Analysis

July 5, 2017

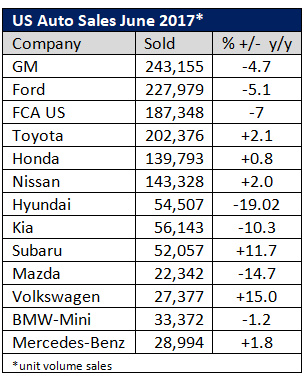

Auto Sales Decline in June

Written by Sandy Williams

Auto sales took a dive in June with the top three American automakers reporting sliding sales and foreign automakers reporting mixed results. Ford Motor Co. sales fell 5.1 percent year-over-year, while GM sales slipped 4.7 percent. FCA USA sales plunged 7 percent, in part due to a planned reduction in sales to its rental operation.

Sales are expected to decline more than 2 percent for the month; Edmunds.com projects a drop of 2.3 percent and Kelley Blue Book 3.6 percent. Wards Auto predicts total sales for the month should come in at 1.46 million.

Honda, up 0.8 percent, described the automotive market in June as “catching its breath.”

“The auto industry has cooled off compared to last year’s record-breaking pace,” said Jack Hollis, group vice president and general manager, Toyota division.