Mexican workers – and that is at the core of the problem.”

The unions offered four priorities that they believe must be addressed in any auto-related NAFTA provisions:

- Strengthening labor standards and raising wages

- Balanced trade

- Real “Made in North America” rules

- A fair share of benefits for workers in each country

“Modern trade agreements aim to pit workers against one another by design, with progress for none the assured outcome,” said UAW and UNIFOR. “Auto workers in the United States, Canada and Mexico must collaborate to ensure that the re-negotiation of NAFTA is an opportunity that delivers gains for all.”