Prices

July 11, 2017

SMU Price Ranges & Indices: Quiet Market Yields Mixed Results

Written by John Packard

The market has become “quiet” over the past week and our sources (steel buyers) are providing mixed messages, which is showing up especially in our galvanized index whose average was down $25 per ton today. The GI number was impacted by cheap pricing being reported on commodity grade galvanized with one GI buyer telling us, “We have seen very little movement since the price increases around 6/6/17. The mills are still willing to negotiate in an effort to fill their books. You do not have to work very hard to get a number under $38 base.” Others have reported higher prices, but for minimal tonnage.

Hot rolled has been one of the stronger items we have seen over the past few weeks. There is a narrow range for HRC at $600-$620 per ton.

As the week goes on, Steel Market Update will be re-evaluating our Price Momentum Indicator, which is currently pointing toward higher prices on the back of the expected Section 232 ruling. That appears to be up in the air now, and a non-ruling is not a positive for steel prices over the next 30 to 60 days.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $600-$620 per ton ($30.00/cwt-$31.00/cwt) with an average of $610 per ton ($30.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to one week ago, while the upper end decreased $10 per ton. Our overall average remains unchanged compared to last week. Our price momentum on hot rolled steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Hot Rolled Lead Times: 2-6 weeks

Cold Rolled Coil: SMU price range is $780-$820 per ton ($39.00/cwt-$41.00/cwt) with an average of $800 per ton ($40.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged compared to one week ago. Our price momentum on cold rolled steel is pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Cold Rolled Lead Times: 5-8 weeks

Galvanized Coil: SMU base price range is $38.00/cwt-$41.00/cwt ($760-$820 per ton) with an average of $39.50/cwt ($790 per ton) FOB mill, east of the Rockies. The lower end of our range decreased $30 per ton compared to one week ago, while the upper end decreased $20 per ton. Our overall average is down $25 per ton compared to last week. Our price momentum on galvanized steel is pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU price range is $838-$898 per net ton with an average of $868 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-9 weeks

Galvalume Coil: SMU base price range is $39.00/cwt-$41.50/cwt ($780-$830 per ton) with an average of $40.25/cwt ($805 per ton) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to last week, while the upper end remained the same. Our overall average is down $10 per ton compared to last week. Our price momentum on Galvalume steel is pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,071-$1,121 per net ton with an average of $1,096 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-8 weeks

Plate: SMU price range is $710-$760 per ton ($35.50/cwt-$38.00/cwt) with an average of $735 per ton ($36.75/cwt) FOB delivered. The lower end of our range remained the same compared to one week ago, while the upper end decreased $10 per ton. Our overall average is down $5 per ton compared to last week. Our price momentum on plate steel is pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Plate Lead Times: 4-6 weeks

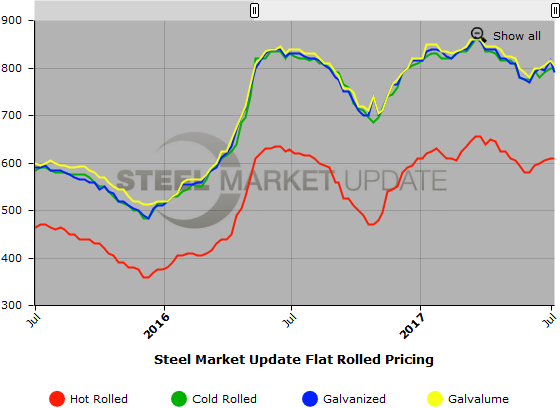

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. We will add plate prices to this graph once we have gathered a few months of data. To use the graph’s interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.