Prices

July 6, 2017

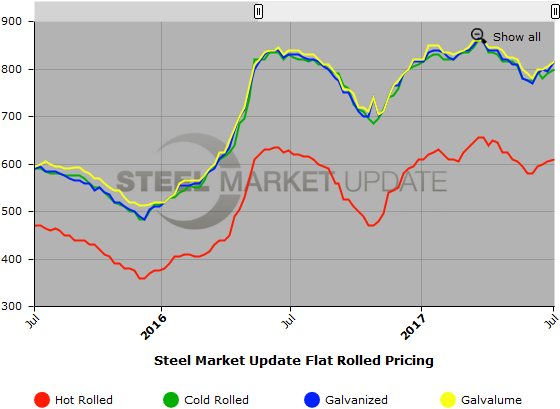

SMU Price Ranges & Indices: Modest Increases

Written by John Packard

Steel Market Update saw modest improvements in flat rolled steel prices mostly associated with reductions of the discounts found at the lower end of the ranges. There are a number of mills that are waiting to see what happens with the Section 232 investigation before announcing new prices or opening their order books for the next business segment. The mills may be forced to open their books without a clear indication as to what is going to happen with Section 232. So, the market sits and waits.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $590-$630 per ton ($29.50/cwt-$31.50/cwt) with an average of $610 per ton ($30.50/cwt) FOB mill, east of the Rockies. The lower end of our range remained the same compared to one week ago, while the upper end increased $10 per ton. Our overall average is up $5 per ton compared to last week. Our price momentum on hot rolled steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Hot Rolled Lead Times: 2-6 weeks

Cold Rolled Coil: SMU price range is $780-$820 per ton ($39.00/cwt-$41.00/cwt) with an average of $800 per ton ($40.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to last week, while the upper end remained the same. Our overall average is up $10 per ton compared to one week ago. Our price momentum on cold rolled steel is pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Cold Rolled Lead Times: 5-8 weeks

Galvanized Coil: SMU base price range is $39.50/cwt-$42.00/cwt ($790-$840 per ton) with an average of $40.75/cwt ($815 per ton) FOB mill, east of the Rockies. The lower end of our range increased $30 per ton compared to one week ago, while the upper end increased $10 per ton. Our overall average is up $20 per ton compared to last week. Our price momentum on galvanized steel is pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU price range is $868-$918 per net ton with an average of $893 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-9 weeks

Galvalume Coil: SMU base price range is $40.00/cwt-$41.50/cwt ($800-$830 per ton) with an average of $40.75/cwt ($815 per ton) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to last week, while the upper end remained the same. Our overall average is up $10 per ton compared to last week. Our price momentum on Galvalume steel is pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,091-$1,121 per net ton with an average of $1,106 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-8 weeks

Plate: SMU price range is $710-$770 per ton ($35.50/cwt-$38.50/cwt) with an average of $740 per ton ($37.00/cwt) FOB delivered. The lower end of our range decreased $30 per ton compared to one week ago, while the upper end remained the same. Our overall average is down $15 per ton compared to last week. Our price momentum on plate steel is pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Plate Lead Times: 4-6 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. We will add plate prices to this graph once we have gathered a few months of data. To use the graph’s interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.