Market Data

July 2, 2017

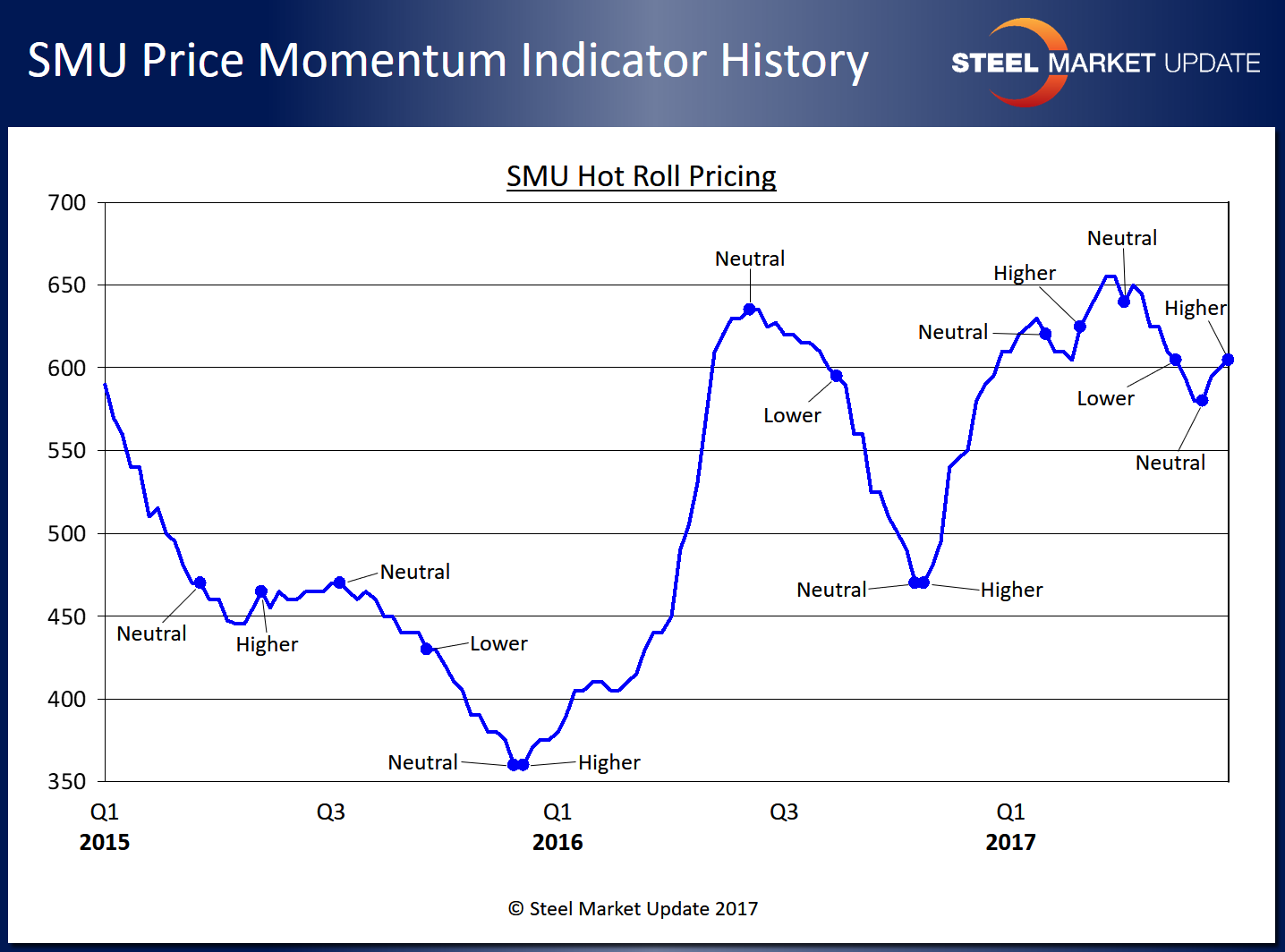

SMU Price Momentum Indicator Moved to Higher from Neutral

Written by John Packard

With the threat of a Section 232 decision in favor of the domestic steel mills looming over the market, Steel Market Update (SMU) has decided to take our Price Momentum Indicator from Neutral to Higher. It is our opinion conditions are in place to push flat rolled steel prices even higher from their current levels. SMU expects steel prices to rise over the next 30 to 60 days.

The steel mills continue to be able to manipulate supply both out of the steel mills (closure of furnaces at Ashland and Granite City and the shutdown of the furnace at Fairfield) as well as from foreign steel sources through AD/CVD trades suits and now Section 232. A favorable ruling on Section 232 could create a shortage of foreign steel, some of which is needed to service business in the U.S. where the products are either in short supply or priced out of the world market.