Market Data

July 9, 2017

Steel Mill Lead Times Remain in Narrow Range

Written by Tim Triplett

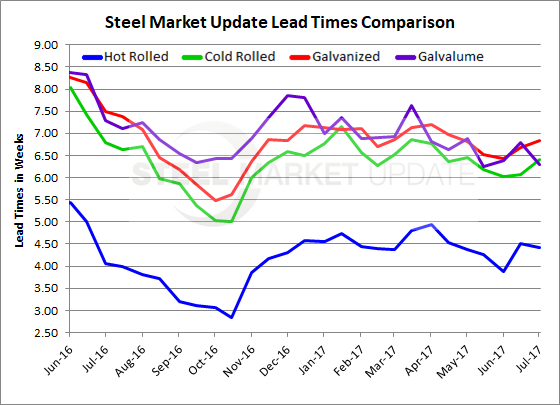

Flat roll lead times have remained within a narrow range over the past six months, according to the manufacturing companies and steel service centers responding to our flat rolled market trends analysis last week.

Hot rolled lead times now average 4.41 weeks, which is the same as what we reported in mid-June, but still one-half week better than what we measured in early June just as the steel mills began announcing a new round of price increases. One year ago, HRC lead times were reported as averaging 4 weeks (4.07).

Cold rolled lead times remain range bound at approximately 6.5 weeks (6.40 last week) where they have been since recovering from a minor dip that took lead times down to 6 weeks during the month of May (just prior to June price announcement). The 6.40 weeks measured last week are slightly lower than the 6.79 weeks we reported as the average in early July last year.

Galvanized lead times are on a similar path as hot rolled and cold rolled described above. After suffering a minor dip in May 2017, GI lead times are now just shy of 7 weeks (6.89 weeks), almost one week longer than what we saw at the beginning of June (6.03 weeks). One year ago, GI lead times were running about one-half week longer at 7.50 weeks.

Galvalume lead times have dropped from the 6.80 weeks reported a couple of weeks ago to the 6.30 weeks measured this past week. This is very similar to what we saw at the beginning of June (6.38 weeks), but well below the 7.29 weeks reported one year ago.

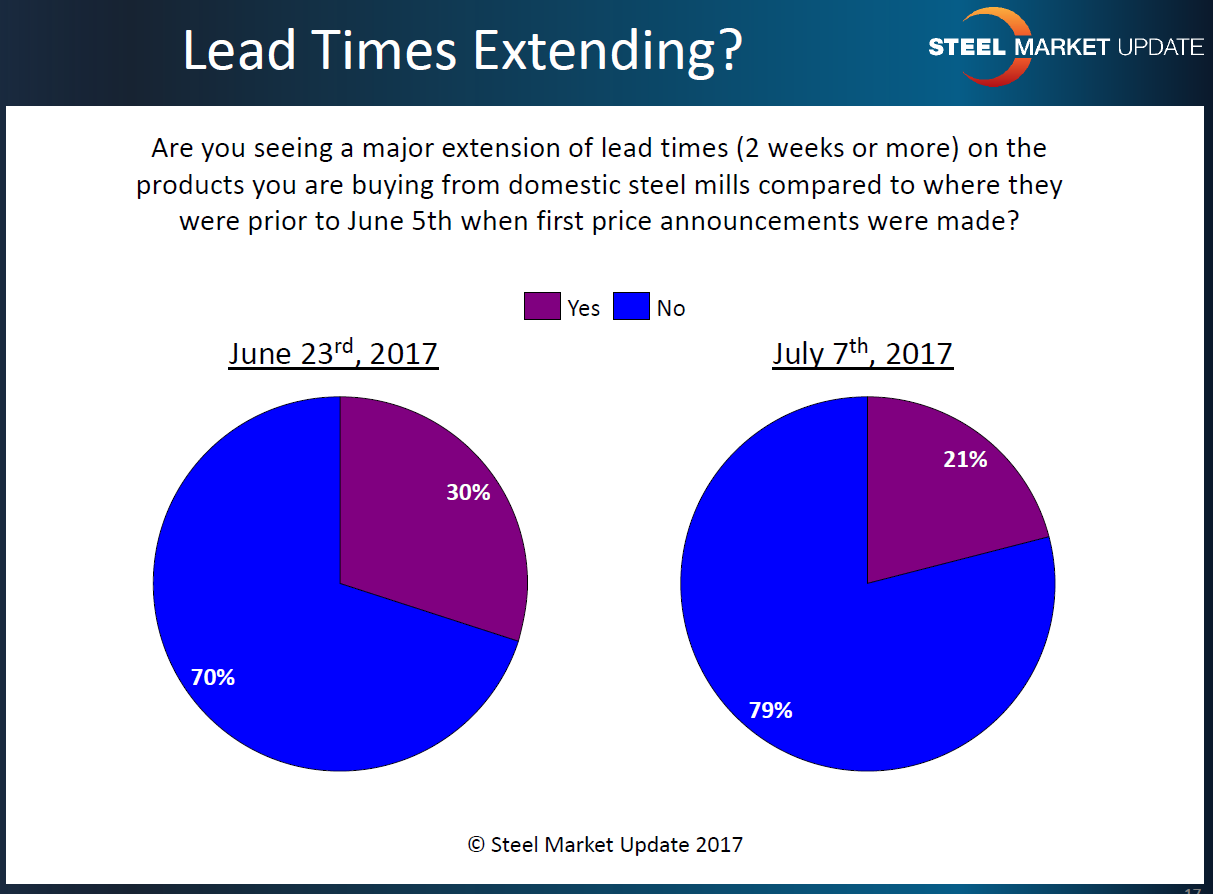

Lead Times Not Extending

Last week, we posed a question to everyone in our survey. We asked if they were seeing a major extension of lead times (2 weeks or more) compared to where lead times were prior to June 5, when the mills all moved to increase prices. We had asked this question in our mid-June survey at which time 30 percent reported lead times as extending. Last week, that number dropped to 21 percent with 79 percent saying there has not been a major extension of lead times.

This is important to note as lead times are one of the key indicators demonstrating the strength (or weakness) of the steel mill order books and are a reflection of demand and inventories.

Note: These lead times are based on the average from manufacturing and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace.